In January, Moneycontrol had given you four reasons why you should still hold on to gold, despite falling gold prices. At the time, COVID-19 infections had drastically started to reduce in India, but there were concerns. Today, you can add one more concern; the COVID-19 second big wave in India.

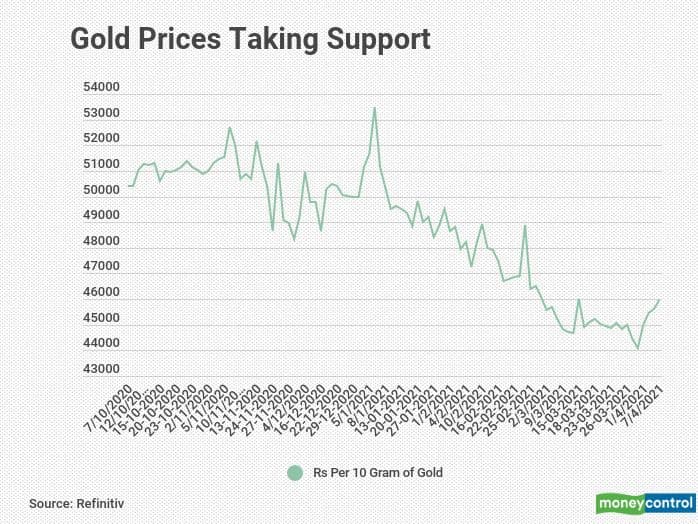

Weak gold prices over the last six months had driven the investors away from gold. However, the recent news of mini-lockdowns or severe restrictions, have made a few take a relook at the yellow metal. The spike in physical gold imports by India in January to March quarter also made investors take gold seriously. Now that various parts of India are going into lockdown as India gets ready to fight the second big COVID-19 wave, what does this mean for gold, as an investment that typically looks up in dismal times?

Situation improves but …No matter how serious the second COVID-19 wave looks, market experts aren’t as pessimistic now as they were a year ago. As the rollout of COVID-19 vaccine gathers speed worldwide, investors’ confidence in equities has gone up.

Rajesh Cheruvu, Chief Investment Officer, Validus Wealth says, “It appears that investor interest in gold has gone down due to catalysts like vaccines, lower fatality in the second and third waves and abundant liquidity to spur the risk sentiment.”

Though the economic recovery is on the way and moreover the policymakers have shown their agility to respond to crisis, at least economically, a slide in the markets cannot be ruled out. “The uncertainty still prevails. It may not be as much as last year because of the vaccine roll out. So the caution will keep the safe-haven gold demand intact,” says Rahul Gupta, Head of Research-Currency, Emkay Global Financial Services.

Experts like Gupta also say that these are early days of COVID-19 vaccine and demand-supply issues still abound. For example, UBS India estimates that even if India administers 3.5 million doses every day, it will only cover 36 percent of its population by the end of CY2021.

In other words, COVID-19 is here to stay for quite some time, despite vaccines. And you cannot completely rule out the possibility of lockdowns or restrictions on economic activity going forward in various parts of the country and world. For example, France has entered third national lockdown.

Physical demand for goldGold prices had gone up on the back of investment demand, in the first half of CY2020. The physical demand has been weak, though. But investors continued to invest in gold through mutual funds and exchange-traded funds (ETF). In CY2020, nearly US$47.9 billion worth of inflows came into the gold ETF across the world, as per World Gold Council Data.

Though the fall in gold prices have driven away the investors to some extent, the physical demand is coming back in the recent past.

Global demand for gold bars and coins grew by 10 percent in the fourth quarter of CY2020. India – the second largest buyer of gold however, is back with the beginning of CY2021. As per news reports, Indian imports surged 471 percent in month of March. India imported a record 321 tonnes in the March quarter, up from 124 tonnes a year ago. Physical gold traded at a premium to the prices quoted on the exchange, throughout March, which indicates strong demand.

This should be supportive of gold prices along with buying by central bankers. Though central bankers worldwide have slowed down their purchases in 2020 and the third quarter has seen selling, the fourth quarter has seen net buying of gold by central bankers.

Along with the COVID-19 related uncertainty and the demand for physical gold coming back slowly in India, gold prices should remain firm, in the months ahead.

Inflation & bond yieldsA rise in inflation is a third possible reason why gold prices might go up.

The infusion of liquidity across the world markets has given rise to inflation. This bodes well for gold prices that rise when inflation goes up. The proposal to raise corporate taxes in the USA may further spook equity markets and work in favour of gold, says Gupta. In the first half of FY2021-2022, the inflation is seen at 5.2 percent. Cheruvu adds that if inflation is caused by people buying more goods, then that need not support gold prices. But if inflation is caused by excessive money supply by central banks- the way it is happening now- this pushes up the gold prices.

Although bond yields have gone up in the recent months, a high inflation keeps the real returns (yields less inflation) low. “Real yields haven't moved up as much and remain negative across much of the developed world,” says Chirag Mehta - Senior Fund Manager - Alternative Investments, Quantum AMC. This means, in real terms, gold works out to be better, says Mehta.

First and foremost, every portfolio must have gold, from an asset allocation point of view. You must not buy gold, purely, because you expect its prices to rise. Gold is a hedge against inflation and typically equity market volatility too.

But 17 percent fall in gold prices from its peak recorded in August 2020 makes it a good opportunity to buy gold. Allocate at least 5 to 10 percent of your money to gold using either gold ETF or sovereign gold bonds or a mix of these two.

If you stick to your asset allocation and keep rebalancing your exposure to various asset classes, you will not get hurt by extreme movements in asset prices. For example, those who chased gold looking at rising prices in the first half of 2020, got a raw deal when the gold prices came down later. Those who followed their asset allocation, ended up investing more in equities when the gold was surging and benefitted from subsequent up move in stocks.

Although you should stick to your asset allocation, if you wish to allocate a bit more to gold, now is a good time.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.