Note to readers: Non-fungible tokens (NFTs) are the new emerging investment options and they are becoming popular by the day with multi-million-dollar sales this year on the exchanges. They have captured the attention of high net-worth individuals (HNIs) and ultra HNIs. Moneycontrol’s two-part series demystifies NFTs and how they work. Today’s story talks about NFT as an investment option and the risks involved.

Investors are jumping on to the NFT bandwagon to make quick profits. The year 2021 has seen multi-million-dollar of NFT sales (refer to graphic). Investing in digital arts, GIFs, music NFTs as collectibles and others are options available on NFT exchanges.

To ride this boom in NFTs, cryptocurrency exchange WazirX has recently launched the country’s first marketplace for NFTs. “Globally, NFT is a $15 billion market. In India, it is difficult to estimate the market size, as we have just launched the services. But they have a huge potential to grow,” says Sandesh Suvarna, VP of WazirX NFT Marketplace.

Also read: Tamil musician sells NFT of phone demo for Rs 1.5 crore to Metakovan of Beeple fame

Investing in NFTsJust like any asset that you buy, you need to understand or at least try and assess the future potential of the NFT. At its core, an NFT has an underlying asset, such as a digital painting, or a unique music collection or any other asset that can be digitized and tokenized.

“But, avoid investing in any overpriced NFT via an auction or at a fixed price on the exchange. While reselling, the price of an NFT may reduce,” says Rishabh Parakh, a chartered accountant and founder of NRP Capitals.

“Investing in NFT is for the asset-light generation investors. They do not want to hold physical assets like real estate, gold, etc. in the portfolio,” says Suvarna. An understanding of cryptocurrencies and the underlying blockchain technology is also a must.

Just because you have money to spare, you shouldn’t jump into it. “First focus on basic financial goals and investment should be in core products such as mutual funds, equities, provident funds and fixed deposits, and have adequate insurance cover for yourself and the family,” says Parakh.

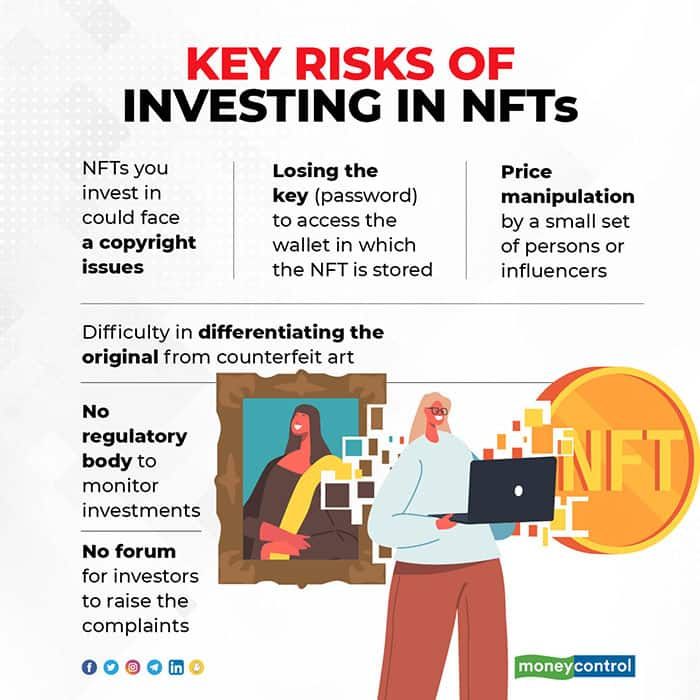

What can go wrong with NFTsLike in any art, an NFT could be counterfeit digital art. When you buy an NFT and the underlying is an art, it means you now own original art. But the painting itself could be inspired by, say, a popular character of adventure movies or comics. “There is a possibility the company that owns the character may sue a creator and you may have to give the NFT art back to the company that owns the original character,” says Mukul Shrivastava, Partner, Forensic and Integrity Services, EY. In such a situation you will lose all your investments.

“If the creators violate any intellectual property rights and buyers complain against them, then we will take down their other listed content from our exchange,” says Suvarna.

Two, NFT bought is stored on the external wallet. “You must evaluate whether the digital wallet is secure and the company whose services you are taking for your wallet doesn’t go bust,” says Shrivastava. Also, the password (key) should be saved carefully. If you lose the key to access your wallet, then you can’t retrieve the NFT.

Three, the NFT market may get manipulated by a small set of people or influencers, just like the cryptocurrency and equity markets. They will have control over the fixed prices of listed products or during an auction. They will push the prices of NFTs up artificially.

Four, it is difficult to identify the original and counterfeit art on the blockchain. You may end up investing millions in counterfeit NFT art.

Five, as there is no regulatory body to monitor investments in NFT, in case of any conflict, investors do not have a suitable forum to raise the complaint and get it resolved.

Also read: Are non-fungible tokens as investment-worthy as cryptocurrencies?NFTs are illiquidThe NFT market is where the crypto market was in 2013, with low volumes and demand. “In NFT, we are at the early adopter stage. Liquidity tends to increase over time with popularity,” says Darshan Bathija, CEO of Vauld, a crypto exchange.

As discussed earlier, NFTs are very unique and specific. So, the initial demand is created for the NFT of art, music, etc. with some marketing and social media posts by the creator while launching. “But, later, reselling becomes a challenge for the first buyer, second buyer, etc. on NFT exchanges. Also, there is no guaranteed liquidity provided on the purchase of NFT,” says Swapnil Pawar, Founder of ASQI Advisors.

Typically, there is no underlying value to NFT, unlike say an M.F.Hussain painting that is still priceless despite the painter’s demise years ago. So, the demand is mainly driven by others who are keen to buy it for emotional attachment or as collectibles. It is an individual's need, a perception that drives the price and demand of NFTs on the exchange.

Should you invest?NFTs are exotic new digital assets. Investors interested in blockchain technology and digital arts, music, photos, etc. should prefer investing in these NFTs. “You shouldn’t invest more than 2-5 percent of your overall portfolio in NFT. Also, you must be ready to lose the principal amount, as the NFT space is still very new and we do not know how it would work as an asset class,” says Parakh. Retail investors, should stay away from investing in NFTs as they are too volatile, overpriced and they need to spend a good amount of time understanding digital assets in the first place.

“NFTs are not an investment options but considered speculative, given their features,” says Pawar. They are considered a weak investment opportunity for diversification in your overall portfolio. It is purely a bet on some other person’s creative work and there is a high risk of price collapsing after the initial purchase.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.