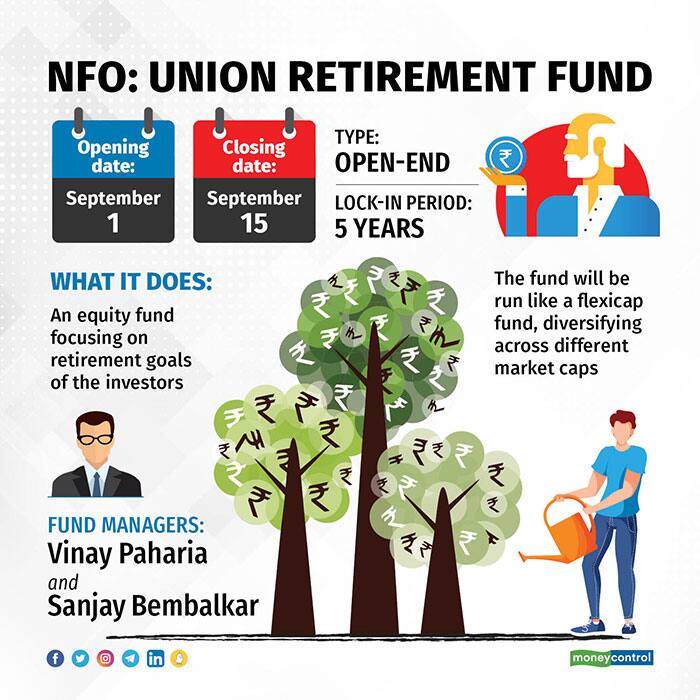

Union Mutual Fund (MF) has launched a retirement scheme, which will open for subscription today. Union MF will become the tenth fund house to enter this category, which already has 24 schemes.

The schemeMost fund houses have multiple offerings in this category, with different asset allocations options between equity and debt.

Union Retirement Fund will only focus on equity investments. The equity portion will be run like a regular diversified equity fund, which will look for opportunities across different market caps and sectors.

What works?The fund comes with a five-year lock-in. G. Pradeepkumar, CEO, Union MF, says this will bring much-needed discipline that is needed to create wealth in the long-term.

“Industry reports show that only 44 percent of equity assets have a holding period of over two years,” points out Pradeepkumar.

The lock-in will help inculcate the habit of long-term investing, especially for those new to equity investing.

“The fund’s `retirement’ tag can impact investor behaviour. They might avoid withdrawing from their ‘retirement’ corpus even during the worst market phases,” says Anup Bhaiya, founder of Money Honey Financial Services.

Also read: How Union Mutual Fund’s schemes may have finally turned the corner

Over a longer holding period, equity-related market volatility tends to even out.

Times have changed as far as retirement-targeted funds are concerned. Two of the oldest schemes in this category have consistently capped their equity exposure at 40 percent. But subsequent retirement-focused plans launched in recent years have come with a leeway to tilt their portfolios towards equities.

“We are offering an equity-only option, as we have seen pure equity allocation deliver superior returns than an equity-debt asset allocation. We want investors to think of generating enough wealth for their retirement, not only to meet their expenses, but also pursue their passions,” Pradeepkumar says.

What doesn’tThe biggest drawback of a goal-focused mutual fund scheme is that aside of the name, there’s nothing drastically different from what other existing funds offer. At its core, Union Retirement Fund — or any other retirement-focused fund — is just like any other scheme that invests in equity.

Retirement fund as a category has remained small as mutual fund distributors usually suggest that investors go for regular diversified funds for their investment goals.

Retirement funds collectively manage just Rs 16,000 crore worth of assets.

Some of the other funds in this category offer tax benefits under section 80C, whereby investors can deduct up to Rs 1.5 lakh of investments from their taxable income. However, this benefit is not available with Union Retirement Fund.

Until 2011, the Indian mutual fund fraternity has had only two designated retirement schemes – UTI Retirement Benefit Pension Fund and Franklin India Pension Fund. Later, mutual funds selectively rolled out schemes focused on retirement as a financial goal. Some of these schemes, especially the previously launched ones, offered tax deduction benefits under Section 80C.

Other funds too come with a five-year lock-in. As mentioned, Union Retirement Fund will only invest in equity investments; there are no other asset allocation options available for investors.

Moneycontrol’s takeUnion Mutual Fund has delivered strong equity performance in its regular diversified schemes. In tilting its portfolio towards equity, the scheme’s intent is right because in the long run, the chances of equities outperforming other asset classes are far higher.

However, given that the scheme comes with a 5-year lock-in, a debt allocation option would have allowed investors to take exposure to debt as well, to reduce volatility in their investments.

While retirement funds with a five-year lock-in force investors to start building the habit of long-term investing, regular equity schemes with existing track-record can be considered for your long-term financial needs, so long as you are disciplined and stick around for at least five or more years. Such funds can also meet your retirement goals, if you are a disciplined investor.

The NFO closes on September 15.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.