The Finance Act 2020 introduced a new provision under the Income-tax Act, 1961 (the Act) by virtue of which employer contribution to Employers Provident Fund (EPF), National Pension System (NPS) or any other superannuation fund (‘SF’), exceeding Rs 7,50,000 per annum in aggregate (now referred as ‘excess contributions’), is now taxable in the hands of the employee as perquisite.

Further, income accruals on such excess contributions by the employer will also be considered as taxable on a year-on-year basis with effect from FY 2020-21.

Earlier, senior-level salaried employees would structure their salary with maximum possible employer contributions towards specified retirals such as EPF, NPS and SF as the employer contributions were not taxable. The above provision to tax employer's contribution towards such funds exceeding Rs 7,50,000 per annum will restrict the benefits availed by salaried employees.

In March 2021, the Government of India introduced a manner to calculate the accretion by introducing Rule 3B which is effective from FY 2020-21 onwards. Employers are now required to calculate the taxable perquisite on account of excess contributions to EPF / NPS / SF and accretions thereto. Such taxable perquisites will now be reflected in Form 16 / Form 12BA of employees.

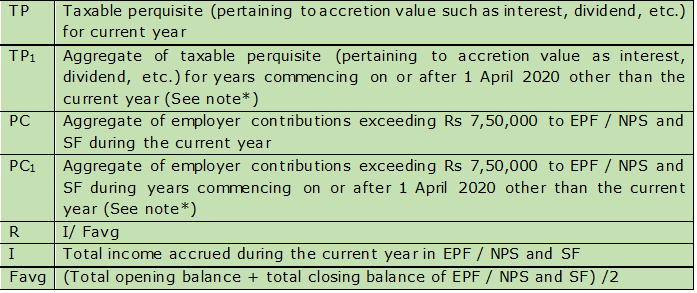

Rule 3B provides a formula to calculate the taxable perquisite value:

TP= (PC/2)*R + (PC1+ TP1)*R

*Note: Where the amount of TP1 and PC2 exceeds the opening balance of EPF / NPS and SF, then the amount in excess of opening balance shall be ignored for the purpose of computing the amounts of TP1 and PC1.

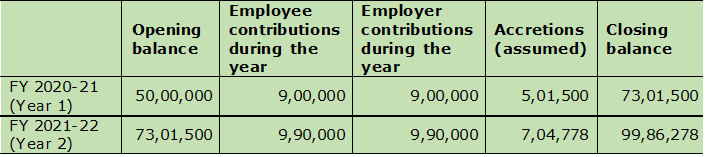

One example of the above calculation is given as under (all amounts in Rs):

Applying the definitions in the above example (all amounts in Rs):

-The value of accretions on the retirals has to be considered while applying the above formula at withholding stage. However, the said value is generally available after the end of the financial year. Hence, there are practical difficulties in determining the value of accretions at the withholding stage. Also, it may noted that accretions on NPS are notional and the values fluctuate depending upon market conditions.

-Where the employee has contributions to multiple retiral funds, such as EPF / NPS and SF, there is no specific guidance on allocating the excess contributions; i.e. whether the excess over Rs 750,000 should be first allocated to EPF, NPS or SF or whether the excess contributions should be allocated on a pro-rata basis.

-The data pertaining to opening / closing value of contributions may not be available with the employer and such details may have to be sourced by the employee. There will be additional practical challenges where employee has shifted jobs during the year.

(With inputs from Niji Arora, Senior Manager, Zalak Shah, Deputy Manager and Bunty Punjabi, Tax Senior with Deloitte Haskins and Sells LLP)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.