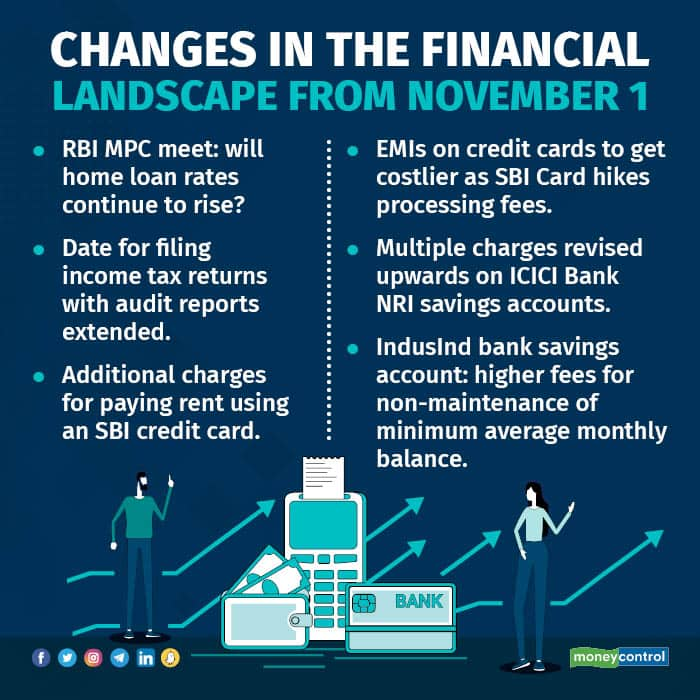

Whether you have an existing loan or plan to take one, have business income, use a credit card to pay rent, or hold a Non-Resident Indian (NRI) savings account, there are a number of important changes coming up in November that will pinch your purse.

Unscheduled RBI MPC meet: rate hike on the cards?

Owing to the failure to curb inflation, the Reserve Bank of India (RBI) has announced an unscheduled meeting of its Monetary Policy Committee (MPC) on November 3. Interest rate hike is a small possibility.

Economists feel the central bank will remain aggressive over the next few MPC meetings in terms of policy rate action. So far, despite a 190-basis point (bps) repo rate hike since May this year, inflation has not shown any signs of cooling down. One basis point is one-hundredth of a percent.

Between July-September 2022, India's headline retail inflation rate as measured by the Consumer Price Index (CPI) was 7 percent, according to data released by the Ministry of Statistics and Programme Implementation. The MPC is targeting to keep the inflation under 6 percent, but has failed to do so in the last three quarters.

If another rate hike comes through, banks will once again raise interest rates on home loans and other loan products linked with the repo rate as an external benchmark, per terms of the loan agreement.

File income tax returns with audit reports

The income tax department has extended the due date for filing income tax returns for fiscal 2021-2022 where audit reports are required, by seven days, from October 30 to November 7, 2022.

A tax audit is the process of checking, reviewing, and inspecting the books of accounts, receipts, invoices, and so on, of a business or profession by a chartered accountant. An auditor is supposed to check whether books of accounts have been maintained and income-tax rules followed properly by the taxpayer.

Every person carrying on a business where total sales exceed Rs 1 crore is required to carry out an audit. ``However, if the total of sales proceeds received or payments made (as the case may be) in cash does not exceed 5 percent of the total amount, then the threshold for an audit goes up to Rs 10 crore,” said Sandeep Sehgal, Partner, Tax, AKM Global, a tax and consulting firm. Also, for every professional with a practice, a tax audit is required if gross receipts from the practice exceed Rs 50 lakh.

Charges for paying rent using a credit card

SBI Card has introduced a processing fee of Rs 99, plus taxes, for paying rent using its credit card. The charges will be applicable from November 15. In October, ICICI Bank had announced a fee of one percent of the amount for paying rent using its credit card.

Rent can be paid with credit cards on a number of third-party websites and apps, including RedGiraffe, Cred, Paytm, and Magicbricks. This charge is over and above processing fees ranging between 0.4-2 per cent charged by these websites and fintech apps for paying rent using credit cards.

Hike in credit card fees on merchant EMI transactions

SBI Card has hiked the processing fee on merchant EMI (equated monthly instalment) transactions to Rs 199, plus taxes, from Rs 99 plus taxes earlier. It is effective from November 15. Merchant EMI refers to transactions above Rs 2,500, which the cardholder chooses to pay in EMIs (can also convert to EMIs post-purchase) at the rate of interest communicated by the card-issuing bank. SBI credit card charges 14 percent interest p.a. on merchant EMI transactions.

ICICI Bank revises charges on NRI savings accounts

Effective November 1, ICICI Bank has introduced multiple service charges and increased penalties on NRI savings accounts.

The bank has introduced service charges on various types of transactions. For instance, Rs 50 will be levied per transaction if cash deposited in a month exceeds Rs 10,000, whether in a single transaction or multiple transactions. The bank has also introduced charges for issuing a duplicate passbook (Rs 100), and will charge Rs 25 per page for updating the passbook. It will charge Rs 25 for re-generation of a debit card pin from over the bank counter.

It has increased the penalty for returning a cheque due to financial reasons (bounced cheque, stop-payment, etc.) from Rs 100 to Rs 200. The bank will charge Rs 50 for returning a cheque due to non-financial reasons (like date not mentioned, etc.), except for signature verification.

Revision in charges for savings accounts at IndusInd Bank

Effective November 1, savings account holders at IndusInd Bank will have to pay 6 percent of the average shortfall for non-maintenance of the minimum average monthly balance, up from 5 percent earlier.

The bank has now introduced fees for Immediate Payment Service (IMPS) transactions. The charges are Rs 2.5 per transaction of up to Rs 1 lakh, and Rs 10 per transaction between Rs 1-5 lakh, which is the limit for an IMPS transaction.

Charges have also been revised for failure of ECS (Electronic Clearing System) due to insufficient balance in savings accounts. The revised charges are Rs 450 per failure for savings account variants, except PIONEER. Earlier, the charges ranged between Rs 200-Rs 350. ECS is an electronic mode of payment / receipt for transactions that are repetitive and periodic in nature.

Charges have also been introduced for issuance and renewal of debit cards. Their Titanium debit card, which came free with Maxima and equivalent savings account variants, will be charged Rs 199 from November 1.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.