SBI Life Insurance has withdrawn its existing term policy – eShield – and replaced it with eShield Next. It is a pure protection cover with several additional features and options. A pure protection policy does not offer any returns or maturity proceeds, but pays out the sum assured to the policyholder’s dependents in case of her death. Term insurance policies ensure financial security for families at low premiums. Over the years, life insurers have introduced several features in this product category such as deferred claim payout and increasing sum assured.

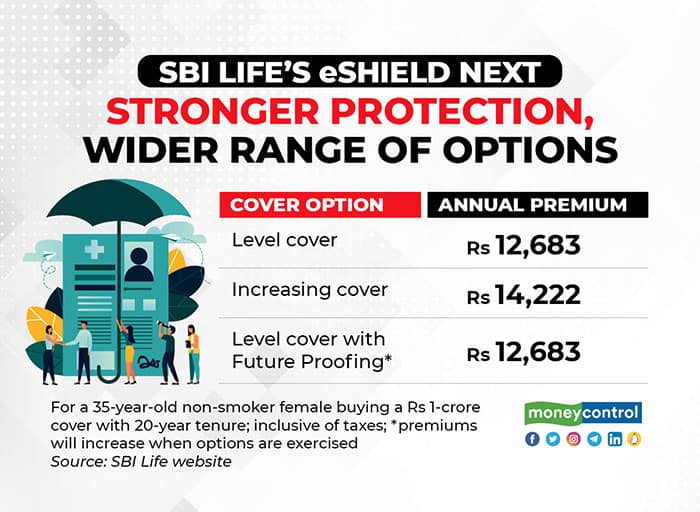

The earlier eShield cover offered just one option with an unchanging sum assured. Now, eShield Next offers not only this option (which it calls the Level Cover), it also gives you options to increase your sum assured as you grow older.

For the Level Cover, regular premium payment option, a 35-year-old non-smoker female buying a Rs 1-crore cover with a policy tenure of 20 years will have to pay an annual premium of Rs 10,586 plus taxes.

Increase your insurance after marriage, child birth

The ‘Level cover with future proofing’ benefit, allows policyholders to increase their life insurance cover at several milestone events. For example, when you get married, you can increase your sum assured by 50 percent, up to a maximum limit of Rs 50 lakh. Likewise, on the birth of your first child, the product will allow you to enhance your cover by 25 percent, up to a maximum limit of Rs 25 lakh.

The key advantage here is that while you will have to shell out higher premiums for the larger cover, you will not have to go through medical underwriting. “Often, people are unable to visualise all the elements of their future requirements, and hence their insurance purchase also doesn’t factor this. Someone who is not married and is buying a term plan may not have envisaged that in future he/she may want to move into a new house and depend on a loan to fulfil the need. Needless to say, his/her insurance cover would become inadequate when such liabilities materialise,” says an SBI Life spokesperson.

If you wish to increase your sum assured at fixed intervals, then you can opt for the ‘Increasing sum assured’ option. Here, your sum assured goes up by 10 percent every fifth policy year.

Life cover for your spouse

Under the ‘Better-half’ benefit option, the spouse who doesn’t draw an income gets a life cover after the policyholder’s death.

The product also offers a limited premium paying term feature. So, you can pay premiums for, say, five years, but the cover can continue for 20 years. According to the company, the limited premium payment term feature is designed to suit millennial’s needs. “Their preference was towards shorter premium payment options, so that they could complete their financial commitments sooner,” he says. Under the product, limited premium payment terms range from less than five years to 25 years. In case of the Whole Life option, the policy can remain in force until the policyholder turns 100.

You can also choose a staggered claim payout option. The claim will be handed over to your dependents over a period of time, instead of a lumpsum amount. “Customers can choose whether the death benefit should be paid as lump-sum or monthly installments, or a combination of both. A lump-sum payout would aid the family pay off large debts while the monthly installments would help make up for the loss of regular income. If dependents are not financially savvy and may not be able to manage a large corpus, then the monthly installments would be a better option for such customers,” he says.

What works

Life insurance experts believe the increasing sum assured benefit is a useful feature. “People are in a bit of a dilemma while determining the sum assured that would be sufficient to meet the future of their family, especially those who start their term plans early in life. So this benefit is quite a useful feature as it helps policyholders maintain their term insurance cover according to their responsibilities and needs,” says Naval Goel, MD and CEO, PolicyX.

While you could always buy a fresh policy to increase your overall coverage when your responsibilities increase, you will have to go through medical underwriting. Put simply, you will face health scrutiny through medical check-ups and additional questionnaires. This could mean higher premiums as it is likely that you would have acquired lifestyle diseases such as diabetes and hypertension by then. “It is not unique in the sense that other products in the space offer such features already. However, term insurance is critical for your protection portfolio and increasing sum assured does away with the hassle of medical underwriting,” says Harshvardhan Roongta, Certified Financial Planner, Roongta Securities.

What doesn’t

The whole life feature carries little utility value. Remember, a term insurance cover is meant to replace a policyholder’s income in case of her death so that her family members’ regular needs and goals aren’t hurt. So, opting for longer tenure serves no useful purpose. You may not need a pure risk term insurance after you retire, if your family is not dependent on your income.

A longer tenure means higher premiums, which could instead be invested in better-yielding instruments. “Some features such as return of premium and critical illness riders are missing in this plan. There is a demand for such riders from customers,” says Goel. The product offers terminal illness benefit, but not a critical illness rider that can hand out a lump-sum in case a serious ailment is diagnosed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!