The much awaited public listing of Life Insurance Corporation of India (LIC) finally took place last week. The fanfare that marked the opening of the initial public offering (IPO), India’s biggest, was conspicuously missing at the time of listing.

Retail investors, more prominently policyholders, had been gung ho about the prospects of stock in LIC, their most familiar personal finance companion.

None of the optimism salvaged the day for LIC’s shares, which listed at a discount of around 9%; the price only trended lower for the day.

The average investor hadn’t expected such a debut. LIC had revised its IPO pricing and almost halved its valuation in a period of two months. Many experts said this brought the valuation of the insurer to a reasonable level, leaving potential for listing gains.

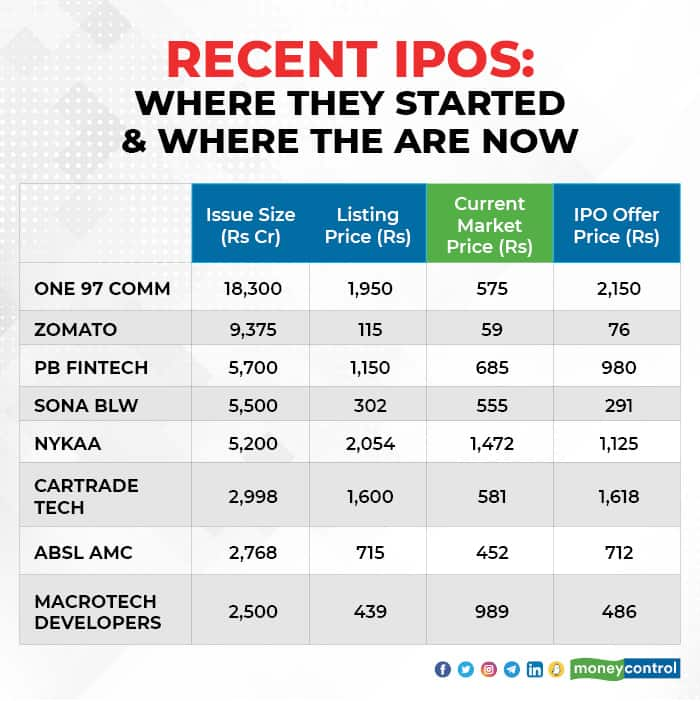

IPOs are heavily marketed to investors, both retail and institutional, but recent experience with new-age businesses shows that IPO pricing may not always leave room for long-term gains.

It’s not just the pricing, but market sentiment also makes a difference. The euphoria around recent e-commerce IPOs has also shown that immediate listing gains do not necessarily mean the gains can be sustained.

FY 2020-21 was the best year for IPOs in India; as many as 76 companies went public and raised over Rs 1.3 lakh crore, according to Prime Database. For the retail investor, the buzz was attractive because of the marketing rather than any substantial financial value to be derived from the IPOs. Here is why retail investors can safely avoid IPOs and save their time and energy for the secondary market after the stock lists.

The price of a stock going public is set in consultation with one or more investment banks. These investment banks work for the company that is listing and are paid by that company. Ideally, the offer price is based on the company’s valuation, arrived at by estimating the future financial prospects of the company. Whether this valuation is reasonable and an accurate representation of the future growth of the company is hard to judge for individual investors who are unaware of its future plans.

“Usually I recommend that clients avoid IPOs as the secondary market is a much more efficient way for long-term investors to create wealth,” said Kavitha Menon, a Mumbai-based Certified Financial Planner,

“The allotment in IPOs is uncertain and typically even if you get an allotment, the number of shares is very less. Plus, you could make money on some IPOs but there are others which are overpriced and on the whole, retail investors don’t end up making much this way.”

How the final IPO price has been arrived at is not a process made public to investors, to whom it is a mystery. If you are unable to analyse the basis of IPO pricing, then why assume that it is accurate?

2. External factors like grey market and market mood matter

Even before the public issue is open for subscription, shares are available through private placement. Based on the over-the-counter price of these shares, there is a ‘grey market’ or active trade based on the listing prospects of a stock. Grey market prices are indicative, but they do show the direction of demand for subscription in the IPO. If demand is high, chances are that the grey market price trades at a premium and the listing takes place with a bang.

Even so, the grey market can distract investors and the premium can well get eroded ahead of listing if market sentiment turns negative. This is the opposite of what happened in case of the listing of Zomato Inc, which listed at a 52% premium to its offer price. Unfortunately, in case of LIC’s listing, the grey market premium fell substantially and the listing was at a discount.

Can retail investors track this sentiment effectively?“The market mood is very important; in a bull market, many people get carried away by greed to make quick gains,” said an Ahemdabad-based broker and mutual fund distributor. “Previously, it used to take months for a stock to list post the offer, but now it’s a matter of putting money in for just 15 days which is not a long time. If there is allotment and listing gains, then for an investor it is immediate gratification, which is what they are looking for.”

Anup Bhaiya, founder of Mumbai-based Money Honey Financial Services, said: “Chasing momentum in stock markets is risky. Most individual investors come with speculative instincts, hoping for some quick gains on listing in a bull phase. But if the sentiment turns for worse, then the businesses with bad fundamentals or businesses asking for rich valuations tend to list below the IPO price and subsequently go down.”

3. Information is limitedEven if you were to scour the IPO prospectus, information about the company is limited because most brokerages and analysts are yet to begin in-depth coverage of the company’s business. Most recommendations of buy or sell for the IPO itself are based on the information given in the prospectus rather than on ground research.

Bhaiya said: “Promoters or existing investors who know everything about the business are offering their stock in the IPO. And a layman is trying to make money out of the IPO. The odds are clearly stacked against the retail investors in most cases.”

Given that there is still a lot to learn about the company’s business, rushing in to subscribe to the public offer may work counter to your expectations. Moreover, a lot of the recent IPOs were just a vehicle for older investors to exit their positions rather than the company raising money for growth and expansion.

“IPO pricing comes with very little value where it is about giving an exit to promoters and early-stage investors,” said Menon. “You have to be aware that money is not being raised to create new value in the business, then why pay a higher price? Companies do not have to be profitable before an IPO, but investing in a loss-making company with the expectation of unmatched execution capability is a big risk.”

4. Secondary market investment“There is an opinion among retail investors that the primary market pricing is going to be the cheapest as it is first hand, but this is not the case,” said the Ahemedabad-based broker quoted above.

Investors always have the option of waiting for the listing to happen and give it 6-9 month, by which time 2-3 quarters of earnings would have been published and analysts would have started deep coverage of the company. Investors will have more information not just about the financial health of the company, but also about how the management makes important decisions and its communication with shareholders.

Experts say that insights come with time and are important in understanding the future value of the company on the basis of which you may want to invest for the long term.

If you are investing in IPOs under peer pressure or in the fear of missing out, then you must also understand the risks involved and the fact that every IPO is not going to make you money. Moreover, after listing, the shares are freely available in the secondary market to buy and sell. Why not just wait for that?.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.