Effective October 1, your automated subscriptions for newspapers and magazines, or even your utility bill payments, will change.

To strengthen the safety of card transactions, new guidelines from the Reserve Bank of India on e-mandates or recurring payments via cards, kicks in from today.

HDFC Bank Axis Bank, ICICI Bank and Standard Chartered Bank have sent text messages and email communications to their customers, alerting them of the change in rules.

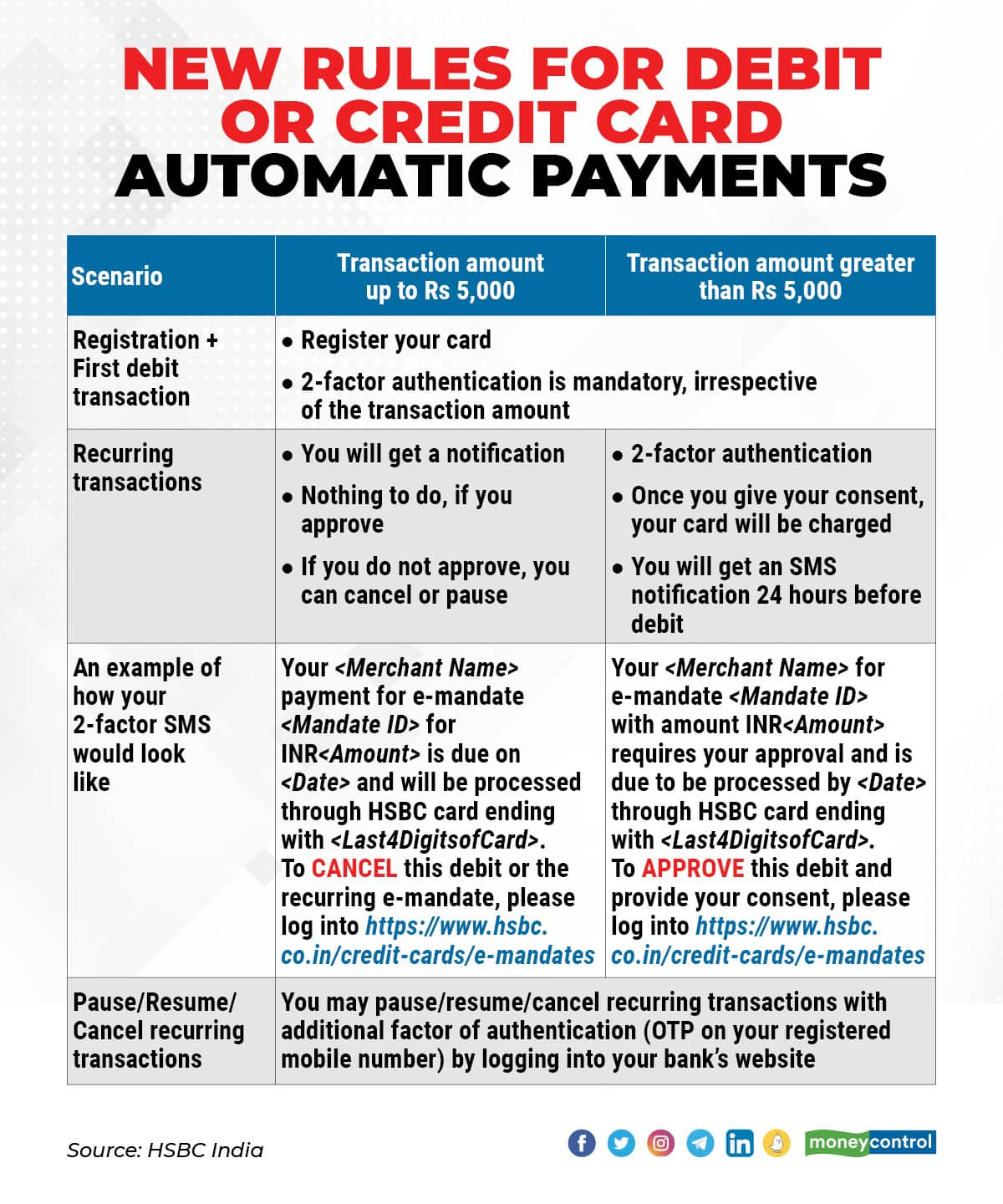

What are the new RBI rules on recurring card payments?If your monthly subscription amount for any service exceeds Rs 5,000, then an additional factor of authentication (AFA) will become mandatory. For automated debits, your card issuer or bank would now need to send a notification at least 24 hours in advance.

An e-mandate or a standing instruction to charge your card is a recurring payment facility for services and utilities.

One time re-registration is required for all e-mandates. For all auto-debit payments above Rs 5,000 a month it will require two-factor authentication. Once you give your consent, the credit or debit card linked will be charged. “Your banks, merchants, payment processors and card companies are in the process of upgrading their systems to facilitate this automation under the new rules,” says Parijat Garg, a digital lending consultant.

Also read: 4 important money matters for which rules change from October 1: Here’s what you must know

Yes. The bank or your card company will send you a detailed notification every month before your payment is due. This notification will contain all the information regarding the upcoming payment (debit). It would also give you the option to opt out. This is the additional factor of authentication, without which your payment would not be processed.

Sanjeev Moghe, EVP and Head Cards & Payments, Axis Bank says, “The new guidelines empower the customers to manage and govern their recurring transactions. Axis Bank is ready to go live on the new solution that meets all the requirements.”

Banks and card companies are also trying to set up portals or websites after tying up with various subscription providers. This is to enable consumers re-register their mandates as per the new requirement and format. You would also need to state the validity period and the maximum amount for which your card can be charged. You can even modify, pause, or cancel any of these mandates later. For instance, if you do not want to renew your subscription for a particular service the following month, you simply need to give an instruction to stop the payment. “This puts greater power in the hands of the users, as they now have more control over the payments,” says Adhil Shetty, CEO of BankBazaar.com.

I pay for international magazines in dollars. Will they be stopped?Yes. The new rule applies to all transactions, whether local or foreign.

Will automated transactions on my bank account also be stopped?No. Your monthly mutual fund systematic investment plans (SIPs) or EMIs for loans from your savings or current accounts will continue as usual.

What are the alternatives if I am unable to re-register?Banks are working to put together a common platform. They would tie up with merchants and allow consumers to register for as many payments as they want via the platform. Till such time, it is expected that such retail payments might get impacted.

Till then, you have two options. First, you could either make a payment every month on the merchant site, manually, using your debit or credit card.

The other option is to use the net banking facility to set up auto-pay directives for utility bills and other recurring payments directly from the savings or current account.

Another option is to set up auto-pay (standing instructions) on external aggregators such as BillPay and BillDesk by registering your debit or credit cards. Banks also have such platforms that allow their own cards to be registered for subscription payments. Citibank’s Billpay, ICICI Bank’s Mandate Hub and Yes Bank’s PayNow are some examples.

Do I need to pay any charges if recurring payments fail due to non-compliance?The bank will not levy any charges. However, the merchant/service providers may levy charges/fees towards delayed payments, and services could get interrupted.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.