Home loan interest rates are set to dip further, with the Reserve Bank of India (RBI) on April 9 reducing the repo rate by 25 basis points, the second such cut since February 7, 2025.

The repo rate now stands at 6 percent, down from 6.25 percent after the monetary policy committee (MPC) decision.

“The MPC noted that the inflation is currently below the target, supported by a sharp fall in food inflation. Moreover, there is a decisive improvement in inflation outlook… On the other hand, impeded by a challenging global environment, growth is still on a recovery path after an underwhelming performance in the first half of 2024-25,” RBI governor Sanjay Malhotra said as he shared the outcome of the first policy announcement of the new fiscal.

The MPC also decided to change the stance from “neutral” to “accommodative”, which could pave the way for more rate cuts.

Also read: Follow our policy liveblog for the latest on the RBI MPC

All new retail floating-rate loans sanctioned after October 1, 2019 are linked to an external benchmark, which is the repo rate for most banks.

The RBI’s decision will directly benefit home loan borrowers, particularly existing borrowers. The interest burden will go down, providing relief to homeowners.

“This will also mean that new borrowers’ loan eligibility will be enhanced. Our estimates suggest that the amount of loan they are eligible for could go up by Rs 25 lakh,” said Vipul Patel, founder, MortgageWorld, a loan consultancy firm.

Home loan interest rates, depending on the lender, are also set to fall.

“Home loan rates are about to go sub-eight percent again with today’s 25 bps rate cut. The lowest rates we’re currently seeing are between 8.10 percent and 8.35 percent. However, the lowest rates are typically reserved for prime borrowers (credit score > 750) and refinance cases. Homeowners paying a substantially higher rate (50 bps or higher above prevalent rates) are advised to refinance their loans to avail lower rates,” said Adhil Shetty, CEO, BankBazaar.com.

Existing borrowers stand to benefit

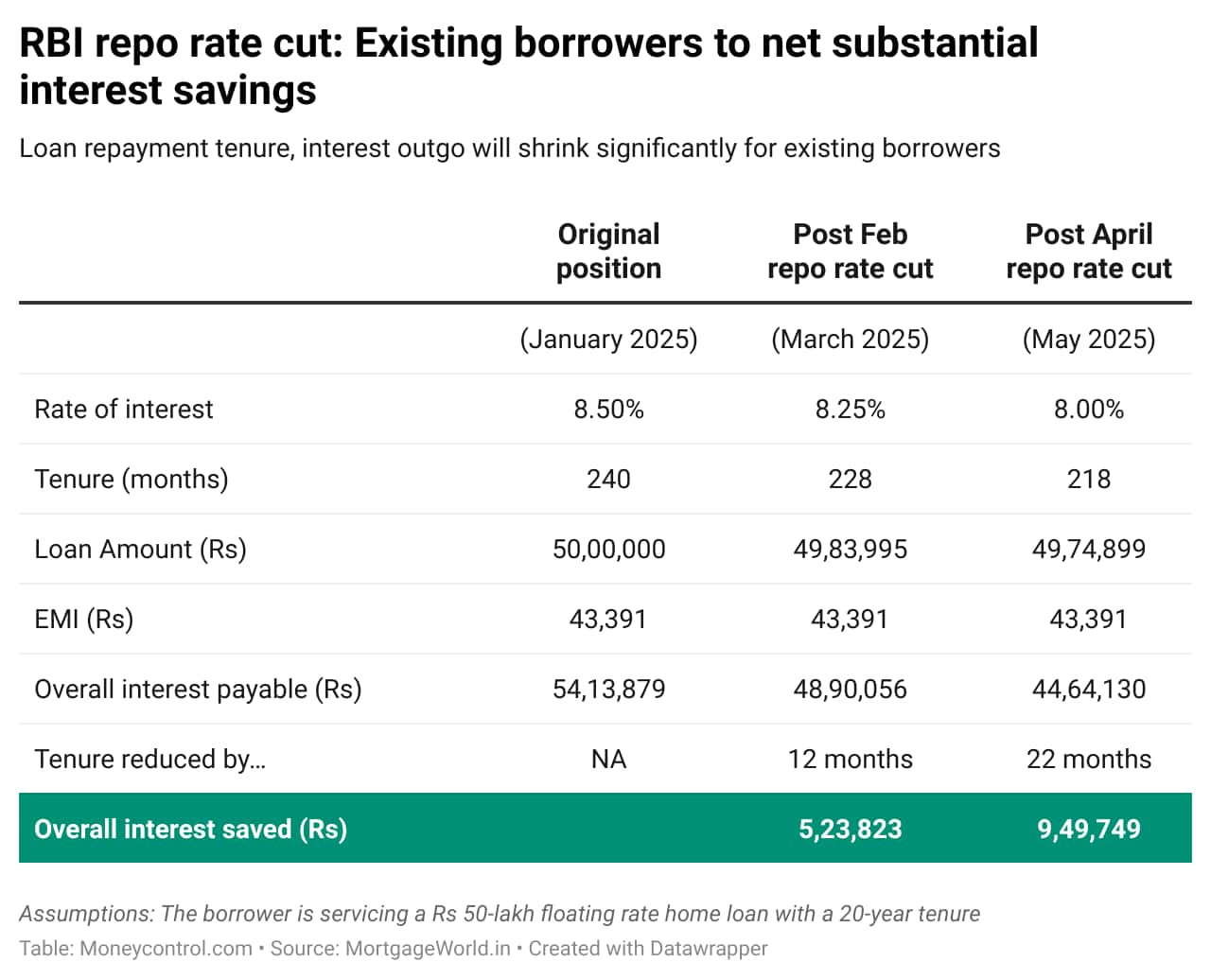

According to the external benchmark lending rules, existing borrowers will get the entire benefit of the 25 bps repo rate cut. For instance, if you are paying an interest of 8.5 percent on your 20-year home loan of Rs 50 lakh taken in March (EMI of Rs 43,391) after today's cut, your interest outgo (Rs 54.14 lakh) will drop by Rs 5.24 lakh to Rs 48.9 lakh and the tenure shrink by 12 months, assuming that you retain your EMI, as Mortgageworld.in data shows.

If your loan was disbursed in January, your total rate reduction will amount to 50 bps once your bank resets your interest rate after the April policy action. In such a scenario, your loan tenure will shrink to 218 months and savings on interest outgo will be around Rs 9.5 lakh.

Also read: RBI Feb repo rate cut: Home loan rates dip, but new borrowers may miss full benefit

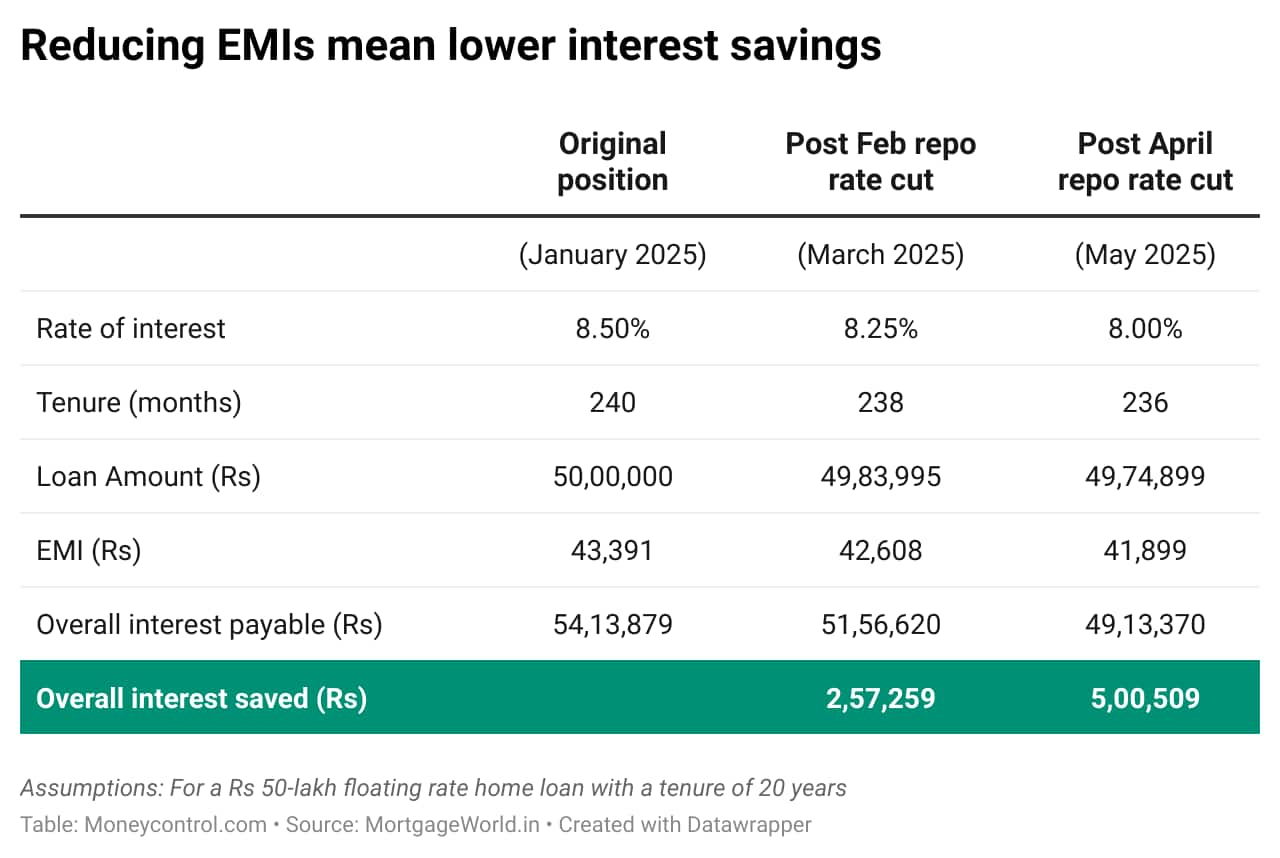

If you choose to reduce your EMI amount instead, your interest savings will be relatively lower.

A BankBazaar comparison of home loan rates as on January 31 and April 4 shows that most public sector banks have reduced interest rates for fresh home loans by 25 bps, in line with the RBI policy action on February 7. However, some private sector banks passed on only 5-10 bps to new borrowers. With the April 9 cut, those looking to take fresh loans now, too, could see rates coming down significantly.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.