In line with the recent upsurge in the equity markets that saw Sensex and Nifty scale record highs, National Pension System’s (NPS) fund managers have improved their performance too. Returns generated by the seven pension fund managers in schemes E (equity) have improved remarkably since October.

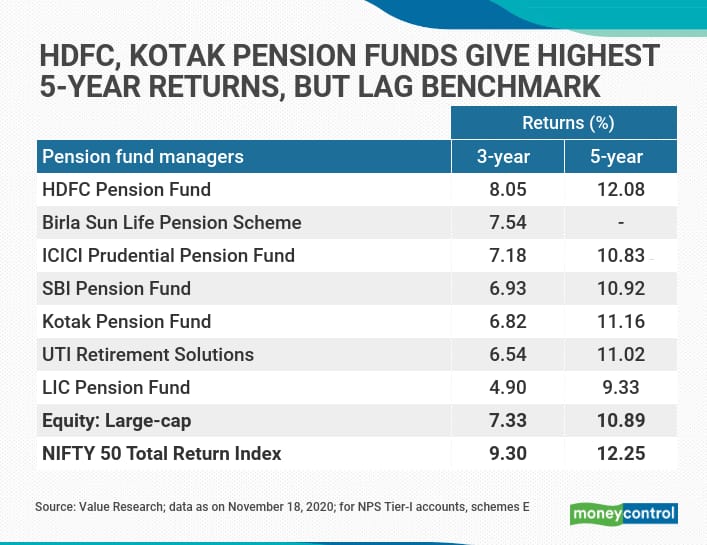

This is evident from the returns delivered over three- and five-year periods (see table), as per data from Valueresearch for NPS Tier-I accounts.

Outperforming MFs, but lagging the Nifty

However, only two schemes – HDFC Pension Fund and Birla Sun Life Pension – out of the seven, managed to outperform their large-cap mutual fund counterparts. They yielded annualised returns of 8.05 percent and 7.54 percent, respectively, over the last three years compared to the large-cap mutual fund category average of 7.33 percent. However, they could not beat their benchmark Nifty 50 TRI, which recorded 9.3 percent returns. Moreover, all other pension funds underperformed mutual funds as well as the benchmark, Nifty, reporting returns in the range of 4.9 percent to 7.18 percent. LIC Pension Fund was the worst performer in this category with returns of 4.9 percent returns.

Pension funds’ performance over the five-year horizon was much better. Four out of six pension funds that had completed at least six years of operations outdid the equity large-cap mutual fund category average (10.89 percent). HDFC Pension Fund was the top performer in this category as well, with 12.08 percent returns annually over five years. It was also the only pension fund that came within striking distance of benchmark Nifty 50 TRI (12.25 percent) during the period. All other funds fetched returns between 9.33 percent and 11.16 percent in the five-year return category. Kotak Pension Fund (11.16 percent) and UTI Retirement Solutions (11.02 percent) were next on the list after HDFC Pension Fund, with LIC Pension Fund bringing up the rear with 9.33 percent returns.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.