Index and exchange traded funds (ETFs) have been getting a lot of attention from investors in the past few years. Actively-managed large-cap funds have found it difficult to outperform their benchmark indices such as the Nifty 50. This also led to many fund houses rolling out fresh passive schemes based on other indices as well. But there is one index that stands out in terms of performance and its future potential.

Enter Nifty Next 50, or the Nifty Junior index as it was previously called. Currently, there are 12 passively managed Nifty Next 50 funds available in the market – six each from index funds and Exchange Traded Funds (ETFs). Their combined assets went up around three-fold over the last two years to Rs 4,393 crore.

Here are five reasons why you must own at least one passively-managed Nifty Next 50 scheme in your portfolio.

Nifty Next 50 outruns large-cap and mid-cap indicesThe Nifty Next 50 index represents 50 companies from the NIFTY 100 index after excluding the NIFTY 50 companies. Some companies eventually graduate to being a part of the Nifty 50 index. Some Nifty Next 50 companies also get demoted to lower-rung indices.

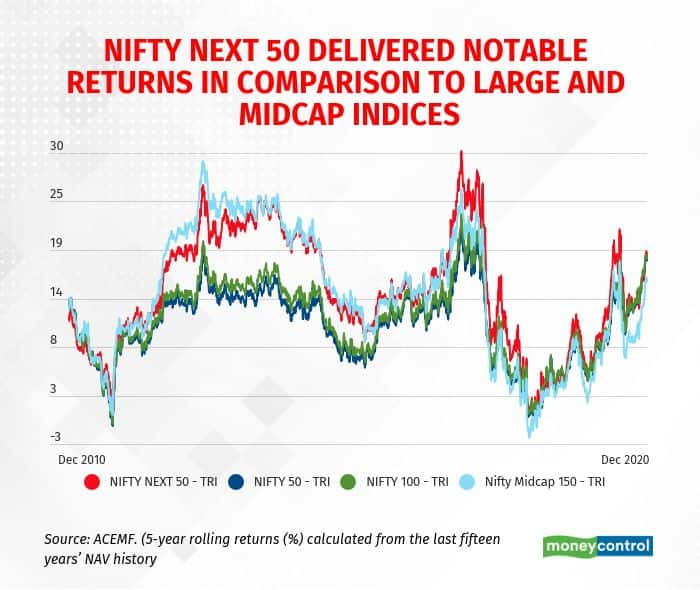

That said, the Nifty Next 50 has given impressive returns, consistently. It not only does well against the Nifty 50 index, but also compares well to mid-cap indices. Over the last 10-year period, the Nifty Next 50 total returns index (TRI) delivered 11.6 per cent returns (compounded). The Nifty 50 TRI gave 9.9 per cent.

On a rolling returns basis, too, the Nifty Next 50 scores over the Nifty 50 as well as the Nifty Midcap 150 (TRI). We looked at the indices’ five-year returns over a total period of 15 years.

The Nifty Next 50 is typically a better diversified index than the Nifty 50. Anil Ghelani, Head of Passive Investments & Products at DSP Investment Managers says that Nifty 50 often sees some of its top holdings crossing 10 percent each. Nifty Next 50, on the other hand, typically doesn’t see its largest holdings cross even 5 percent. “The top 10 holdings in the Nifty Next 50 index are typically around 35-40 percent; in the case of Nifty 50, they are around 60 percent,” says Ghelani.

So, in comparison, the Nifty Next 50 Index is more diversified, with less concentration risk across stocks and sectors. The Nifty Next 50 often has a few mid-cap stocks as well, which typically make up 8-10 percent of the portfolio.”

The sector composition of Nifty Next 50 also offers good diversification to your Nifty 50 based passively-managed schemes.

A look at Nifty Next 50 index tells us that its top holdings are in growth-styled companies in typically defensive sectors. The total weight of consumer non-durables, pharmaceutical and other utilities sectors is around 46 per cent as of November 2020. In the Nifty 50 index, the weightage for these sectors is only around 15 percent.

This helped Nifty Next 50 index outperform the Nifty 50 in most of the secular bull-run years between 2014 and 2017. However, the cyclical heavy Nifty 50 (around 52 percent) helped it to deliver higher return than Nifty Next 50 in the polarized markets seen in 2018 and 2019.

As far as the sectoral compositions are concerned, they complement to each other. Hence, both Nifty 50 and Nifty Next 50 funds can be part of one's portfolio.

‘The Nifty Next 50 is an incubator for the Nifty 50. Whenever new companies enter into Nifty 50 basket, they are selected from the Nifty Next 50” says Vishal Jain - Head - ETF - Nippon India Mutual Fund. DSP’s Ghelani adds that in the last 20 years, 44 stocks have moved from Nifty Next 50 to Nifty 50. Which is also why Nifty Next 50 is typically referred as a set of ‘tomorrow’s bluechip companies.’

Nifty 100 versus a combination of Nifty 50 and Nifty Next 50Although the Nifty 100 index consists of all stocks that are in the two indices – Nifty 50 and Nifty Next 50 – it’s not as simple as it looks. Around 87 percent of Nifty 100 lies in Nifty 50 stocks, and just 13 percent lies in the Nifty Next 50 constituents, as of November 2020.

“While optically one might think that it would be better to have only one (Nifty 100) rather than owning two funds, but practically, the risk and return expectations would be very different,” says Ghelani who advices a mix of Nifty 50 and Nifty Next 50 indices.

Index funds or ETFs with lower tracking error and expense ratio are preferred investment option. Additionally, higher liquidity matters if you want to invest in ETFs through secondary markets. Minimum investment horizon should be five years or more.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.