The rally in stock markets has pushed up equity assets of several mutual funds, thus increasing their profits for the financial year 2020-2021. Some fund houses also saw a sharp rise in own investments in equity schemes, along with significant savings on office-running expenses due to the COVID-19 induced lockdown.

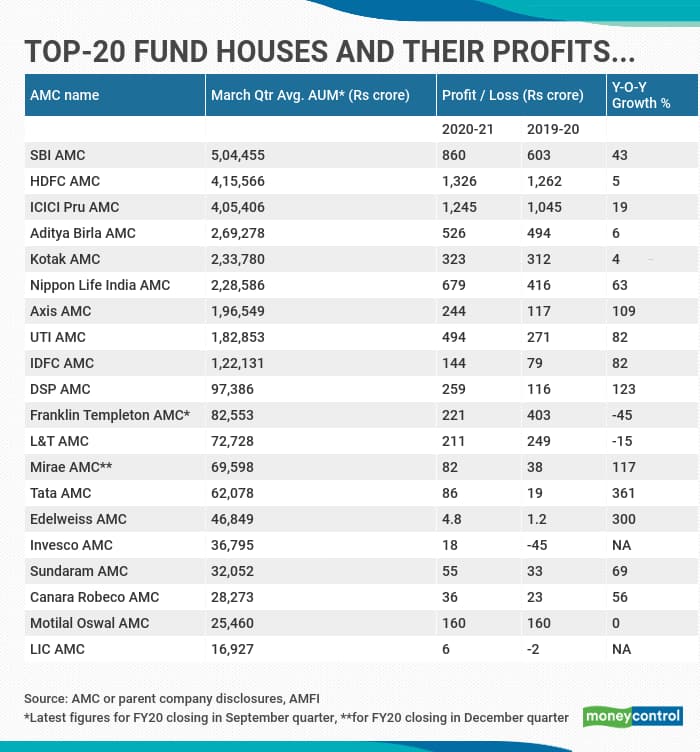

As many as 14 asset management companies (AMCs) reported a more than 50 percent increase in their net profits for financial year 2020-2021.

An analysis of disclosures of 37 AMCs or their parent companies showed that 27 fund houses reported profits in financial year 2020-2021. As many as 10 AMCs recorded losses.

Some houses with sound track-records of delivering healthy returns on their equity schemes saw sharp rises in profits.

Mirae AMC’s profits increased 117 percent in financial year 2019-2020 (closed on December 31, 2020), while Axis AMC’s profit was up 109 percent.

Swarup Mohanty, chief executive officer, Mirae AMC, says the profit surged on the back of its asset growth and the heavy equity tilt in its asset mix.

Fund houses make more on equity assets than debt funds, as AMCs can charge higher management fees on equity schemes. Also, investor flows coming into equity schemes tend to be stay on for longer.

Having a lean team also helped the fund house. Between the March 2020 and March 2021 quarters, Mirae AMC has seen a 60 percent jump in investor assets.

Axis AMC has also seen a sharp jump of 40 percent in investor assets in the same period. Industry observers say the fund house too has benefitted from the popularity of its equity schemes.

“Axis AMC has been garnering a large share of equity flows in the industry,” points out Kaustubh Belapurkar, director-manager research, Morningstar.

“Among the top-10 AMCs, we have seen the largest growth in our asset base. Between 50-55 percent of our asset mix has always been in favour of equity,” says Chandresh Nigam, managing director and chief executive officer of Axis AMC.

How the top the AMCs faredSBI AMC -- the country’s largest asset manager -- saw its profit rise by 16 percent. This is on the basis of its profit before tax, and excludes other income.

If all that is factored in, the AMC’s net profit has grown by 63 percent in financial year 2020-2021.

SBI AMC saw a strong growth in investor assets, which have grown by 35 percent between March 2020 and March 2021 quarters.

HDFC AMC reported 5 percent growth in its profit after taking into account other income as well as any tax-related changes, while ICICI Prudential AMC reported 19 percent jump in its net profit.

Other AMCsTata AMC has reported four-times jump in its profits. The AMC's other income gains from its foreign currency transactions, significant decline in rent-related costs and various office-running expenses has contributed to the growth. The fund house didn't wish to comment.

Tata AMC has also seen its investor asset base expand by 16 percent between March 2020 and March 2021 quarters.

Other AMCs have also seen savings from office-running expenses due to lockdown.

Franklin Templeton AMC (FT AMC), which has been embroiled in legal challenges over its decision to wind-up its six debt schemes in April 2020, saw 45 percent fall in profit in financial year 2019-2020 (September 30 closing).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.