Small-cap funds have had a splendid run over the past year or so. The category delivered 98 percent returns in one year. No wonder investors have flocked to them. Both the incremental investments of investors and rising stock prices meant that small cap funds as a category commands an asset size of Rs 80,379 crore as on May 31, 2021. Despite the momentum and euphoria surrounding the space, investors may be better off going slow on small-cap funds.

Broad-based rallyUnlike CY2018, 2019 when only a few select stocks rallied, the market upswing from 2020 has been quite broad-based across segments. Since March 31, 2020, the Nifty Small Cap 250 TRI has risen 164 percent, compared to 86 percent gains recorded by the Nifty 50 TRI. Deepak Chhabria, Founder and Managing Director, Axiom Financial Services says, “As small-cap stocks saw a larger price correction in March 2020 compared to their large cap counterparts, they have also bounced back more than large-cap stocks.”

As many investors picked up small and micro-cap stocks, valuations have risen sharply. The price to book value ratio of the Nifty Small Cap 250 index has risen to 3.51 as on June 28, 2021 compared to 1.2 as on March 31, 2020.

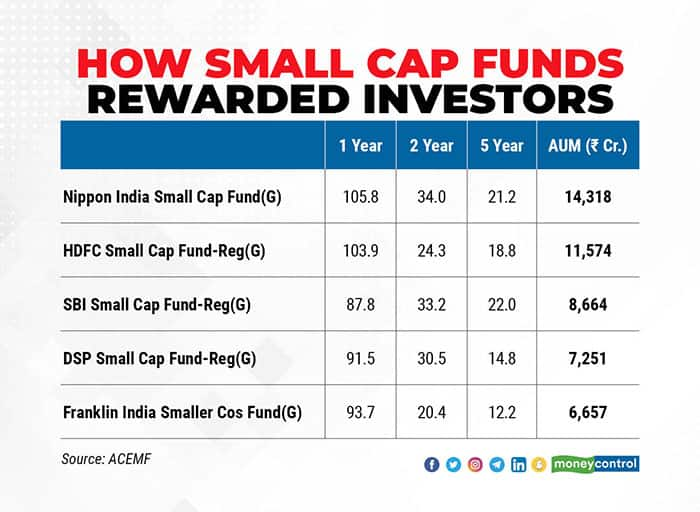

Scheme sizes riseThere are seven small-cap schemes that manage more than Rs 5,000 crore each. The largest is Nippon India Small Cap Fund, which manages Rs 14,318 crore. Harshad Patwardhan, Chief Investment Officer-Equities, Edelweiss Asset Management, says, “In small-cap investing, liquidity of stocks is of utmost importance. If the fund manager ignores liquidity in search of returns, then it may become difficult to sell the stocks in an orderly manner, in case the tide reverses suddenly.”

In a recent interview, Samir Rachh, who manages Nippon India Small cap said the fund has a well-diversified portfolio of about 120 stocks, for adequate diversification and liquidity.

“Over a period of time, the liquidity in the small-cap space has improved due to investors’ increasing participation and the rise in the market capitalization of small-cap companies,” says Vinit Sambre, Head-Equities, DSP Investment Managers. “While constructing a small-cap portfolio, factors such as inclusion of large-sized good-quality small-cap companies and 5-6 percent held in cash, have helped maintain liquidity despite growing size of small-cap schemes,” he adds.

Beating benchmark still toughThough small-cap funds clocked spectacular returns, many schemes have found it difficult to beat the Nifty Small Cap 250 TRI that clocked 106 percent over the last one year. “In the last few years, we have seen anaemic earnings growth and a few stocks kept on moving upwards. However, the government policies such as focusing on infrastructure and production-linked incentives, should ensure that economic growth is broad-based in the next few years, which in turn should help many small-cap companies post good profit growth,” says Patwardhan. “Valuations are not cheap anymore. However, there are many good-quality small-cap stocks available at fair prices if the investor has a long enough investment timeframe,” he adds.

Sambre advises investors to moderate their returns expectations in future. “Though the economy is expected to grow and corporate profits are expected to be healthy, investors need to have a long enough investment timeframe, given the rich valuations in many pockets.”

Do not ignore volatilityExperts say all the easy money in small-caps is behind us. In the near future, the rising inflation may make small-cap investing a volatile ride, though in the medium to long term, it may be worth the risk.

“Invest only if you have the risk appetite and have seen one full market cycle. If a 20-30 percent loss unnerves you and you aren’t able to average costs during falls by investing money, then small caps are not meant for you,” says Chhabria.

Small cap investing must tie in with your financial goals. “Investors generally aim to double their money in five years with mid and small-cap schemes. We have doubled the value in just the last 12-15 months,” says Anup Bhaiya, Founder and Managing Director, Money Honey Financial Services. After this spectacular run, he advises booking profits in small-cap schemes. “Many times, it has been proved that periods of very high returns are followed by volatility,” he adds.

For those of you who enjoyed enormous profits, it is time to take some gains off the table. Also, if you are closer to you goal, it makes sense to sell units and move the money to safer avenues.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.