The stock market crash in March 2020 following the outbreak of COVID-19 cases in India and subsequent lockdown led to several investors withdrawing their mutual fund (MF) investments and stopping their monthly SIPs. For some it was a genuine case of needing cash due to job loss or meeting some other financial obligations. This made it difficult to continue with SIPs.

But some withdrew in panic as they saw a sharp drop in the value of their equity investments. Were they wise to exit and run away?

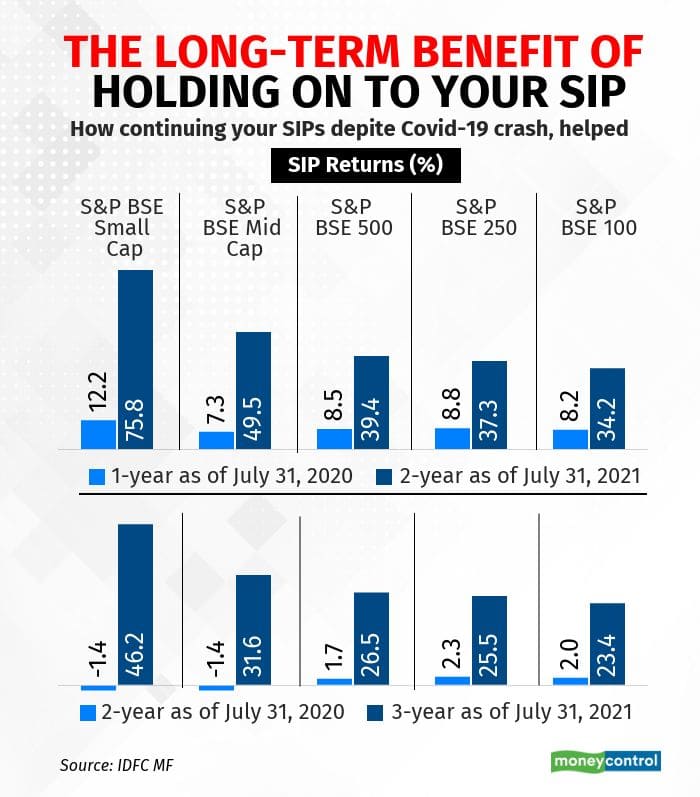

A look at SIP returns of MF benchmarksAn analysis by IDFC MF looks at SIP returns across various indices against which the major categories of equity MFs are benchmarked.

The large-cap index -- S&P BSE 100 TRI -- has delivered 2-year SIP returns of 34.2 percent as of July 31, 2021. The one-year SIP returns up until July 31, 2020, for S&P BSE 100 TRI was just 8.2 percent.

Besides the sharp market recovery over the last year, SIP returns have benefitted from rupee cost averaging. SIP helps you to keep your average cost of investment low. You end up buying more units for the same SIP amount when markets correct and less when markets rise.

The S&P BSE Small-Cap TRI has delivered a staggering 75.8 percent on two-year SIP returns (see table), whereas its one-year return was 12.2 percent until July 31, 2020. The S&P BSE Mid Cap TRI has delivered two-year SIP returns of 49.5 percent, which was 7.3 percent up until July 31, 2020.

The S&P BSE 500 TRI, which is the benchmark used by flexicap funds, has delivered two-year SIP returns of 39.4 percent. The S&P BSE 250 Large & Midcap TRI has given returns two-year SIP returns of 37.3 percent, improving significantly from the one-year returns up until July 30, 2020, till just after the Covid-19 crash.

MF distributors say that when markets fell sharply last year, they had to spend a lot of time counselling their clients. “We urged them to be patient. They may stop the SIPs, but avoid withdrawing all of their investments. Wherever possible, we told investors to withdraw investments to the extent of their immediate needs and not clean up the entire portfolio in one go,” says Ritesh Sheth of Tejas Consultancy.

“After returns moved from negative to double-digit by December 2020, some of the investors who had stayed on withdrew as they felt it was better to take money off the table as markets may correct again. Continuous communication helped to handhold investors through last year’s volatility,” says Srikanth Matrubai, chief executive officer of SriKavi Wealth.

What about three-year SIP returns?Even before the COVID-19 crash in 2020, the stock markets were reeling under pressure as economic growth had already started slowing down.

The market benchmark S&P BSE Sensex managed to gain 15 percent in the calendar year 2019, after just about five percent in the previous year. However, only a handful of large heavy-weight stocks in Sensex had contributed to these gains. For most of the broader markets, this was still a disappointing period.

If investors had held onto their investments and continued till now, they could be sitting on strong SIP returns.

The three-year SIP returns for the large-cap index --S&P BSE 100 TRI -- is 23.4 percent as of July 31, 2021. The two-year SIP returns up until July 31, 2020 for the index was just 2 percent.

The S&P BSE Small-Cap TRI has given three-year SIP returns of 46.2 percent, whereas its two-year return was negative 1.4 percent up until July 31, 2020. The S&P BSE Mid Cap TRI has delivered two-year SIP returns of 31.6 percent, which was also negative 1.4 percent up until July 31, 2020.

The S&P BSE 500 TRI has delivered two-year SIP returns of 26.5 percent. The S&P BSE 250 Large & Midcap TRI has given returns two-year SIP returns of 25.5 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.