India’s wealthy are increasingly scouting for real estate investment opportunities in overseas destinations and are also looking to acquire apartments in gateway cities around the globe.

London is one example. Indians form one of the largest communities of property owners in the city. To be sure, the United Kingdom recently scrapped its golden visa programme.

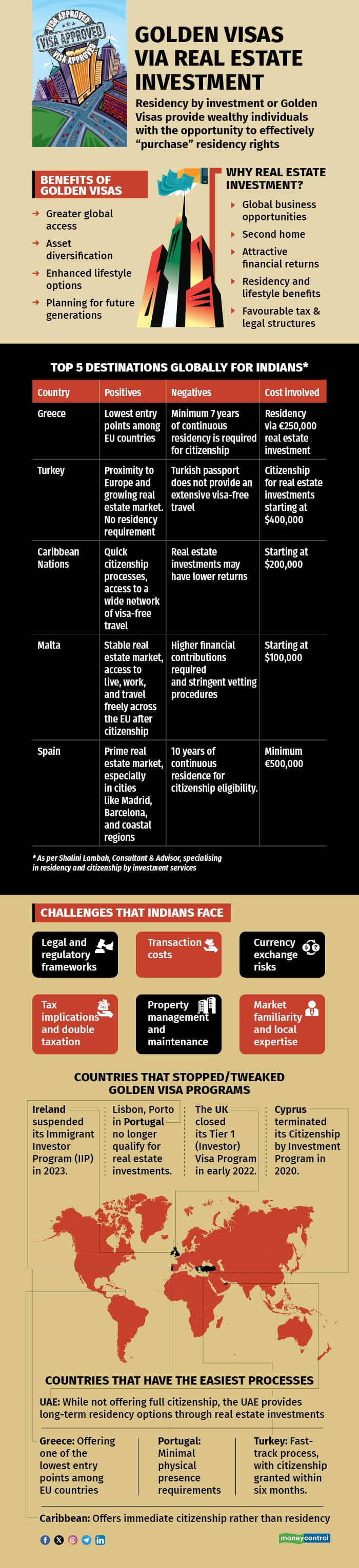

Still, the desire for greater global access, asset diversification, enhanced lifestyle options, and strategic planning for future generations make overseas real estate investment an attractive choice for Indians seeking a second residency.

Second residency, investment migration or residency by investment is a way to secure immigration, permanent residency or eventually citizenship in another country.

These 'golden visas' provide wealthy individuals the opportunity to effectively 'purchase' residency rights.

While there are many programmes globally that allow second residency via investments, which could be done in a local business, by generating employment opportunities or donations, the real estate investment route is among the top choices for Indians.

What are the top destinations?According to Shalini Lambah, Consultant & Advisor, residency and citizenship by investment services and UAE Golden Visa programme, the top global destinations for Indians for real estate investment are Greece, Turkey, Caribbean Nations (St. Kitts and Nevis, Dominica, St Lucia, Grenada, Antigua & Barbuda), Malta and Spain.

Also read | You're doing SIPs, but are you doing it smartly?“These programmes offer diverse benefits and trade-offs, often balancing cost, ease of access, and the ease of visa-free travel with longer-term residency and citizenship timelines. Further, ease of process and quick turnaround, political and economic stability, English-speaking countries with good lifestyle choices, minimal residency requirements, investment opportunities and real estate appreciation are other plus points for these jurisdictions,” said Lambah.

Experts also say Malta in Europe is fast becoming a top choice for Indians for golden visa via investments.

“It's very friendly for investors and provides an easy transition for people wanting to move business. Also, this is directly a permanent residency, unlike other European programmes. Malta, being a permanent residency programme, helps a lot of people feel more comfortable in getting PRs (permanent residency) from the get-go and not having to worry about stay requirements or residential requirements. Also, there's no language barrier,” said Binu Varghese, Regional Director – India, RIF Trust, a provider of Global Residency and Citizenship by Investment services.

The concept of residency through investment came into prominence globally around 2011-12, after the financial crisis in 2008-09.

For resident Indians, non-resident Indians (NRI) or global Indians, the real demand for residency by investments started after the Delta wave of COVID-19. There were a lot of high net worth individuals (HNIs) who could not even get to their network or family members or friends.

That was the kind of an eye-opener they needed for a Plan B or a second home option, which could hedge one's sovereign risk.

“Traditionally, Indians have always favoured the idea of sending kids abroad for higher education. Now, one of the top reasons for getting the second residency include children’s education, global investment scenario, wealth preservation, expanding business or their markets,” said Rohit Bhardwaj, Country Head - India & Director Private Clients, Henley & Partners Immigration Services India.

Why real estate?Wealthy Indians are increasingly drawn to overseas real estate for several strategic and lifestyle-focused reasons.

Additionally, many countries offer golden visa programmes in exchange for property investment, providing residency rights and access to high-quality healthcare, infrastructure, and a cosmopolitan lifestyle.

“Overseas property allows investors to diversify their portfolios beyond the Indian market, offering a hedge against currency fluctuations and geopolitical risks. Many Indian families are keen on securing high-quality education for their children, often in countries like the US, the UK, and the UAE. Buying property in these locations not only ensures a residence for their children but also acts as a long-term investment avenue,” said Akash Puri, Director - International, India Sotheby's International Realty.

Also read | Can energy-focused mutual funds power up your investment portfolio?Further, key international markets offer high rental yields and the potential for stable capital appreciation, often outpacing returns in India. This income potential makes global real estate an appealing addition to an investment portfolio.

“Global average rentals are not much. But for a residency in India, on average, it is not more than 2-2.5 percent. But in some global markets, it can be roughly around 3 percent, on average, post-tax ,” said Henley & Partners’ Bhardwaj.

As per India Sotheby's International Realty, Dubai continues to stand out as a preferred choice, especially for Indian investors, often considered a ‘home away from home’.

“The UAE's golden visa programme, which grants 10-year residency for qualifying investments, has made Dubai’s real estate market more accessible to Indian families by lowering investment thresholds. This, coupled with Dubai’s tax-free environment, absence of capital gains tax, and competitive rental yields (often ranging from 5-8 percent annually), enhance the city’s appeal as a prime investment destination,” said Puri.

Navigating the challenges deftlyAccording to experts, Indians can face several challenges, including financial, bureaucratic, and lifestyle hurdles. Therefore, careful planning and professional advice are essential.

“Some of the key challenges are significant financial investments and additional expenses, complex legal and tax implications, cultural and language barriers and comprehensive documentation with stringent due diligence and background checks,” said Lambah.

Further, currency volatility can pose significant financial risks, especially if an investor plans to sell property and repatriate funds.

“Many foreign markets have substantial transaction costs, including property taxes, registration fees, and legal expenses, which can quickly add up and impact the overall investment yield. Additionally, some countries impose annual property taxes or maintenance fees that investors may not initially anticipate,” said Puri.

Also read | Here are the top small-cap stock picks of PMS firms amid market correctionUnderstanding local practices, negotiating property deals, and handling legal documentation can be daunting due to cultural and language differences. Lack of local market knowledge can lead to uninformed decisions regarding property location, pricing, and rental demand.

Note that different countries have unique property laws, foreign ownership restrictions, and compliance requirements, which can be complex and unfamiliar to Indian investors. Navigating these regulations often require local expertise, adding to legal costs and due diligence efforts.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.