Direct mutual fund platform, Finity on October 21 said it expects investor assets managed by passive funds to account for 37 percent of total mutual fund (MF) industry assets by 2025, from the 10 percent share that it has right now.

Abhilash Joseph, business head of Finity said it is a conservative estimate. “We are expecting the growth of passive assets and mutual fund industry assets to continue with the same momentum that it has seen in the last five years. We expect the passive fund assets to continue to compound at 69 percent annualised growth over next five years, and the overall mutual fund industry assets to grow at 21 percent,” he said.

The share of assets managed by passive funds in the US mutual fund industry is 35 percent at present.

Joseph pointed out that not just new-age fund houses like Navi Mutual Fund and Zerodha, but also traditional fund houses like HDFC MF, are now focusing on passive funds.

Also read: Zerodha gets in-principle approval to launch mutual fund, says Nithin Kamath

“We have seen strong growth in past in passive assets, but we are still scratching the surface. Now, trading fund houses like HDFC MF, which have a wide banking network, are also getting serious on passives. This will add to the growth of passives,” Joseph said.

Also read: HDFC Mutual Fund files for nine exchange traded funds with SEBI

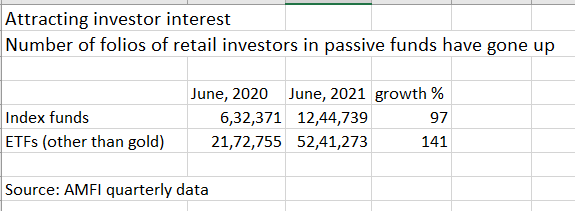

AMFI data showed a significant jump in the number of new investor folios opened over the last year. The folios of retail investors for index funds were up 97 percent, while the folios in exchange traded funds (excludes gold ETFs), were up by 141 percent.

Finity’s Passive Investing Report 2021 cites the high costs of actively-managed funds and the recent challenges in outperforming benchmark indices, as the major reason for the growing popularity of passive funds.

“Passive funds are low-cost products. The recent SPIVA report highlighted that over the last five-year period, 69-80 percent of actively-managed schemes have underperformed their benchmark indices. This is for small-, mid- and large-cap schemes,” Joseph pointed out.

According to the Passive Investing Report, the average expense ratio of actively managed large-cap funds hovers in the range of 1.5 percent to 2.5 percent, whereas the expense ratio of passive funds hovers in the range of 0.05 percent to 0.3 percent.

More innovations in passivesSome of the recently-launched fund houses are only focusing on passive funds. For example, Flipkart co-founder Sachin Bansal-backed Navi Mutual Fund has been filing several passively-managed funds with SEBI.

Navi MF has been filing several passive funds, some of which are first-time funds for the MF industry. For example, recently Navi MF filed for a Total Market Index Fund, which will give investors exposure to large-, mid-, small- and even microcap stocks. Navi MF has earlier filed for an electric vehicle fund.

NJ Mutual Fund, which is another new fund house to recently get approval from SEBI, will be focusing on rule-based funds, also known as smart-beta funds.

Smart-beta funds use a combination of rules or factors to pick investment ideas, without a fund manager getting into the picture.

Also read: NJ India: The distributor of schemes will now run a data-driven mutual fund house

Zerodha, the country’s largest brokerage in terms of active users, is also expected to bring in more innovation in the passive funds' space.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.