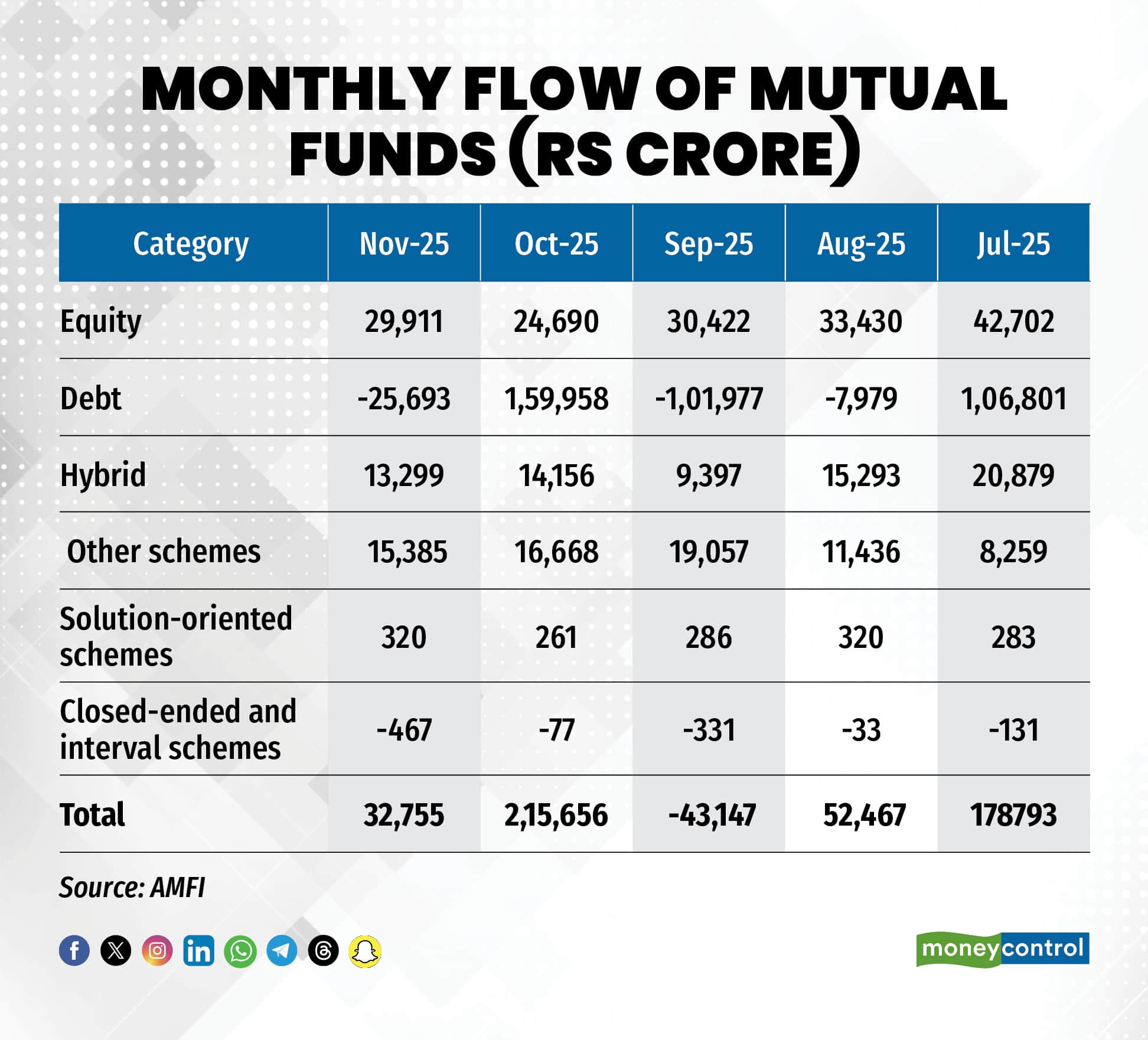

Equity mutual fund inflows rose to Rs 29,911 crore in November 2025, marking a strong 21.2 percent increase from Rs 24,690 crore in October, according to data released by the Association of Mutual Funds in India (AMFI). The momentum returned after several months of softening inflows, supported by broad-based investor participation across categories.

The total Assets Under Management (AUM) of the mutual fund industry (open-ended schemes) stood at Rs 80.5 lakh crore, while the equity AUM rose to Rs 35.66 lakh crore, up from Rs 35.39 lakh crore in the previous month.

During the month, around 24 new schemes were launched across categories, mobilising around Rs 3,126 crore.

AMFI’s November data also shows that gold ETF inflows stood at Rs 3,742 crore as against Rs 7,743 crore in October.

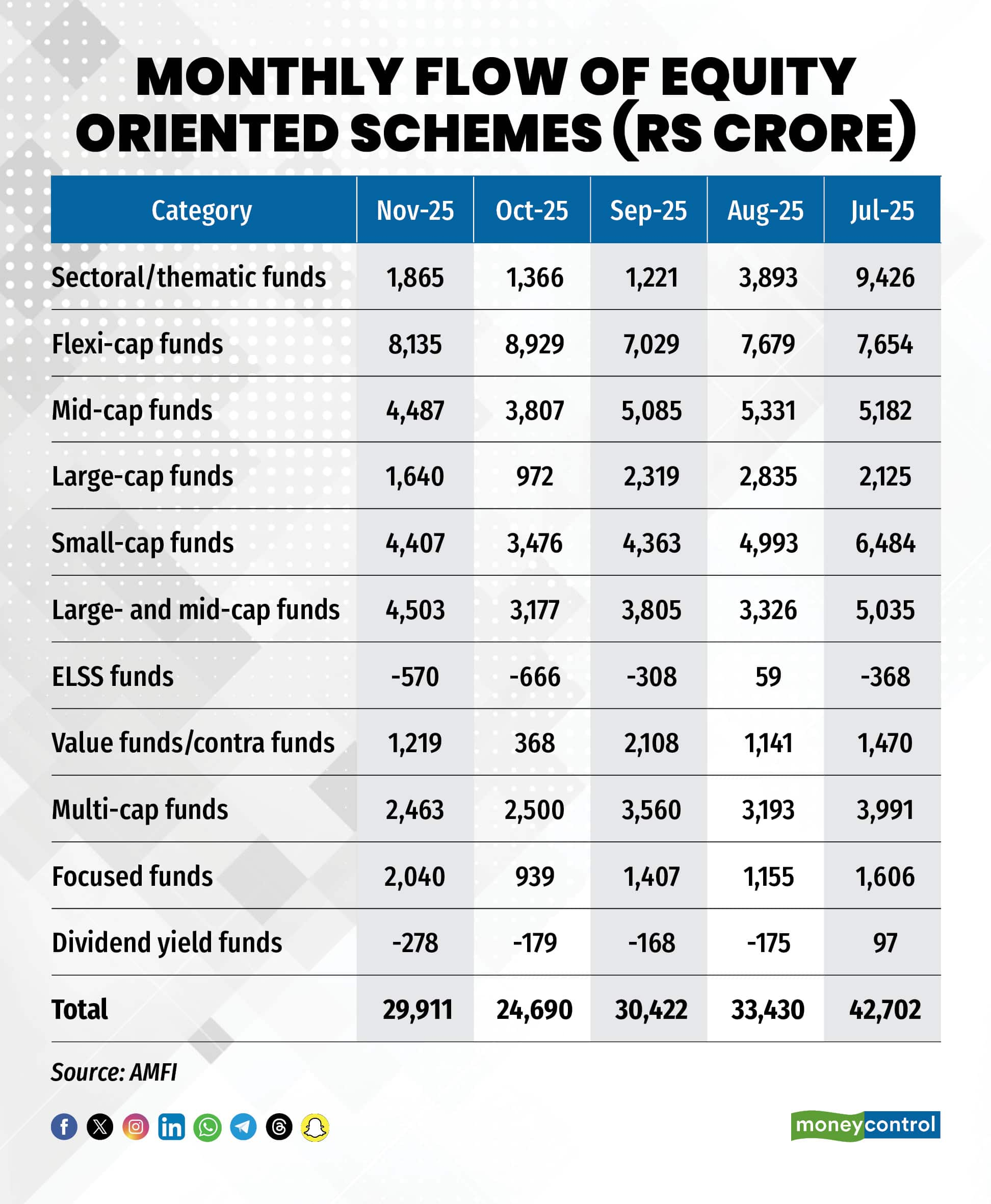

Equity mutual fund inflows saw a significant jump of 21.2 percent to Rs 29,911 crore in November 2025, up from Rs 24,690 crore in October. This marks a strong recovery in investor interest, driven by broad-based participation across categories.

Large-cap funds staged a sharp recovery, recording Rs 1,640 crore in inflows, up 68.7 percent from October’s Rs 972 crore. Large & mid-cap funds also posted a strong month with Rs 4,503 crore, rising 41.7 percent month-on-month, while mid-cap funds saw inflows increase 17.9 percent to Rs 4,487 crore. Small-cap funds collected Rs 4,407 crore, improving 26.8 percent from October.

In contrast, ELSS funds and dividend yield funds witnessed net outflows of Rs 570 crore and Rs 278 crore, respectively.

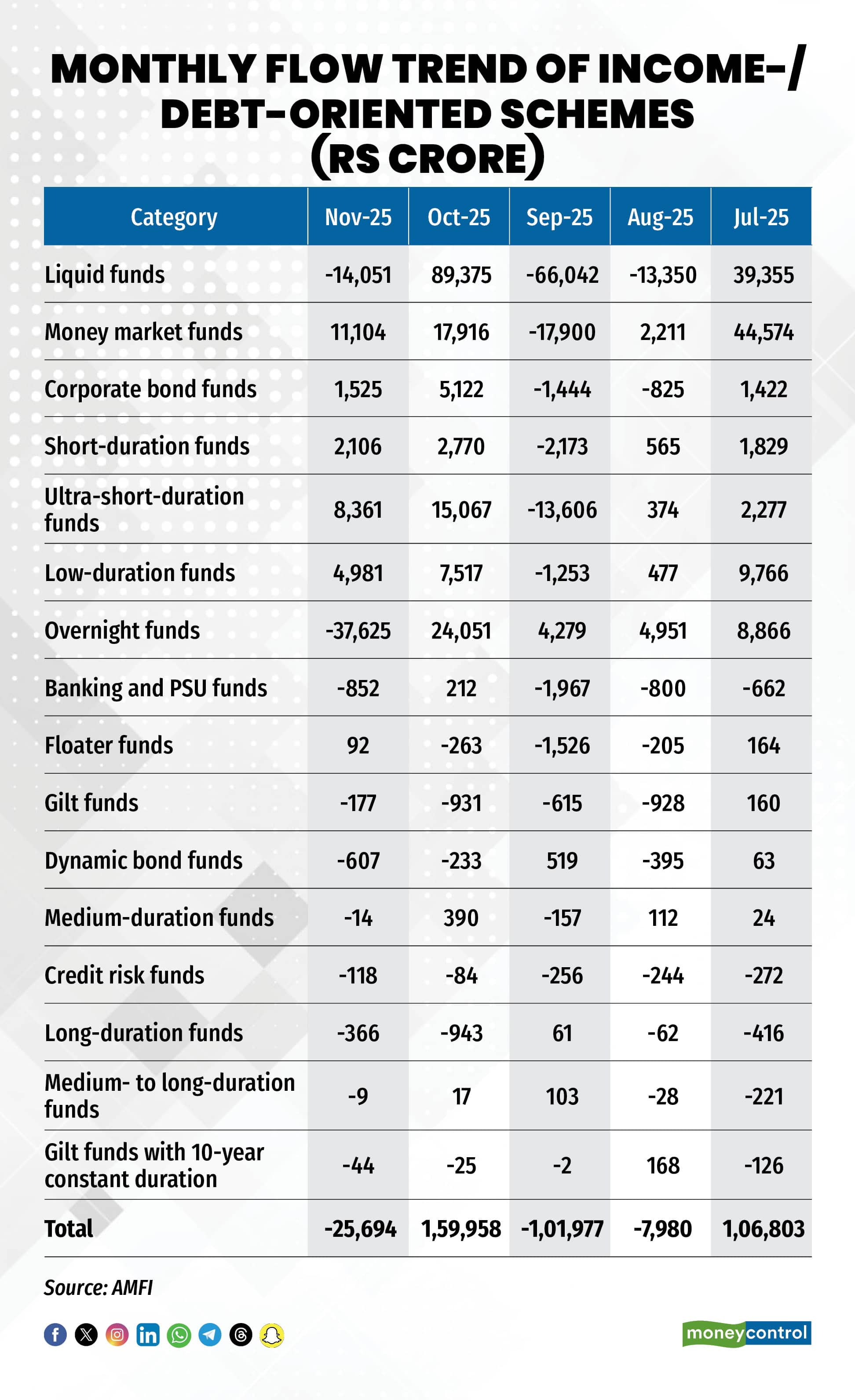

In November 2025, debt-oriented schemes saw a significant shift in investor sentiment, with a total outflow of Rs 25,694 crore, a stark contrast to the Rs 1,59,958 crore inflow in October. Liquid funds led the outflow with Rs 14,051 crore, followed by overnight funds at Rs 37,625 crore.

Money market funds, however, saw a moderate inflow of Rs 11,104 crore, while ultra-short-duration funds attracted Rs 8,361 crore. Corporate bond funds and short-duration funds also saw inflows, albeit smaller, at Rs 1,525 crore and Rs 2,106 crore, respectively. The overall trend suggests a cautious approach among investors, with a preference for shorter-term and lower-risk instruments.

Gold ETFs continued to witness healthy investor interest in November 2025, recording net inflows of Rs 3,742 crore, extending their streak of positive flows for the seventh consecutive month. “Although moderating from the unusually strong surge seen in September and October, the latest figure still reflects sustained demand for gold-backed products in a market environment marked by elevated macro uncertainty and intermittent risk-off sentiment,” said Nehal Meshram, Senior Analyst – Manager Research, Morningstar Investment Research India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.