With the Reserve Bank of India Governor Shaktikanta Das announcing the monetary policy on April 6, and with interest rates being paused for the time being, let’s shift the attention back to debt funds and how investors should plan their savings. But first, a bit of flashback.

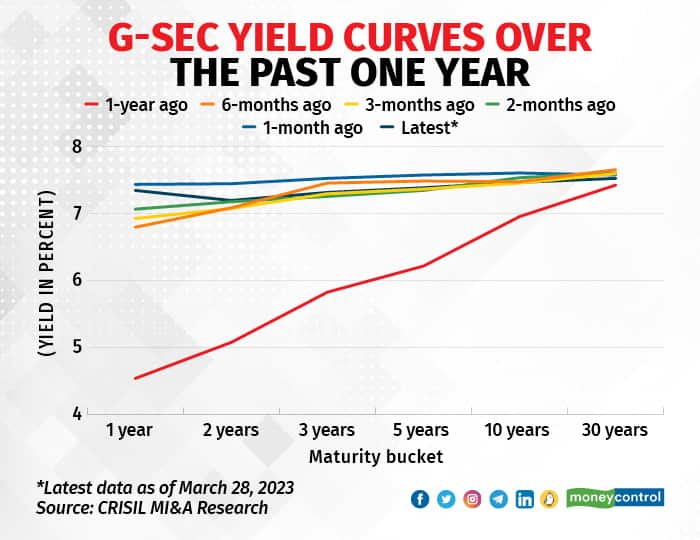

The government securities (G-secs) market witnessed a rare phenomenon a few weeks back.

At the March 8 auctions, banks demanded more on the 364-day Treasury bills (T-bills) than the last-traded yield for the benchmark 10-year G-Sec. The cut-off eventually came in at 7.48 percent for the T-bills, compared with 7.45 percent for the benchmark paper.

Typically, short-term debt securities fetch lower yields than long-term ones. Thus, what happened on that day was quite the contrary. Ergo, ‘inversion’.

Now, that sounds like jargon. This also presents an opportunity for retail investors. Though the curve has tilted towards normalisation since then, short-term yields remain attractive.

Short-term blip in yield curveTraditionally, an inverted yield curve is seen as a harbinger of slowdown and recession as they indicate investors expect growth to dip in the medium term. Thus, long-term securities such as the 10-year benchmark G-sec lose their lure.

ALSO READ: Small-saving schemes turn attractive after March-end rate hike: Here’s what you should doThe latest inversion in the yield curve was caused by uncertainties over further rate hikes by central banks amid upheavals of all sorts, and further tightening of domestic financial conditions.

The ‘March effect’ of advance tax outflows, along with redemptions in long-term/ targeted long-term repo operations had an impact, too.

All these factors have shrunk the spread between short-term and long-term bonds to the lowest in eight years. However, this inversion or flattening of the domestic yield curve is not expected to last for long.

Demand for medium-to-long-term papers is expected to revive — thereby normalising the curve — once the government’s borrowing calendar for the new fiscal is released in April and as global rate-hike bets are repriced.

ALSO READ: RBI pauses rate hikes. Time to ride debt fundsYields are seen declining by the end of fiscal 2024 because of lower fiscal deficit and crude oil prices, and some rate cuts by the RBI.

Opportunities in short-term debt mutual fundsWhile the yield curve is on a normalisation course, with the long end of the curve inching up again, the spreads versus short-term papers remain thin. This presents an opportunity for debt mutual fund investors.

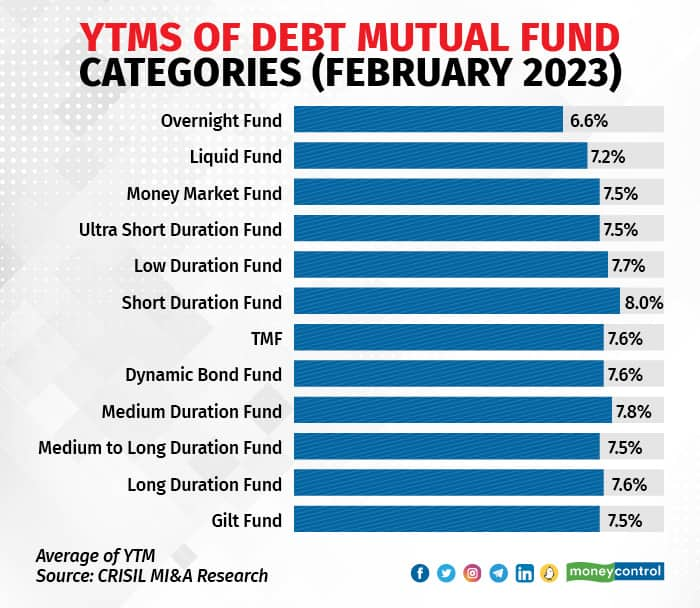

Further, the yield to maturity (YTM) of short-maturity debt mutual funds, including the passive fund category of target maturity funds (TMFs), is attractive compared with long-term debt mutual fund categories.

ALSO READ: RBI rate hike pause brings relief to borrowers. But that could just be temporaryAs of February, the YTM of short-duration funds stood at 8 percent, the highest among debt fund categories analysed. Indeed, the YTMs of all the short-maturity debt fund categories — including low-duration funds, ultra short-duration funds, money market funds, and TMFs — are comparable to those of long-maturity ones.

Thus, conservative investors who prefer debt and short-term investment horizons can use multiple options on both active and passive (TMF) routes to benefit from the opportunity of a spike in short-term yields.

That said, as and when the yield curve normalises and yields start declining, based on RBI rate cuts, longer-maturity debt mutual funds would be in a vantage position.

Thus, investors should track the interest-rate movement in the market to be able to benefit from the opportunity as and when it happens.

Moreover, as part of prudent financial planning, investors should map their goals and risk-return profiles with the products before investing. Due diligence on the underlying fund, such as asset allocation, rating profile, investment strategy, and fund manager profile, is also a must in the investment journey.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.