The keys to your dream home are just a decision away. We have the lowest ever home loan interest rates. There are also festive offers in the form of processing fee waiver. EMIs are as low as Rs 650-700 per lakh and the easier eligibility criteria for the salaried as well self-employed make availing a home loan quite an attractive option.

However, choosing a lender is not an easy call for a home buyer. Here is a borrower’s checklist to help you make an informed and confident home loan decision.

Things to know about a home loanA home loan is an affordable as well as prudent financing option to purchase, construct or renovate a housing unit. You can take a home loan from a bank or Housing Finance Company at affordable EMI plans for 10-30 years. There is absolute repayment flexibility and no foreclosure or prepayment charges attached with floating rate home loans.

As per RBI guidelines and a lender’s internal credit policy, the bank/HFC will extend a home loan of 75-90 percent of the property cost. This is called the loan-to-value (LTV) ratio. The balance amount is called the down payment and needs to be paid from the borrower’s own funds. The rate of interest and tenure vary according to the borrower’s risk profile, primarily constituting income and repayment capacity.

Further, repayment of home loan entitles the borrower to several tax benefits under sections 80C & 24. After factoring in repayment benefits, the effective lowest rate of interest for borrowers in the highest tax slab stands below 5 percent a year.

Also read: Top banks queue up to offer low rates on home loans this festive season: Should you switch?

Why lowest interest rate is not the only secret?Opting for the lowest interest rate offer is a no-brainer. But there are other factors to consider.

One, opt for a home loan where interest is calculated on a reducing balance method. Herein, the principal outstanding reduces with payment of each home loan EMI. Thus, you pay out lower interest cost each month. Two, women applicants get 5 basis points discount on the rate of interest. So, if viable, apply for a joint home loan with a woman co-borrower. Three, a majority of the lenders are offering home loans at a floating rate that tends to move with changes in benchmark rates. Thus, the choice is not between a fixed or a floating interest rate, but a slightly higher rate of interest that remains fixed for the entire loan term and a lower rate deal today that may go up in the future.

In the current scenario, rates are at the lowest ever mark in the last 15 years. Rates are expected to rise only marginally in the near future.

Processing fees & other chargesThough there are no prepayment charges involved with floating rate home loans, a lender may still cap the time and amount of prepayment. In the case of fixed home loans, pre-payment charges are imposed. Thus you should carefully read the terms & conditions before signing up for a home loan.

Next, a home loan lender incurs expense on assessing & verifying property’s cost and loan application. So, administrative charges & processing fees vary across the lenders in the range of 0.25 percent to 1 percent of the sanctioned amount.

Thus, besides the interest rate, you must consider processing charges, foreclosure charges, late payment penalty, administration costs, etc.

Tenure: How long to repay EMIs?Both public as well as private lenders offer home loans for a maximum of 20 to 30 years. However, it is advisable to not opt for the longest tenure. Rather, you should plan to repay your home loan within 10-15 years.

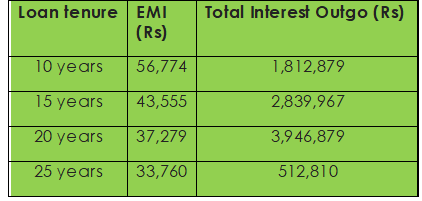

Longer the loan tenure, smaller is your EMI and higher is the interest outgo. So, a very long tenure could indeed be an expensive option.

Here is an overview on changing EMIs and interest liability for a home loan of Rs 50 Lakh at 6.5 percent a year for various tenures.

Opting for a home loan overdraft is one good way to minimise interest cost of a housing loan. The product carries a marginally higher rate of interest than a plain home loan. Yet, the benefits of high liquidity and low interest cost makes it a perfect solution for people with surplus funds. The interest is charged only on outstanding balance in the account linked with the home loan. A few popular home loan products are SBI Maxgain, Axis Bank Super-Saver, HSBC Smart Home, and Citibank Home Credit.

Also read: 5 mistakes to avoid while applying for a home loanHome loan insuranceIt is in the best interests of the borrower as well as the lender to buy a home loan insurance. Though insurance is not mandatory for home loan, lenders these days insist on property insurance. You can also buy it independently from the insurance company as well. A property insurance will typically safeguard loss caused by disasters such as fire, floods and earthquakes. Further, in case of an unfortunate turn of events such as the death of the primary applicant, the loan repayment will be covered by the insurance company. Opt for a suitable insurance plan to ensure financial security for your family.

Final WordsHome loan is a long-term commitment. It is thus paramount to opt not only for a low rate with suitable loan terms, but also superior post-disbursal services with a lender that is responsive to customer requirements.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.