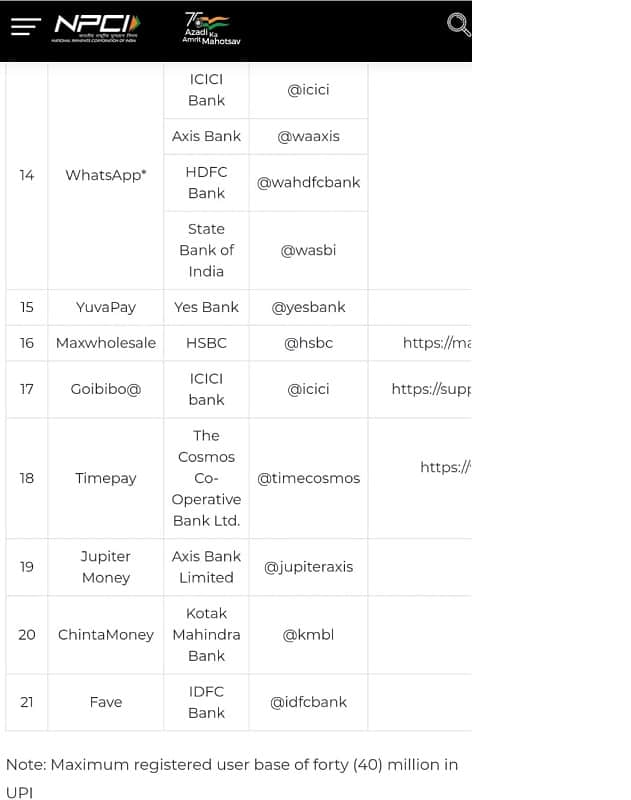

In a move that could intensify competition in the digital payments space in India, NPCI has approved increasing the user cap for WhatsApp's payment service from the current 20 million to 40 million.

Moneycontrol was the first to report earlier this month that WhatsApp is pushing for an increase in user cap beyond the 20 million and that this is being reviewed by NPCI. Moneycontrol also reported that NPCI will increase this in a phased manner so that the payment system is not overwhelmed.

Read More: WhatsApp seeks higher UPI user cap; NPCI may relax limit in phases

"They were pushing for the cap to be lifted altogether but NPCI didn't want to do that so they have increased it to 40 million. Their numbers have gone up significantly and is very close to breaching the 20 million limit," a source said.

The National Payments Corporation of India (NPCI), which operates the country’s retail payment and settlement systems, had allowed WhatsApp to start payment services in November last year with a cap of 20 million users. The Meta-owned company was expected to disrupt the payments space with its large user base in India, but it had not taken off in a big way.

Now, WhatsApp has decided to ramp up efforts to expand the payment service and wants more users.

WhatsApp’s messenger service has over 400 million users in India and lifting the limit for the payment service in one go may lead to extremely high transaction volumes on NPCI’s platform.

NPCI is considering increasing the cap in a phased manner because it cannot handle the huge volumes that might come with removing the cap completely,” the source added

Moneycontrol reached out to WhatsApp seeking comments. This story will be updated when it replies. NPCI did not offer comments.

Since September, WhatsApp has been doubling down on expanding its payment service in India.

WhatsApp India’s director of payments Manesh Mahatme said in September that it is scaling up the service in phases in partnership with NPCI. Mahatme said the focus will be on accelerating marketing initiatives to increase awareness of the payments feature on the instant messaging app.

As part of this drive, the company made the payment service more visible by featuring the rupee icon in the chat composer, between the attachment and the camera icons. It allowed the camera icon on the WhatsApp home screen to be used to scan QR codes and make payments across 20 million stores in India.

Its renewed efforts to boost its payment play seem to be paying off as transactions on its platform have seen a steady uptick.

Transactions on the app doubled to 1 million in September from August. That number surged to 2.6 million in October.

Transacted values grew from Rs 44 crore in August to Rs 62 crore in September. There was a 67 percent increase in transaction values to Rs 104 crore in October, aided by the festival season and improved sentiment.

However, WhatsApp’s share in India’s monthly payments remains at a minuscule 0.06 percent compared with 47 percent for PhonePe and 34 percent for Google Pay.

Separately, NPCI in November last year capped the volume of United Payment Interface-based transactions for third-party payment apps such as Phone Pe, Google Pay and WhatsApp to 30 percent of the total volume of transactions processed in the preceding three months on a rolling basis. Operators are required to comply with this norm by January 2023.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.