As a tactical pick, we have selected Jyothy Laboratories (JL), a midcap FMCG company, which is now way past the adverse impact of last year's Kerala floods. With a market capitalisation of Rs 6,832 crore, a small player compared to market leader, the company has a strong presence in south India in the household and personal care segments.

What makes us constructive on the stock?

Better margin ahead in fabric care (42 percent of sales) Historically known for its Ujala brand, JL has substantially diversified over the years, with a strong performance by Henkel brands. The company benefits from the premiumisation trend, leading to increasing acceptability for products like Henko Staincare, wherein it competes with Hindustan Unilever (HUL) and Procter & Gamble Hygiene and Health Care. The recent correction in prices of its key raw material -- linear alkyl benzene (LAB) -- should help segmental gross margin.

Strong presence in the dishwashing segment (31 percent of sales) JL is second only to HUL in dishwashing segment on a pan India level through its brands Exo and Pril. It has a strong presence in south India, with 30 percent market share and seems well-positioned for market share gains in the rest of India.

Trend for naturals help personal care (nine percent of sales) Through its brands Margo soap, Fa (Talc and deodorants) and Neem toothpaste, the company has substantial presence in the naturals category in few southern states and West Bengal. Growing trend for naturals should help in gaining higher share in this relatively better margin category.

Significant retail reach Complementing above trends is the strong direct retail reach of about eight lakh outlets, which is comparable to bigger peers such as Dabur India and Nestle India. In this context, low penetration in some of the categories in which it operates provides scope for market share gain, particularly in the hinterland. We believe that company’s wide distribution reach should be helpful in executing that.

Key concern In recent years, the household insecticides segment (14 percent of sales) segment has been impacted by growth in illegal incense sticks. This is a category-wide challenge enumerated by market leader Godrej Consumer Products as well. Among listed companies, JL has been at the forefront in meeting this challenge through new product launches like natural incense stick. However, intense competition, particularly from illegal incense sticks, has capped growth and adversely impacted margin. This remains a key factor to watch.

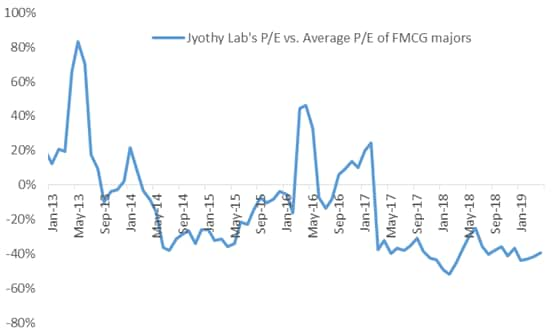

JL trades at a significant discount to FMCG majors  Source: Moneycontrol Research Note: FMCG majors include HUL, Marico, Dabur, Godrej Consumer and Britannia Industries

Source: Moneycontrol Research Note: FMCG majors include HUL, Marico, Dabur, Godrej Consumer and Britannia Industries

Attractive valuation The stock is trading 25 percent lower than levels witnessed before last year’s monsoon and seems to be finding support near current levels. The counter currently trades at 29 times FY20 estimated earnings, which is an about 40 percent discount to the average of FMCG majors.

This valuation discount is unprecedented in our view and should shrink going forward as the earnings potential unfolds further. It is noteworthy that JL’s 23 percent earnings CAGR in the last five years has been among the best and margin improvement has been broadly in line with the sector.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.