Highlights: - Solara Active's operating profit spikes on better product mix - Steady commercialisation; new products comprise 7 percent of sales - Third successive zero Form 483 inspection by FDA - Boasts of a strong portfolio of molecules backed by R&D investment - Recent fund-raising offers scope to bolster its position in complex molecules

Solara Active Pharma Sciences (market cap: Rs 1,133 crore), the demerged API (active pharmaceutical ingredient) entity of Strides and Sequent, posted a strong show in operating profit for the June quarter.

As the progress of the commercialisation of newer molecules steadied, its wide API portfolio, ongoing expansion plans and strong R&D focus make it an interesting pure API pick.

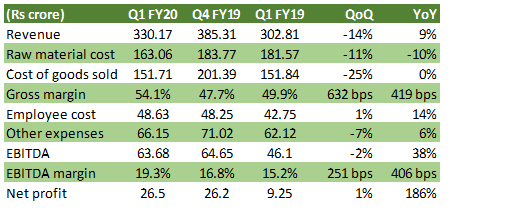

Table: Q1 Financials

Sales jumped 9 percent YoY (year on year) in Q1 FY20 as a major chunk came from regulated markets (75 percent of sales), which grew 6 percent. Q1 sales include Rs 19 crore revenue from Strides Chemicals, which was acquired from Strides Pharma on September 1, 2018.

EBITDA margin expanded 406 bps, chiefly on account of a better product mix and cost-saving measures, partially offsetting higher R&D expenses (19 percent) and employee cost (14 percent). The pharma player said there is no significant impact of new accounting standards on net profit.

Furthermore, it continued with steady commercialisation of new researched molecules. In the quarter gone by, the company commercialised one new product and with this, fresh products comprise 7 percent of sales.

Key negativeSequentially, sales declined due to seasonality, though at the operating profit level, the change was flat on a better mix.

According to the company update, its Cuddalore facility cleared an FDA inspection with nil Form 483s. An FDA Form 483 is issued at the conclusion of an inspection of a company when an investigator observes any conditions that in its judgment may be a violation of the Food Drug and Cosmetic (FD&C) Act and other related Acts.

This is the third successive instance for Solara in the past three quarters. This makes it better ranked on the regulatory compliance front. In one of the FDA inspections in July 2018, some observations were made for its Mangaluru plant. This inspection was completed by November 2018 after the issuance of Establishment Inspection Report (EIR) from the USFDA.

In FY19, the company filed for nine DMF (Drug Master File). Going forward, it intends to file more than 10 DMFs per year, with R&D investment run-rate of 3.5 percent of sales, which should help in new product launches.

The balance sheet is relatively leaner, with net debt to equity of ~0.5 times. In the medium term, gearing ratios are expected to improve further as the pharma company pays back from recurring cash flows and recent fund-raising programme.

Early this year, it announced fund-raising to the tune of Rs 460 crore from promoters and private equity player TPG, which would help in funding capex plan, inorganic opportunities in CRAMS (contract research and manufacturing services) and reduction in existing debt. In lieu of funds infusion, convertible warrants have been issued which on conversion raise the number of shares by 42 percent.

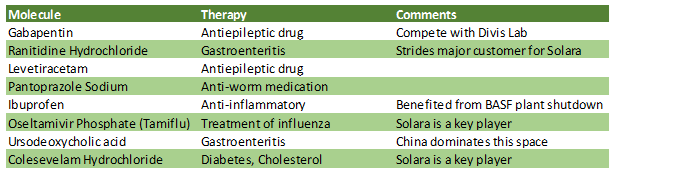

OutlookIn FY19, Solara Active benefited from a favourable market for ibuprofen API, and higher capacity utilization. In the near term, it should continue to benefit from emerging API opportunities due to supply disruption in China and steady commercialisation of new molecules.

In the medium term, while resumption of API production plants in China can temper the pricing growth of APIs, we believe that the next leg of growth would come from the niche complex molecules backed by R&D investment (~3.5 percent of Q1 FY20 sales).

Additionally, foray into CRAMS should help achieve double-digit sales CAGR (compounded annual growth rate) for the next 3-5 years. The firm is looking at ramping up utilisation for its newly commissioned Ambernath facility, from about 30 percent in FY19. Additionally, it’s setting up a new plant with Rs 250 crore investment in Vizag, which is expected to be commissioned in FY21.

EBITDA margins are likely to remain elevated on account of a better product mix and cost-saving initiatives offsetting higher R&D expenses. Taking into account of reduction in interest cost along with equity dilution after convertible warrants, earnings CAGR (FY19-21e) is expected to be 22 percent.

Table: Key molecules

Finally, the stock is trading at 12x FY21 estimated earnings, which is at the lower end of the valuation multiple range of the sector. We believe long-term investors can take a closer look at the stock, given its mix of good growth expectations, reasonable valuations and an improving balance sheet position.

For more research articles, visit our Moneycontrol Research page.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.