Jitendra Kumar Gupta

Moneycontrol Research

An infrastructure company, predominantly owning large funded assets like road, power and metro rail, aiming to become debt-free is certainly a case worth studying. The company in question here is Reliance Infrastructure, which recently concluded a deal valued at Rs 18,800 crore with Adani Transmission to transfer its lucrative Mumbai power assets.

Recently, when Reliance Infrastructure defaulted on its small amount of the debt (NCD), the majority of rating agencies downgraded its debt instrument rating to “D”, which is assigned for the instruments either in default or are expected to be in default soon. The company attributed this to the delays in completion of deal with Adani Transmission, whose proceeds were supposed to be deployed for the payment of interest and debt.

Out of debt trap

The Rs 18,800-crore deal is now a reality and company is all set to retire its debt, which has been a big overhang on its performance. It would significantly improve its credit profile.

Last fiscal, the company’s interest coverage ratio fell to 1.16 times as against 1.54 times in FY15 and 1.89 times in FY14. In July this year, the rating agency CRISIL downgraded its Rs 585-crore NCD and Rs 125-crore bond to “CRISIL D”. The report said that financial profile constrained by high ratio of debt-to-EBITDA (earnings before interest, tax and depreciation, and amortisation) and below-average debt protection metrics.

“With a delay in deleveraging plans, the debt-to-EBITDA ratio (including regulated income as part of EBITDA) remained high at around 5.3 times as at March 31, 2018,” said the CRISIL report.

While debt servicing is critical, it’s inflating trade payables only added further pressure. Since fiscal 2014, trade payables have moved up from Rs 6,517 crore to Rs 2,2147 crore in FY18. On the contrary, in this period, the receivables have remained in the region of about Rs 5,000 crore. In totality, these numbers explains why rating agencies are worried.

Capital allocation

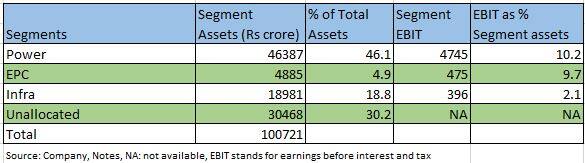

The answer now lies in its capital allocation. It has different businesses, which consumed over rupees one lakh crore capital (Rs 100721 crore) by the end of fiscal 2018.

Power business earned an earnings before interest and tax of Rs 4,745 crore or 10% of the assets deployed in the business. Interestingly, the rest of the segments such as EPC, infrastructure and unallocated capital accounted for 54% of the total assets, earned a mere Rs 2355 crore of earnings before interest and tax, which is about 4.3% of the assets. No wonder, its consolidated return on equity stood at 7.8% in FY18. A large part of the capital is not contributing partly because of the nature of the projects and over Rs 13,000 crore are stuck in arbitrations and regulatory recovery accounts. That’s the reason why it is even more important to cut debt.

Scope for improvement

The company said that the deal with Adani is expected to reduce its debt by about Rs 13,000 crore to Rs 7,500 crore. That apart, the company has proved arbitration claim of Rs 6,000 crore and regulatory assets Rs 5,000 crore, which are recoverable in the coming months. Taking part of this into account, which is quite possible, it expects to be debt-free by the end of current financial year.

Moreover, even after selling the Mumbai power business, it would still be sitting on fairly good assets. The company said that its Delhi power assets are 2.5 times the size of Mumbai power assets making a cash EBIDTA of about Rs 4,000 crore and revenue of about Rs 16,000 crore as against about Rs 8,000 crore of sales turnover in the case of Mumbai power assets.

Besides, the management further added that the Mumbai power assets makes an EBITDA of about Rs 1,500-1,600 crore, which is marginal compared to consolidated EBITDA of about Rs 8,400 crore.

The company now expects to cut interest cost by about Rs 1800 crore and improve its liquidity and financial profile. It now intend to focus on Delhi Power business, Metro business and 11 completed road assets.

The company has invested close to Rs 12,000 crore in the road assets which will throw more cash in the coming year. Further, the management indicated that the E&C business, which is having an order book of close to Rs 27,000 crore should start contributing. Last fiscal, the E&C business reported a sales turnover of Rs 1,559 crore, which the management believes has the potential to reach Rs 5,000 crore annually. The management is optimistic on the potential of the remaining businesses. So post the balance sheet restructuring, if the execution and delivery happens as per management’s guidance, stock could see a re-rating.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.