Phillips Carbon Black posted a strong set of numbers with sales up by 54 percent on YoY (year-on-year) basis and sets an expectation for a robust result from its peer Himadri Speciality’s Carbon Black business.

Table: Q3 result

There was a sequential improvement in topline numbers aided by sustenance of elevated realizations and an improved utilisation. It is noteworthy that company added 43,000 tonne capacity in FY18 through debottlenecking initiatives.

EBITDA margin (excluding forex impact) sequentially declined but improved on YoY basis on account of operating leverage. There was a moderate increase in employee cost and Other expenses. EBITDA per tonne has marginally declined and remains close to Rs 17,200 per tonne.

Key negativesSequential surge in raw material cost was a key aspect to notice. Raw material cost moved 62 percent YoY and 12 percent sequentially leading to gross margin contraction. It’s noteworthy that company’s key raw material, CBFS (Carbon Black Feed Stock), is derived from the crude oil and majorly imported. In contrast, Phillips Carbon’s one of the closest peer, Himadri Speciality sources raw material for Carbon Black from Coal Tar Oil.

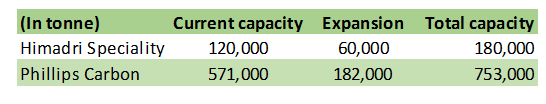

Other observations – periodic capacity additionPhillips Carbon is currently operating near 80 percent capacity utilization level. In order to meet increasing demand, company is pursuing Rs 450 crore brownfield expansion, under which company has commissioned 56,000 tonne capacity in the quarter gone by. This plan also includes capacity addition of 32,000 tonnes for specialty grade carbon black which is expected to operationalize by Q2 FY20e.

In a medium term company as well has plans for a greenfield project (Rs 600 crore) targeting 1,50,000 tonne capacity in South India. These capex plans would take the total capacity of the company to 7,53,000 tonne by 2021.

Himadri Speciality is pursuing a 50 percent increase in capacity with a focus on specialty grade.

Stock has corrected by 27 percent from the 52 week high and currently trades at a reasonable multiple of close to 7.6x FY20e earnings. Company’s capacity expansion programs ensure continuance of dominant market position and facilitates a potential for high single digit volume growth in medium term. While sizeable tyre production capacities are lined up in India, there is no major carbon black capacity planned (other than Phillip Carbon) catering to this industry.

Further, anti-dumping duty on Chinese imports should continue to support better realizations. Additionally, higher share of specialty carbon black (currently 5 percent), given the capex plans, should be supportive for the 3-5 year period.

However, given the recent soft patch in auto sector one needs to keep a close watch as demand slowdown can have an adverse impact on the carbon black volume growth. It might also make it difficult to pass through higher raw material prices in the near term.

Follow @anubhavsaysDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.