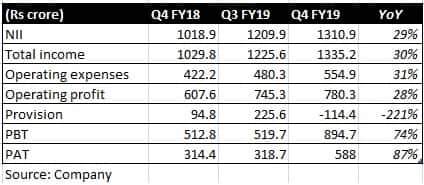

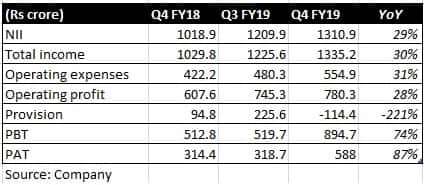

Mahindra & Mahindra Financial Services (M&M Fin) has seen an improvement in its FY19 operating environment. The trend continued in the final quarter of FY19, with the company reporting robust headline numbers. However, business deceleration was evident. Impending uncertainties due to elections and a probable disappointing monsoon may keep sentiment subdued and the stock might trade sideways. However, given the solid domain expertise and immense long-term rural potential, a weak phase may be an ideal accumulation opportunity for long-term investors.

Key positives There was a remarkable improvement in asset quality, with gross and net non-performing assets (NPA) falling to 5.9 percent and 4.8 percent from 7.7 percent and 5.8 percent in the previous quarters, respectively. In absolute terms, gross and net NPA showed sequential decline of 20 percent and 11 percent, respectively. In fact, the quarter saw a reversal in provision on bad assets, thereby providing a big kicker to reported earnings. The operating environment has improved considerably as evident from the 28 percent decline in contracts under NPA.

M&M Fin has a diversified funding base and saw little impact of the funding crisis that had engulfed the non-banking financial company (NBFC) space in recent times. In Q4, the company reduced reliance on Certificate of Deposits as a funding source and increased share of securitisation as well as public deposits.

In fact, M&M Fin was able to improve its interest margin for FY19 despite the challenging funding scenario.

The company's dependence on Mahindra & Mahindra (M&M) appears to be declining, with the share of M&M in M&M Fin’s asset book at 43 percent, a two percentage point decline over the last one-year.

Healthy asset growth, improvement in interest margin and fall in asset quality stress and consequent decline in credit cost enabled the company to report a 2.6 percent return on assets (RoA). If the market conditions do not deteriorate, the probability of reaching three percent RoA in FY20 cannot be ruled out, riding on cost optimisation and further improvement in asset quality.

Some of the company's important subsidiaries are showing an improvement. Mahindra Rural Housing (88.75 percent stake) reported 44 percent growth in after tax profit for the fiscal with a gradual improvement in asset quality. Mahindra Insurance Brokers (stake 80 percent) posted a 37 percent growth in FY19 PAT.

Key negatives Overall growth in assets under management for FY19 stood at a healthy 26 percent to touch Rs 61,250 crore. The key drivers were commercial vehicles/construction equipment as well as pre-owned vehicles that grew on a lower base. Other auto segments -- utility vehicles, cars and tractors -- grew at a moderate pace. The SME segment saw a decline. But what is noteworthy is the growth deceleration in Q4.

In terms of disbursement growth, Q4 was the weakest with disbursement declining. The weak government-led activity ahead of the election and significant discount by automobile manufacturers, which impacted the used vehicle market, led to this softness.

While optimistic about the rural geography with its multi-product and pan-India presence, the management is cautious about near-term growth in light of the election and monsoon uncertainties.

Outlook M&M Fin with its deep rural penetration has carved out a niche for itself. The diversification in asset as well as funding book makes the business relatively de-risked and the marquee parentage insulates it from the funding issues. We see M&M Fin as a vantage player to wean away market share from weaker competition.

The near-term uncertainties may keep the stock rangebound in the near term. The stock is valued at 2.1 times FY20 estimated price-to-book. The weakness may be a perfect time to accumulate the stock for the long term.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.