Neha Dave Moneycontrol Research

Highlights: -Government’s disinvestment target for FY21 now hinges on listing LIC -Over the years, LIC has been the lifeline for the Government’s disinvestment program -LIC will be India’s most valuable firm if listed -Listing LIC will improve Government finances, enhance corporate governance --------------------------------------------- The Union Budget 2020 proposes to sell a part of the government’s holding in Life Insurance Corporation (LIC) by way of Initial Public Offer (IPO). This was the most positive announcement amongst the measures announced for the financial sector and could go down in the history as real big reform if it paves the way for privatisation of the insurance behemoth.

While it wouldn’t be an easy task, we assess and try to understand why listing LIC is imperative, how it can help unlock value and most importantly how much it can add to the government’s kitty.

Listing LIC can impart much needed transparency Over the years, LIC has become ‘the lender of last resort’ to the Government of India.

Thanks to its huge corpus of funds, LIC has been the government’s go-to lender for all its funding needs. It has come to the government’s rescue in capitalising state-run banks (LIC holds equity stake in many public sector banks), bailing out a weaker company (it bought the troubled IDBI bank) and investing in various Government initiatives (it subscribed to UDAY bonds and invested in National Investment and Infrastructure Fund).

Additionally, LIC has been the lifeline for the Government’s disinvestment programme for many years now. Successive governments — earlier the Congress-led United Progressive Alliance (UPA) and now the BJP-led National Democratic Alliance (NDA) in an unprecedented manner — have used LIC to meets its divestment agenda.

Back in FY10, LIC accounted for more than half the money raised through disinvestment as it invested more than Rs 10,000 crore in Initial Public Offers and Follow-on Public Offers of state run companies.

The reliance on LIC continues till date, whenever the government faces trouble in finding private takers of public companies. For instance, in March 2018, LIC subscribed to 70 percent of shares on offer in the Hindustan Aeronautics Limited IPO.

Is the government right in treating LIC as a sovereign wealth fund and using its funds whenever required? Definitely not. The money that LIC manages is not the government’s money. All of LIC’s money comes from the premium paid by policyholders on which it has to offer competitive returns.

While LIC’s investment decisions are supposedly backed by a due diligence process, it’s pretty clear that it obeys government diktats. The insurance and pension funds of millions of policyholders demands far greater transparency and accountability.

Since LIC is entrusted with the hard earned savings of the people of India, creating a culture where shareholders exercise control over the company run by professional managers is a must. And this can only be achieved by listing LIC.

That said, we have also seen that many public sector undertakings that are listed and have board-driven mechanisms are not totally independent of the Government.

We have to hope, therefore, that LIC’s listing announcement is not just to raise funds but also to help achieve the real objectives of the government’s disinvestment programme, which also includes improving corporate governance of the public entity, as put up on the website of Department of Investment and Public Asset Management (DIPAM).

Listing LIC could also help reduce costs of the exchequer. LIC does not need capital today, but given the rate at which it is used as the government’s financier, at some point in time in future a situation may well arise where the government might have to fund its savior.

But how much is LIC’s worth? History will render its own verdict on Mr Arun Jaitley’s performance as finance minister between 2014 and 2019. However, the shepherd of many legislative accomplishments hinted at something big at the Diamond Jubilee celebrations of the LIC in September 2016 when he said that “If LIC is listed, it would be the most valued company in the country with the highest valuation as well as one of the largest across the world”.

LIC continues to be advantaged by its status under special legislation (it is not a company), with an explicit government guarantee for all sums which it assures. Thanks to this, LIC enjoys market leadership even as India opened up the insurance sector to private players 19 years ago.

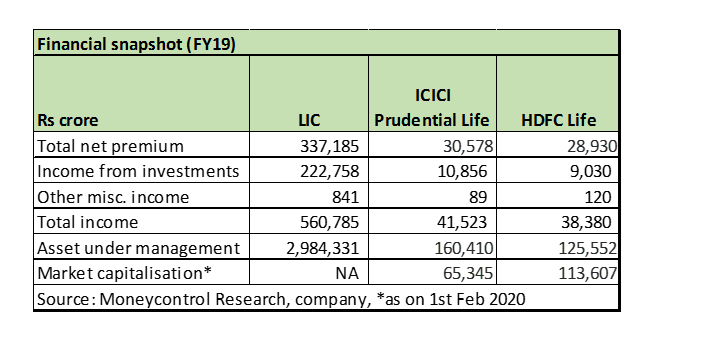

It is a monolith with an investment book of around Rs 29 trillion as at end March-19, more than the total assets under management of the entire mutual fund industry.

Though private insurers are catching up fast, LIC continues to have a giant market share. LIC has continued to lead the market with a 66.24 percent of the market share in total first year premium and 75 percent in new policies in FY19.

ICICI Prudential life, which is cheapest of the three listed life players is trading at 40 percent of assets under management. Given LIC’s strong market position and financials today, it may command a valuation of around Rs 8-10 lakh crore (assuming 30 -40 percent of AUM), making it India’s largest company by market capitalisation.

This implies that divesting 5-10 percent stake and eventually bringing down stake to 50-60 percent can help put government finances in a better shape.

However, listing LIC wouldn’t be an easy task and calls for a political will. LIC is a statutory corporation set up by an act of Parliament passed in 1956. As a first step, the act needs to be repealed and LIC has to be converted into a company.

The International Monetary Fund (IMF) in April 2018 has asked the Indian government to remove the explicit sovereign guarantee on every LIC policy and convert LIC into a company. Earlier, the Financial Sector Legislative Reforms Commission (FSLRC) had given the same advice to the former UPA government.

Given the dire state of the economy and sluggish tax revenues, government finances need a big shot in the arm and listing LIC could be just what the doctor ordered.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.