Nitin Agrawal Moneycontrol Research

Highlights: - Telecom industry witnesses net addition - Reliance Jio added the highest number of customers in the month among all players - Bharti Airtel bucked the last three-month's trend and added subscribers - Vodafone-Idea lost customers for the sixth month in a row --------------------------------------------------

The entry of Reliance Jio Infocomm (Jio) had turned the tables in the Indian telecommunication space. Jio’s freebies intensified the price war leading to consolidation in the industry and elimination of marginal players. Big players faced the heat due to a steady decline in Average Revenue Per User (ARPU) and found it difficult to maintain their market share as Jio’s competitive pricing helped it dd new customers. This trend continues and was visible in the latest subscriber addition numbers reported by Telecom Regulatory Authority of India (TRAI).

What does the latest TRAI data suggest? Recently, the telecom published subscriber data for October 2018. The industry continues to grow and witnessed an addition of 8.5 million new customers, taking the total subscriber base to 1.02 billion.

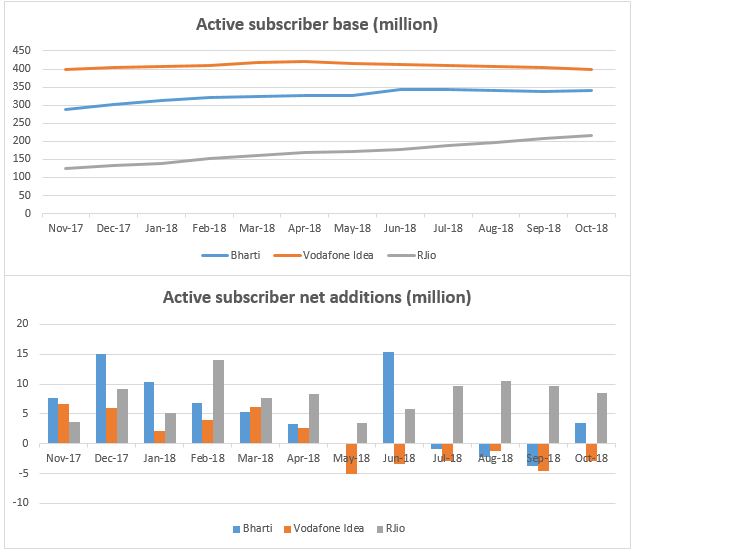

Jio reducing the gap with leaders Jio continues to maintain its momentum and added 8.5 million subscribers in October 2018, the highest monthly subscriber additions in a month. Significant addition was driven by JioPhone2 flash sale. Jio currently has an active subscriber base of 216 million. On the back of its competitive pricing strategy, it continues to gain market share and reduced the gap with incumbents. Its market share touched 21.1 percent in October 2018, up from 20.5 percent in the preceding month.

Bharti Airtel bucks last three-month's trend Bharti Airtel, the leader in term of active subscriber base before the Vodafone-Idea merger, saw net monthly additions after three consecutive months of disappointment. It added 3.4 million subscribers, taking the subscriber base to 340 million. It maintained its market share at 33.3 percent.

Vodafone–Idea – struggle is on The company struggling the most is Vodafone-Idea, which has been continuously losing market share. It saw its subscriber base and market share fall 20.1 million and 303.6 bps over the last six months, respectively. The company lost 2.9 million customers in October 2018, with its total subscriber base at 400 million at the end of the month.

What to expect going forward? We see no signs of rising ARPUs yet as Jio continues to aggressively add customers on the back of its JioPhone and postpaid customers. Although Jio has not been slashing tariffs any further now, we expect stability in ARPUs going forward. But competition is not expected to ebb in the near term and hence advise investors to tread cautiously in the sector.

For more research articles, visit our Moneycontrol Research page

Disclosure: Reliance Industries Ltd is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.