JHS Svendgaard reported a weak set of numbers for the March quarter, with sales declining sequentially and operating profit margin contracting.

We expect this decline to be transitional in nature as the company aligns its operations with the new capacity it has recently commissioned. JHS Svendgaard expanded its toothpaste manufacturing capacity to 175 million tubes a year from 90 million tubes earlier, during FY18.

The company remains a beneficiary of the ongoing trend of competitive disruption in oral care. Dabur, which is one of its most important clients, continued to put up a strong show in the toothpaste segment, having grown at 13.7 percent year on year in the quarter under review.

Also read: These 3 factors may get Dabur's stock re-rated

Having said that, one of the most prominent concerns for the company at the moment is its recent foray into setting up Patanjali stores, and the capital allocation that came with it. JHS Svendgaard's return ratios are seen getting adversely impacted as a result, in our view.

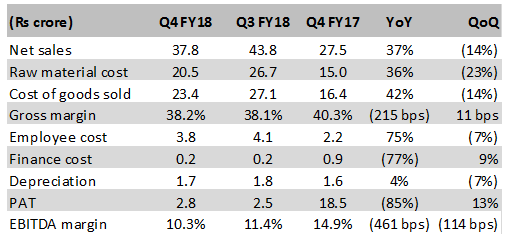

JHS Svendgaard Q4 FY18: Sequential decline

In the reporting quarter, JHS Svendgaard's net sales grew 37 percent year on year as the company's newly-commissioned capacity became operational. Operating profit margin contracted, primarily because third part contracts expanded and employee cost increased.

Sequentially, there was a dip in the company's top line, but its gross margin improved due to a sharper decline in cost of raw material. This, coupled with higher other income, which doubled quarter on quarter to Rs 2.2 crore, resulted in net profit growing 13 percent over the period.

JHS Svendgaard's quarterly results were below our expectations, both in terms of top line and operating profit margin. Keeping this in mind, we have lowered our projections on the company's earnings, taking into account the upfront investment of around Rs 50 crore to set up 100 Patanjali stores.

While the stock is currently trading at 16.3 times its estimated earnings for FY19, which means it is available at a discount to the industry average, we remain cautious about what the company does on the capital allocation front.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.