Anubhav Sahu

Moneycontrol research

Dabur reported volume-led growth, marked by market share gains in key categories. While reduced competitive intensity is a key positive, improving rural demand and recovery in international business is expected to keep volume growth in a high single-digit trajectory.

Strong like-for-like growth

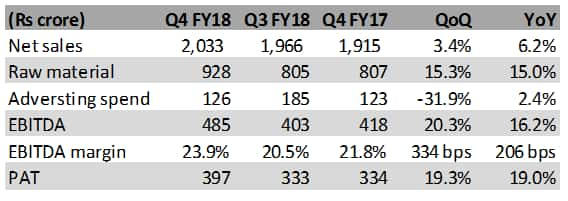

Consolidated revenue for Q4 FY18 grew 11.1 percent year-on-year (YoY) backed by both domestic and international businesses. The domestic FMCG business (70 percent of Q4 FY18 revenue) witnessed a 10 percent comparable gain, led by 7.7 percent volume growth (versus 2.4 percent in Q4 FY17). International business (26 percent) also reported a healthy 16.8 percent revenue growth on a constant currency basis. EBITDA margins improved 206 bps YoY on the back of cost optimisation, lower promotional cost and better product mix, offsetting the surge in raw material prices.

Rural recovery faster than urban

Rural growth has been 3-4 percent higher than urban areas in the last quarter, gaining from traction in hair oil and oral care categories. The management expects this trend to continue on the back of the government’s budget announcements for rural areas and expectations of a normal monsoon.

Competitive intensity from Patanjali fading

Competitive intensity appears to have decreased in some categories where Patanjali was a core challenger. In healthcare segment (32 percent of sales), the company posted 11.2 value growth led by chyawanprash and honey (up 24 percent YoY). In the case of Dabur Honey, the company is close to reaching its historic sales peak.

In the oral care (17 percent of sales) as well, the company continues to improve its market share with 13.7 percent growth in the tooth paste category. The hair oil category (23 percent of sales) grew 8.8 percent YoY backed by market share gains for coconut oils. Sales in shampoos surged 31.3 percent YoY driven by restaging of Vatika shampoo.

Watch out for the beverages segment

Beverages segment (part of the foods segment and constituting 18 percent of sales) remains a sore point for the company and grew by only two percent YoY on account of increased competition from both listed and unlisted players. Its market share has fallen a bit to 54 percent from its peak of 56 percent. However, the management remains confident of sustaining its position in the longer term, backed by its entrenched distribution strategy. It also expects the cash burning initiatives of competitors to fade out eventually.

Another category to look out is the home care segment (five percent of sales) which was impacted by weak seasonality and low institutional sales for Odomos. The latter didn’t do well in the last quarter due to lower mosquito-related diseases. The management said no structural destabilising factor is at work.

International business recovers

Traction in the international business was led by relatively higher margin in GCC (Gulf Cooperation Council)markets. Regional sales were up 51 percent YoY on a constant currency basis led by business in Saudi Arabia and Egypt. Growth was well diversified, except for the let down in the US business of Namaste due to category issues.

Stock poised for a re-rating

The company’s quarterly result has been above expectation. We are particularly enthused by improvements in the competitive landscape, except for the juices category). The management expects high single-digit volume growth in the medium-term. Rural growth is expected to be main growth driver as its distribution strategy is in place. Additionally, recovery in its international business, particular in the West Asia North Africa region, diversifies growth.

Raw material cost inflation is a key monitorable but we draw comfort from the fact that the management is confident of maintaining its current level of operating margin in the near-term.

The stock is currently trading at 41 times FY19e earnings which is a steep discount to the market leader and sector average. We expect improving growth outlook led by demand in rural areas, falling competitive intensity (except for juices) and improvement in international businesses to lead to a re-rating in the stock.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.