Anubhav Sahu Moneycontrol Research

Highlights: - Change in central banks’ stance – higher liquidity and lower rates for longer - Lower cost of equity helps re-rate stocks - Emerging markets to outperform; India to benefit from growth differential - A word of caution: unlike earlier QE phases, focus on stocks with strong balance sheet -------------------------------------------------

Back in November 2018 when US Federal Reserve Chairman Jerome Powell signalled a change of stance on its interest rate tightening policy, a surge in flows favouring emerging market (EM) equities was widely predicted. Since then, the Fed has not just hit the pause button on rate hikes, but has also indicated a halt in the unwinding of its balance sheet later this year.

Unwinding of the central bank’s balance sheet simply means that the Fed sells securities, which sucks up money supply in the market. A halt in unwinding therefore means that liquidity would continue to remain accommodative.

Similarly, the European Central Bank (ECB) has signalled it won’t raise of its ultra-low negative 0.4 percent policy rate this year and announced new measures of refinancing. China too is increasing liquidity.

Back home, the Reserve Bank of India (RBI) has changed its stance to 'neutral' from 'calibrated tightening' and has cut interest rates. In sum, there has recently been a synchronised U-turn in the monetary policies of several important central banks.

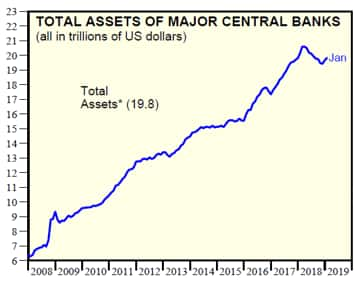

Implications This change in central banks’ stance means two things. One, liquidity levels would remain elevated. Since the start of 2018, the Fed’s balance sheet has reduced by $474 billion, which has had adverse implications for market liquidity.

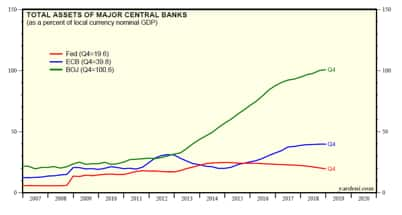

But now as the central banks stay put or rather look for means to increase liquidity (ECB and BoJ), liquidity itself may not be concern. Total assets of major central banks are now close to 23 percent of global GDP.

Total assets of central banks  *Includes Fed, ECB, BoJ and PBOC Source: Haver Analytics, Yardeni research

*Includes Fed, ECB, BoJ and PBOC Source: Haver Analytics, Yardeni research

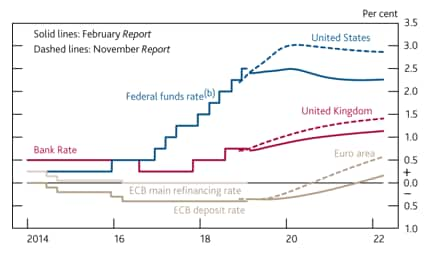

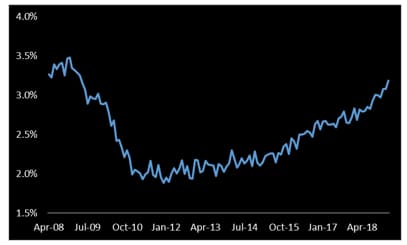

Secondly, policy rates may remain low for longer. Back in September last year, when the S&P 500 index peaked, the Fed’s dot plot expected three rate hikes in 2019. The current stance is of a pause in rate hikes.

Policy rate path

Reset of cost of equity (risk free rate + equity risk premium) All these measures lead to a lower cost of equity. Due to the U-turn by central banks, not only does the outlook for the risk free rate moderate, but there is also a loosening of financial conditions. Hence, the equity risk premium also shrinks. Our back of the envelope calculation suggests that compared to September 2018 levels, changes in the implied cost of equity warrants around 10 percent re-rating in S&P 500, other things remaining the same.

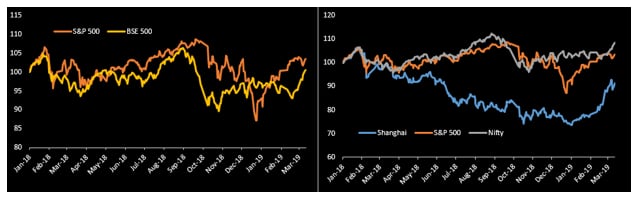

Not surprising, risky asset classes such as EMs have seen a spurt in fund flows recently.

Broader EM indices catch up

Is it dial back to QE? Will the FII flows sustain? Now the moot question is – are we re-visiting easy money again? We don’t think so. Most of the major markets have reached limits to monetary policy easing in terms of both policy rate (negative interest rate in Eurozone and Japan) and the quantum of rate cuts possible.

Total assets of central banks (% of GDP)

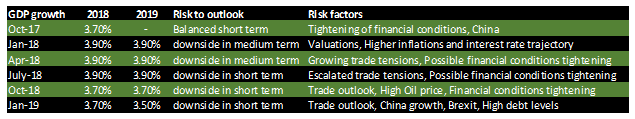

We continue with our base expectation for growth moderation and not recession. A look at the risk factors highlighted by the International Monetary Fund (IMF) suggests that some of them have already moderated. Key fundamentals like wage growth are improving on both sides of the Atlantic: the US and the Eurozone.

US wages two-year rolling CAGR

IMF projections

The Fed has indicated that it would come back to the rate hike cycle as and when inflation catches up and global growth stabilises.

So, what’s in for investors? Given the change in central banks’ stance, we expect EM assets to continue to outperform. The Indian market, in particular, can see further fund flows ($5.8 billion since February) aided by the carry trade and the growth differential.

However, it’s a late cycle course correction for the central banks and investors should not get euphoric about it. The stimulus programmes may not continue for long. At the same time, global debt levels are elevated. And unlike the quantitative easing periods, when a rising tide lifted all boats, this time investors should look for stocks with robust balance sheets and impeccable management.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.