The decision at the Federal Reserve's September meeting was on expected lines with a policy rate hike of a quarter of a percentage point (Fed fund rate range: 2-2.25 percent).

The Fed's statement exhibited higher conviction in the growth outlook and projections outlined the policy rate path. This means that investors could increasingly opt for US over emerging markets, given the former's high growth. The interest rate differential would betwen US and EMs would also narrow.

While market participants still don’t completely factor in the 2019 fed fund rate expectations of FOMC, medium-term implications for emerging markets are negative in terms of currency and fund flows.

Central banks of emerging markets may pursue corresponding rate hikes. This would be a negative for equity market valuations (thanks to a higher discounting rate).

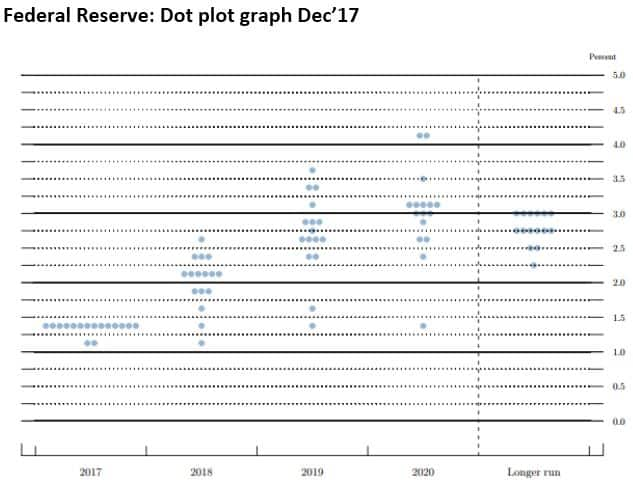

Dot plot: Three rate hikes in 2019 expectedCompared to the last projections made in June 2018, FOMC participants have a higher conviction for another rate hike in the current calendar year. Median expectations for the year 2019 and 2020 remain the same: at three rate hikes and one rate hike respectively.

Chart: FOMC participants fed rate targets

The higher conviction and steeper trajectory in the Fed rate path over the period so far in 2018 is backed by improved growth expectation. GDP growth rate projections have been upgraded for both 2018 and 2019.

Interestingly, nominal GDP projection for 2018 was 4.4 percent in Dec 2017 which has gradually gone up to 5.2 percent. Changes in the corporate tax code have been a crucial factor, along with strong domestic demand backed by sustained improvement in the labour market.

In the current year, market expectations for four rate hikes have edged up recently. Market implied probability for a December 2018 rate hike has increased to ~78 percent which appears fairly in tandem with FOMC projections. While the median Fed rate target eyed by FOMC for 2019 implies three rate hikes, market is currently factoring (~65 percent probability) not more than two rate hikes.

Market circumspectClearly, the market is not thoroughly in sync with FOMC projections for 2019. Concerns which keep market participants on the sidelines are that current momentum in economic growth might moderate as the benefit of reduced corporate tax code wanes. Further, global trade tensions continue to simmer while export growth slowdown cannot be ruled out.

Caution on Asian growth outlookDeveloping Asian countries growth outlook is also weighed by the emerging trade war. As highlighted by the Asian Development Bank in a recent outlook report that trade conflict and steeper US fed policy rate cycle have a potential to reduce investor confidence and dampen portfolio flows.

Synchronized interest cycle may be on cardsWhile the market remains cautious and trade war has a potential to skew terms of trade for emerging markets, an upward trajectory of fed rate is expected to lead to synchronized interest rate cycle for emerging markets. Pressure on emerging market currencies vs dollar is expected to continue on account of increasing growth differential with respect to the developed markets and inflationary pressures on account of weaker currency and widening of Current Account Deficit (CAD).

In this context, it may not be surprising if we witness another wave of policy rate hikes from Central banks of emerging market. With the RBI’s next policy meet on October 5, weak levels of USD/INR and external account may lead to extension of the hawkish stance.

Follow @AnubhavSaysFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.