We had initiated coverage on Lumax Industries (Lumax) and Fiem Industries (Fiem) on October 17, 2017 and January 18. The companies provide lighting solutions to automobile manufacturers and caters to all major segments. The duo posted impressive set of Q1 FY19 earnings on strong industry opportunities and wider adoption of LED lights.

Market leadership, marquee clients, focus on developing technologically advanced products and adoption of LED-based products provide improved earnings visibility for the companies and therefore merits investor attention.

Quarter in a snapshotLumax Industries In the quarter gone by, net revenue from operations grew 45.8 percent year-on-year (YoY) on the back of 35 percent volume growth. The remaining value growth was driven by higher adoption of LED products. On the profitability front, the company posted 97 basis points expansion in earnings before interest, tax, depreciation and amortisation (EBITDA) margin and 65.2 percent growth in EBITDA.

Margin expansion was driven by operating leverage, led by favourable product mix tilted towards LEDs. Profit after tax (PAT) grew 32.2 percent, with PAT margin contracting 43 bps due to sharp drop in the profit from associated companies.

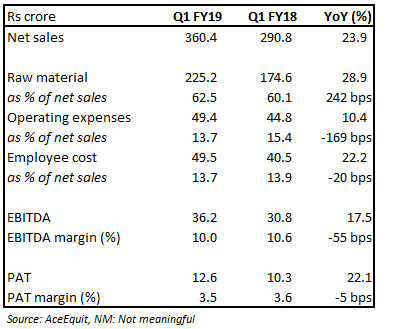

Fiem Industries Riding on growth accruing from the two-wheeler segment, Fiem posted a strong 24 percent rise in sales, led by a 22 percent growth in the automotive segment. This was driven by 12 percent and 16 percent volume growth registered by its key clients Honda Motorcycle and Scooter India and TVS Motor Company, respectively. The LED luminaries business clocked Rs 2.1 crore in revenue as compared to negative sales of Rs 3.12 crore (due to sales return in Q1 FY18).

The company posted a 55 bps YoY contraction in EBITDA margin due to a significant rise in raw material prices. This was partially offset by operating leverage and cost reduction efforts undertaken by the company. PAT grew 22.1 percent to Rs 12.6 crore.

What we like about these companies

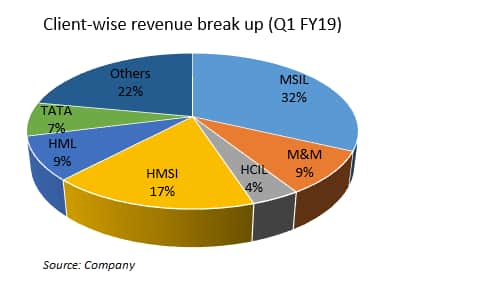

What we like about these companiesStrong clientele Lumax boasts of strong clientele. As a percentage of total revenue, Maruti Suzuki is its largest client with 32 percent share, followed by HMSI and Honda Motors (HML) with 17 percent and 9 percent share, respectively. The top five customers generate around 71 percent of total revenue.

Fiem also boasts of having marquee clients in its kitty and services almost 90 percent of original equipment manufacturers (OEMs) in India. It has TVS and HMSI as its top customers, which generate around 70 percent of total revenue.

Ahead of competition Lumax has a strong financial and technical collaboration with Stanley Electric Company (Stanley), Japan, which is a world leader in lighting and illumination products for automobiles. The company receives strong cutting-edge technology from its foreign partner, which keeps it ahead of competition. Apart from that, it has in-house R&D facilities and a design studio that helps it in working on innovative products.

Fiem has a strong in-house R&D centre and has become India’s first National Accreditation Board for Testing and Calibration Laboratories for testing of automotive lamps. Given its strong focus on R&D, the company was the first to supply LED-based lamps for a 2W model. Unlike other players in the industry, who have sourced technology from outside and pay royalty, Fiem does not have that obligation, which positively impacts its financial performance.

Industry opportunities, unaffected by move towards electric vehicles Lumax and Fiem are dominant players in the four-wheeler and 2W lighting industries, respectively. With the auto sector returning back to normalcy after various regulatory challenges witnessed in FY17/18, both 4W and 2W segments are posting strong volume numbers. These are expected to augur well for both these companies.

In percentage terms, HMSI is Fiem’s automotive segment largest client followed by TVS. These two customers are the strongest players in the fast-growing scooter segment within the 2W space. The company is therefore in a vantage position to ride the upcoming wave of growth in the scooter segment.

Both these companies are unaffected by electric vehicle disruption, going forward, as its products are immune to EV adoption.

LED segment: A game changer The management of both companies continue to be remain positive on the adoption of LED lamps and indicated that adoption is faster than what they had expected. They indicated that LEDs are high margin products and wider adoption of LEDs would unlock huge potential in terms of sales growth and margin expansion.

Moreover, the government’s decision to make ‘automatic headlamp on' (AHO) mandatory in 2W from 2017 is providing an additional growth kicker. Bharat Stage-VI norms, to be implemented by 2020, would require vehicles to be more energy efficient, which would lead to faster adoption of LEDs.

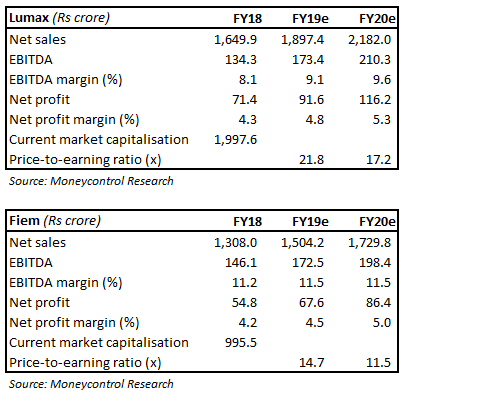

Valuation The recent correction in share prices, amid overall weakness in midcap stocks, provides a great investment opportunity. Lumax and Fiem are currently trading at 17.2 and 11.5 times FY20 projected earnings, respectively. We advise investors to buy these businesses for the long term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!