Anubhav Sahu

Moneycontrol Research

Bhansali Engineering Polymer's (BEPL) improving earnings trajectory, strengthening balance sheet and traction in capacity expansion adds to our conviction on the stock.

Near-term earnings remain positive on better pricing

In Q4 FY18, the company posted net sales of Rs 302 crore (up 17% QoQ and 56% YoY), backed by improved pricing and higher capacity utilisation. Raw material prices were in check (49% of sales in Q4 versus 57% in Q3). However, higher stock in trade capped EBITDA margin improvement.

While finance and employee costs were sequentially down, higher other expenses (63% QoQ) due to a forex loss (Rs 6.82 crore) and debtor write-off (Rs 8.56 crore) dented net profit sequentially (-2% QoQ).

ABS imports stabilising

Improved capacity utilisation and firm ABS (acrylonitrile butadiene styrene) prices have been the key earnings growth driver in recent quarters. ABS import data suggest flows are stabilising and BEPL, given the higher sales volumes, is improving market share amid improved demand.

Financial projections and valuations

The company’s near-term growth continues to be guided by elevated ABS pricing. At the same time, BEPL is on track as far as its immediate capacity expansion plan of reaching 137,000 MT by December 2018 is concerned.

Its first phase involves increasing capacity to 100,000 MT from 80,000 MT, which has already been completed last quarter. This will further aid in capturing the import-dependent domestic market (industry’s domestic capacity caters to 60 percent demand).

Further, the company’s greenfield expansion of 2 KTPA capacity, which has received the board’s approval, would be set up near Pipavav Port tentatively by FY21.

We are also encouraged by recent promoter activity (sequential improvement in share holdings), debt pay-off (zero debt company) and the release of pledge shares.

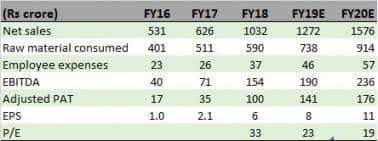

Taking into account its recent quarterly results, demand trends and balance sheet improvements, we have tweaked our earnings estimates (21% CAGR FY18-20E) upwards.

As far valuation multiples are concerned, the stock is currently trading at 18.5x FY20E earnings, which partially factors in its near-term expansion plans. However, its capacity expansion and R&D investment plans will help it emerge a dominant player in the domestic ABS market, where the positive outlook for end markets - auto (50%) and consumer durables - is supportive. Hence, the stock remains an accumulation candidate with a long-term view.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.