Indian markets bounced back sharply last week after a steep 3.5 percent fall witnessed earlier in the month of August, but the action was focussed around small and midcap stocks which rose up to 36 percent in a matter of just 4 trading sessions.

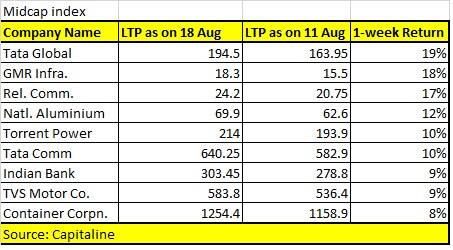

The S&P BSE Midcap index rose by about 3 percent. Top gainers among the midcap stocks include names like Tata Global Beverages (up 19 percent), GMR Infrastructure (up 18 percent), Reliance Communications (up 17 percent), Nalco (up 12 percent), and Torrent Power (up 10 percent) among others.

Tata Global Beverages has been in news throughout last week on restructuring. The company is looking to restructure its business in Eastern Europe to cut losses and improve efficiency.

GMR Infrastructure after the Supreme Court of India allowed Delhi International Airport (DIAL) to use airport land for commercial purposes. Reliance Communication saw some activity after NCLT approved Reliance Communications-Aircel merger, Brookfield deal.

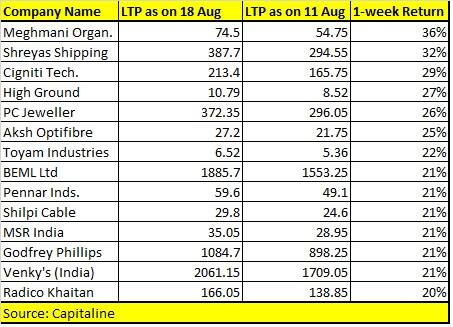

The S&P BSE Smallcap index rose by about 4 percent. Top gains among the smallcap space include names like Meghmani Organics (up 36 percent), followed by Shreyas Shipping (up 32 percent), PC Jeweller (up 26 percent), BEML (up 21 percent), and Shilpi Cable (up 21 percent).

Meghmani Organics has been on traders trader radar after strong Q1 results. The company reported a healthy 74 percent year-on-year (YoY) growth in net profit at Rs 32.9 crore in June quarter (Q1FY18). It had profit of Rs 18.8 crore in the same quarter year ago.

Shreyas Shipping too saw buying interest post strong Q1 results. The net profit for the quarter ended June 30 increased by 93 percent to Rs 20.46 crore in the quarter ended June 2017, from Rs 10.62 crore in the preceding quarter. In the June 2016 quarter, the company had posted a net profit of Rs 4.87 crore.

Interestingly, foreign portfolio investors (FPIs) have been busy booking profits in the month of August largely weighed down by concerns over expensive valuations as well as weak global cues.

“We may see volatility rising in coming times. Infrastructure sector has good long term potential & large & midcaps Companies with good management and controlled debt will perform very well in long term.(L&T, Dilip Buildcon),” Arpit Jain, AVP at Arihant Capital Markets told Moneycontrol.

The Nifty50 index is likely to consolidate further but there will be stock specific action. The index rebounded on the back of easing of international geopolitical tensions but faced resistance at 9,950.

The volatility has also increased last week. Despite the intermediate Nifty pullback from 9,700 to 9,950, India VIX remained above crucial resistance of 14 percent which remains a concern for any extended profit booking.

“Index may see further larger movements as Volatility index has seen a positive move in last one week and has been able to sustain the lower levels around 13 at which it has given a decisive break,” Mustafa Nadeem, CEO, Epic Research told Moneycontrol.

“In coming sessions since volatility is seen higher, we may see larger swings. Some key levels to watch on the India VIX index will be 14.98 and 13.67,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.