The market ended with moderate gains during the week ended November 8 despite starting on a positive note, as profit booking on the day dragged the indices from their recent highs.

On November 8, the Sensex touched a fresh all-time high of 40,749.33. On November 7, the Nifty closed above psychological 12,000 levels for the first time since June 4, 2019.

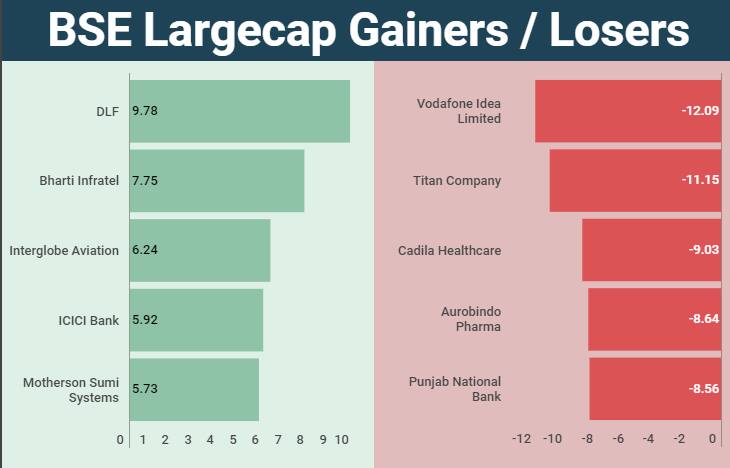

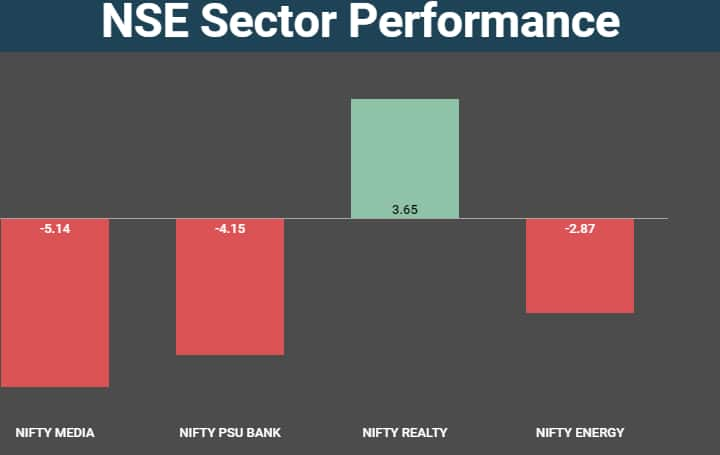

Earnings from India Inc, the Morgan Stanley Capital International (MSCI) rejig and fresh measures announced by the government to revive interest in real estate and finance companies with exposure in real estate are among the things which fueled the rally.

However, Moody's downgraded their India outlook to "negative" from "stable" citing that lower economic growth over the coming years has punctured the rally.

On the global front, sentiment got a boost after news that the US and China agreed to proportionally roll back tariffs on each other’s goods in phases.

MSCI announced a semi-annual rebalancing in its Global Standard Index (GSI) on November 7. And a total of 78 stocks witnessed changes in the latest rejig.

SBI Life is amongst three largest additions to the MSCI Emerging Markets Index. It also added eight and deleted six companies from the MSCI India Domestic Index.

Meanwhile, Nifty Bank index touched 31,000 levels for the first time since July 8.

"Technically, Nifty formed a Doji Candle on weekly scale. Multiple supports are seen at lower zones while selling pressure is seen near 12,000-12,050 levels. Now it has to continue to hold above 11,850 zones to witness an up move towards 12,035 then 12,103 levels while on the downside supports are seen at 11,780-11,750," Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services said.

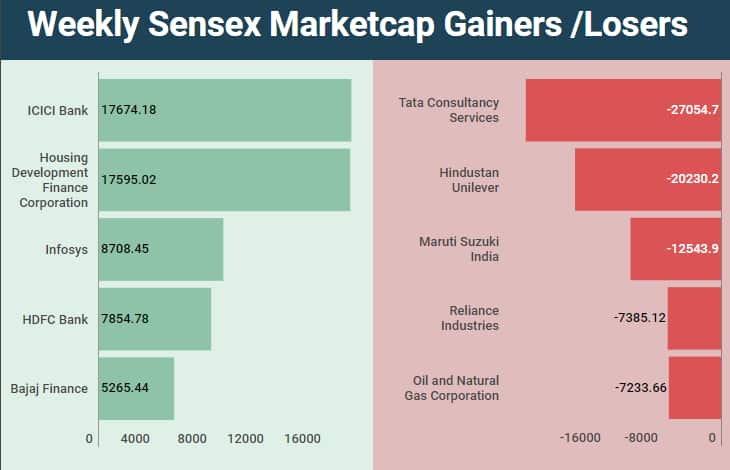

Foreign Institutional Investors (FIIs) remained net buyers the past week as they bought equities worth Rs 3,204.93 crore, while Domestic Institutional Investors (DIIs) sold equities worth of Rs 4431.27 crore.

Last week, the Sensex rose 158.58 points (0.39 percent) to end at 40,323.61 , while Nifty added 17.55 points (0.14 percent) ended at 11,908.15.

On a weekly basis, the rupee fell 48 paise at 71.29 on November 8 versus the November 1 closing of 70.81.

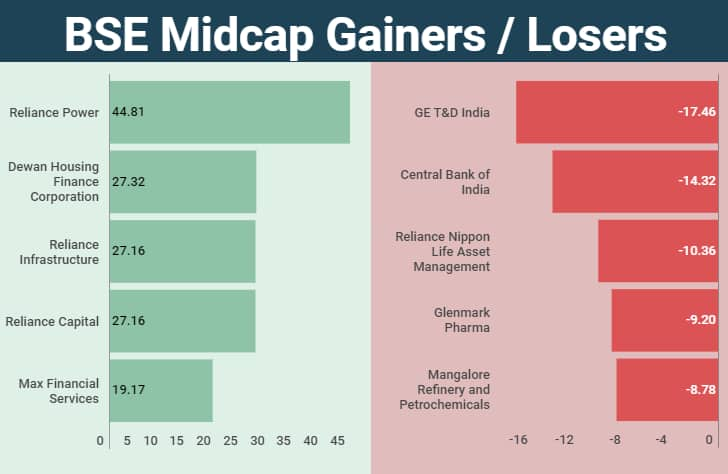

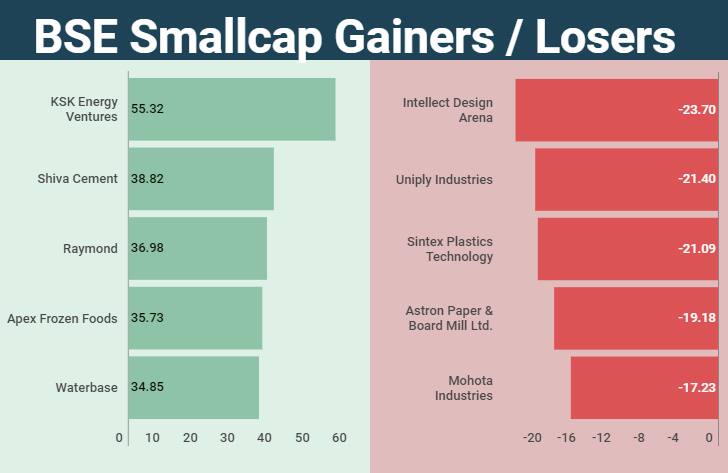

The BSE mid-cap index fell 1.07 percent, and the small-cap index was down 0.93 percent in the past week.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.