'Invest like a bull, sit like a bear and watch like a hawk'

This mantra is very well known among stock market investors.

But D-Street veteran Vijay Kedia, MD, Kedia Securities, famous for his songs on stock market investing, recently highlighted the principle of Chinese Bamboo Tree.

In a tweet earlier this month, Kedia said investing is just like ‘Chinese Bamboo Tree’, it takes time to achieve success, on the sidelines of ‘Ted Talk’ at IIM Amritsar. Patience is key to making it big in stock market. It is more like a ubiquitous Chinese bamboo tree, which takes years to grow, he said.

As per the latest shareholding data, Kedia raised his stake in two companies during December quarter as compared to September quarter 2018.

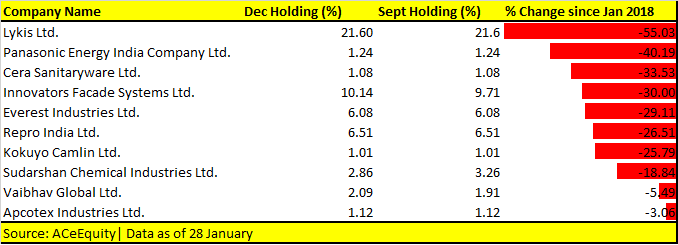

A quick look at his portfolio reflects the Chinese Bamboo Tree approach - all the stocks that have declared their shareholding pattern for December quarter in which Kedia has a stake are down up to 55 percent.

He tweaked stake only in three companies, which reflects his stand of staying put and giving his investments time to grow and give multi-fold returns.

Of the 10 companies in Kedia's portfolio in which he holds more than 1 percent at the end of the December quarter, he raised stake in two companies — Innovators Facade Systems and Vaibhav Global.

Innovators Facade is a leading façade and fenestration one-stop solution provider. And Vaibhav Global is a multi-national electronic retailer, wholesaler, and manufacturer of fashion jewelry and lifestyle accessories.

Kedia, along with another veteran investor Ashish Kacholia, holds more than 1 percent stake in Vaibhav Global. Vijay Kedia raised his stake from 1.91 at the end of September quarter to 2.09 at the end of December quarter, shareholding data showed.

Kedia reduced stake in Sudarshan Chemical Industries from 3.26 percent recorded in the September quarter to 2.86 percent seen in the December quarter.

Sudarshan is a leading colour & effect pigment manufacturer with experience of over 60 years. The company primarily serves the coatings, plastics, inks and cosmetics markets.

Kedia held his stake constant in 7 out of 10 companies — Lykis, Panasonic Energy, Cera Sanitaryware, Everest Industries, Repro India, Kokuyo Camlin and Apcotex Industries.

Disclaimer: The above report is for information only and not necessarily buy or sell ideas. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.