The market had a strong rebound of 1.5 percent but failed to sustain those gains in the last couple of hours of trade and closed with minor losses on January 28, the first day of February series, as banks, and auto weighed on sentiment, however, the buying in FMCG, IT, pharma and select metals stocks restricted losses.

The BSE Sensex fell 77 points to end at 57,200 and the Nifty50 declined 8 points to 17,102, but the broader markets performed smartly as the Nifty Midcap 100 and Smallcap 100 indices rallied 1.5 percent and 1 percent.

Stocks that were in focus include LIC Housing Finance, Laurus Labs, Coforge, Can Fin Homes, and Bata India which were top five gainers in the futures and options segment on Friday.

LIC Housing Finance climbed 10.9 percent to Rs 383.15, Laurus Labs jumped 7.55 percent to Rs 499.80, and Coforge spiked 7.1 percent to Rs 4,713.25, while Can Fin Homes was up 6.9 percent at Rs 616, and Bata India rose 5.97 percent to Rs 2,072.75.

Here's what Jayesh Bhanushali of IIFL Securities recommends investors should do with these stocks when the market resumes trading today:

The stock has reversed from the supply zone of Rs 395-400 which is further enhanced from the presence of the 200-EMA (exponential moving average) on the daily chart.

If the stock breaches the Rs 388 levels on Monday, we may see Rs 400 levels in the short term. Hence one can create long positions above Rs 388, with a stop-loss price of Rs 375 and a target price of Rs 400.

The stock has formed a Bullish Engulfing candlestick pattern on the daily chart with an uptick in the volumes, indicating a short-term reversal.

However, we expect the stock to face a resistance around its 200 EMA and a falling trendline level, hence one should look to reduce the stock on rallies.

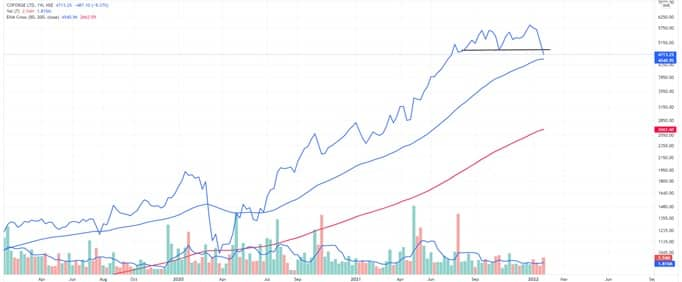

The stock has given a breakdown from the double top pattern formed at the top of the rally on the weekly chart, and has closed right below the 200 EMA on the daily chart.

The stock looks weak for the short term. Short term momentum traders should implement a sell on rise strategy with a stop-loss at Rs 4,900 and a target of Rs 4,400.

The stock has formed a Cup and Handle pattern on the daily chart but found resistance exactly at the neckline of the pattern.

Short-to-medium-term bullish momentum can be expected if the stock is able to sustain above Rs 640 levels. One can buy with a stop-loss of Rs 614 for a target of Rs 675.

The stock has given an Inverse Head and Shoulders pattern breakout on the daily chart with rising volumes. The stock looks bullish for the short term.

One can buy with a stop-loss of Rs 1,980 for a target of Rs 2,200 in the short term.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!