The market snapped two-day winning streak and ended the volatile session on a weak note December 29, following negative global cues. The BSE Sensex managed to close above 57,800 levels with 91 points loss, while the Nifty managed to hold on to the 17,200-mark and ended with 20 points loss.

Meanwhile, Nifty Midcap 100 and Smallcap 100 indices outperformed the benchmarks, rising 0.13 percent and 0.59 percent, respectively.

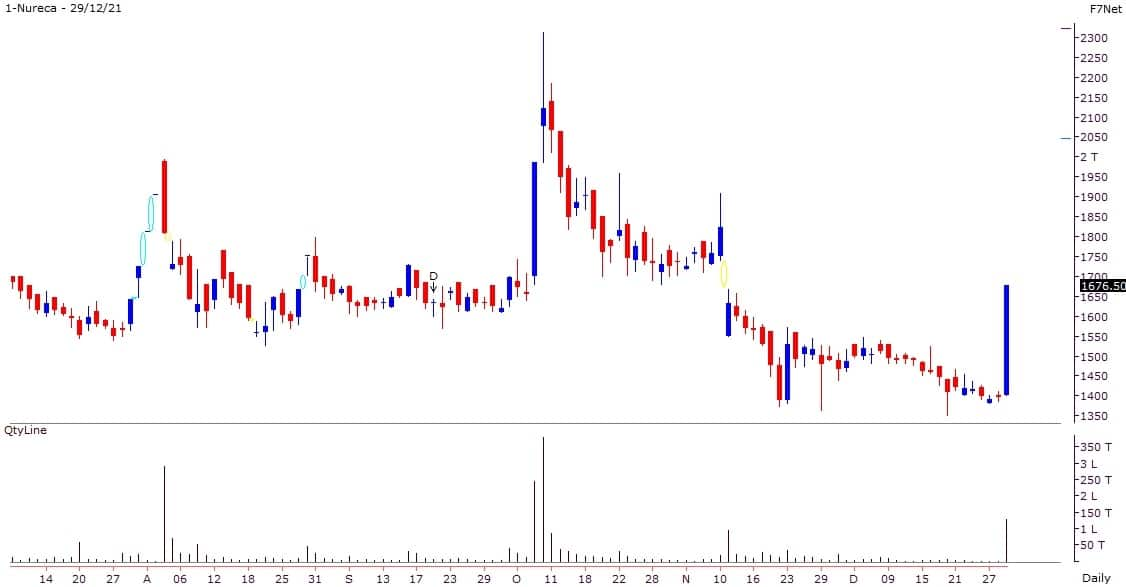

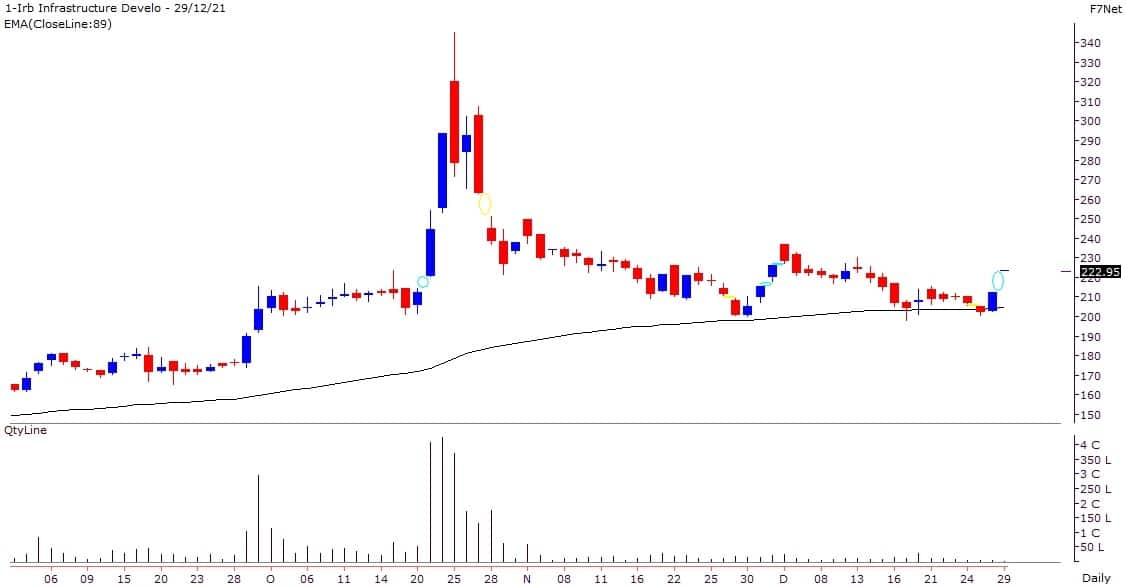

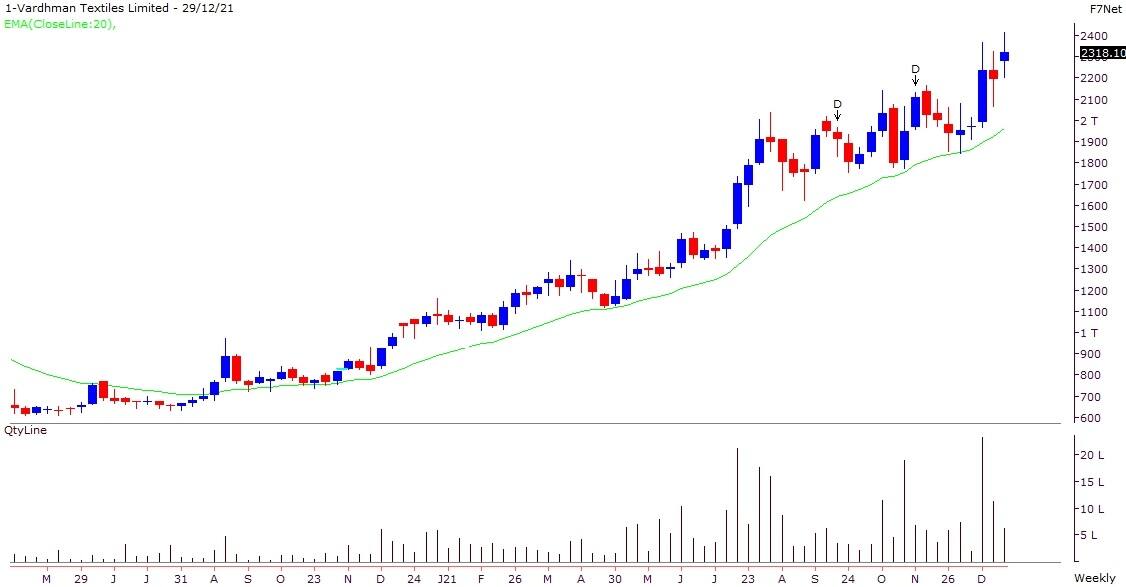

Stocks that were in focus include Nureca, which was locked in 20 percent upper circuit at Rs 1,676.50, IRB Infrastructure Developers (at 5 percent upper circuit at Rs 222.95), Rain Industries (rallied 11.62 percent to Rs 231), and Vardhaman Textiles (rose 0.41 percent to Rs 2,318.10). On the other hand, JK Cement was the biggest loser in the futures & options segment, falling 5.1 percent to Rs 3,202.

Here's what Ruchit Jain of 5paisa.com recommends investors should do with these stocks when the market resumes trading today:NurecaRecently, the price up move in this stock was accompanied by higher volumes and the volumes during price correction were low. This indicates buying interest in the stock.

On Wednesday, the stock was locked in the upper circuit and the volumes were much higher than the daily average.

Hence, investors with existing positions could continue to hold the stock with a stop-loss placed below Rs 1.350 which has now become a sacrosanct support.

Rain industries is going to be the one of new additions to F&O segment from the January series. It witnessed a good buying interest in Wednesday's session and prices gave a breakout above its swing high of Rs 223.

Thus, the near term trend for the stock is positive and hence, traders with existing positions can look to ride this trend.

The earlier resistance will now act as a support on declines and hence, one should adopt a buy-on-dip strategy for fresh entry in the counter. On the higher side, the probable near term target for the stock is seen around Rs 255.

This stock has recently consolidated within a broad range and today we witnessed price correction with higher volumes. This certainly does not bode well and hence, one should look to exit from this stock.

Investors willing to remain invested within the same sector can look to switch to other names such as UltraTech Cement or HeidelbergCement as the risk reward ratio is favourable in those names and could provide better returns.

Post the recent price wise correction, the stock has managed to consolidate above its '89-DEMA' support and has seen a buying interest in today's session.

Hence, Rs 200-197 has now become an important support zone and till this is intact, once can stay invested for a probable pullback towards Rs 250.

This textile stock has witnessed a good buying interest in the recent past and has shown an outperformance within the sector. The stock continues to form a 'Higher Top Higher Bottom' structure on the weekly charts and hence, the long term trend still continues to remain positive.

Infact, in the past few sessions we have seen price up move with good volumes indicating buying interest in the counter even at current levels. The support base for the stock is placed in the range of Rs 2,100-2,000 and one should continue to hold the stock in the portfolio and look to add on any declines.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.