Equity market benchmarks Sensex and Nifty ended in the green for the fifth consecutive session on June 2, tracking positive Asian peers. Optimism around resumption of economic activity and government's commitment to the reform process underpinned market sentiment.

The Sensex closed with a gain of 522 points, or 1.57 percent, at 33,825.53 and the Nifty ended 153 points, or 1.56 percent, higher at 9,979.10.

"The Nifty is within kissing distance of the 10,000 mark. We continue to remain upbeat as long as the upward gap area of June 1 remains intact. 9,900 followed by 9,820 should now act as an immediate support zone. On the flip side, a sustainable move beyond 10,000 would unfold the rally towards 10,100-10,200 or beyond," said Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel Broking.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for NiftyAccording to pivot charts, the key support level for Nifty is placed at 9,870.23, followed by 9,761.37. If the index moves up, key resistance levels to watch out for are 10,041.78 and 10,104.47.

Nifty BankThe Nifty Bank index closed 2.86 percent higher at 20,530.20. The important pivot level, which will act as crucial support for the index, is placed at 20,049.93, followed by 19,569.66. On the upside, key resistance levels are placed at 20,813.13 and 21,096.07.

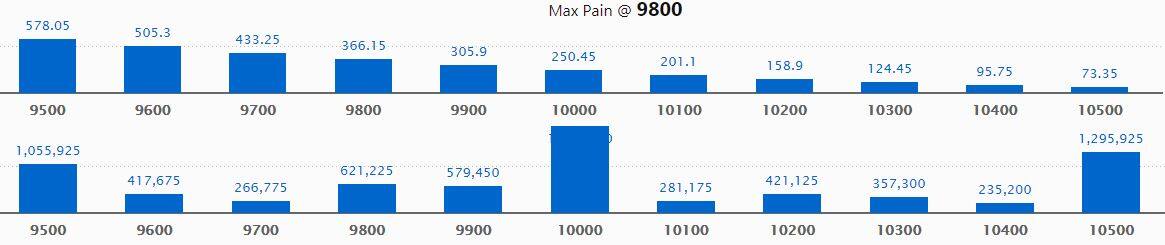

Call option dataMaximum call OI of 18.44 lakh contracts was seen at 10,000 strike, which will act as crucial resistance in the June series.

This is followed by 10,500, which holds 12.96 lakh contracts, and 9,500 strikes, which has accumulated 10.56 lakh contracts.

Significant call writing was seen at the 9,900, which added 97,050 contracts, followed by 10,500 strikes that added 49,125 contracts.

Call unwinding was witnessed at 9,500, which shed 67,650 contracts, followed by 10,300 strikes which shed 51,450 contracts.

Source: MyFNOPut option data

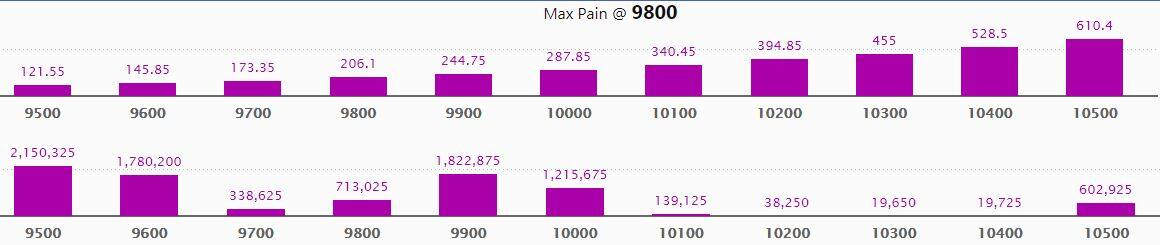

Source: MyFNOPut option dataMaximum put OI of 21.50 lakh contracts was seen at 9,500 strike, which will act as crucial support in the June series.

This is followed by 9,900, which holds 18.23 lakh contracts, and 9,600 strikes, which has accumulated 17.80 lakh contracts.

Significant put writing was seen at 9,500, which added 2.6 lakh contracts, followed by 9,900 strikes, which added 2.22 lakh contracts.

No put unwinding was seen on June 2.

Source: MyFNOStocks with a high delivery percentage

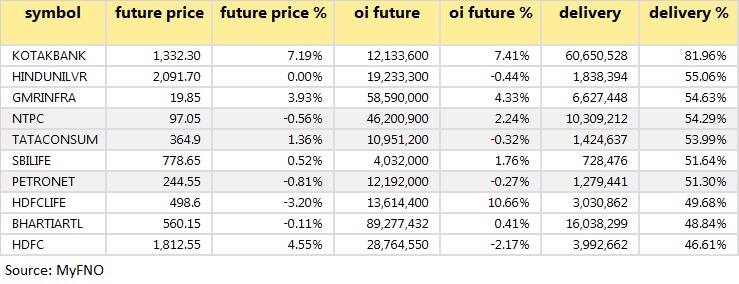

Source: MyFNOStocks with a high delivery percentageA high delivery percentage suggests that investors are showing interest in these stocks.

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

Aurobindo Pharma, BPCL, Cholamandalam Investment, Dishman Carbogen, DCM Shriram, MAS Financial Services, Oriental Hotels, Shriram Asset Management, Transgene Biotek and Vesuvius India.

Stocks in the news Britannia Q4: Profit at Rs 374.75 crore versus Rs 297.23 crore, revenue at Rs 2,867.7 crore versus Rs 2,798.96 crore YoY.

InterGlobe Aviation Q4:Loss at Rs 870.8 crore versus profit at Rs 595.8 crore, revenue at Rs 8,299 crore versus Rs 7,883 crore YoY.

Lupin:Company received approval for Meloxicam capsules, which is used to reduce osteoarthritis pain.

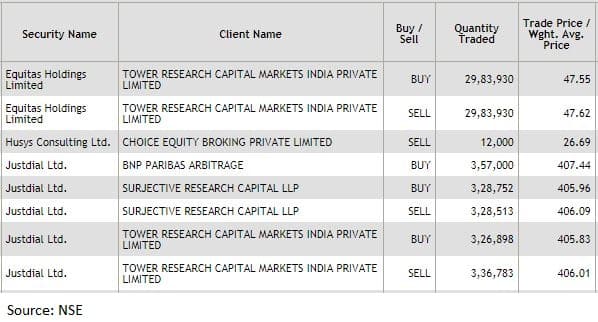

Just Dial:BNP Paribas Arbitrage bought 3,57,000 shares at Rs 407.44 per share.

Syngene International:Company tied up with HiMedia Laboratories to manufacture ELISA test kits for COVID-19.

Fund flow

Foreign institutional investors (FIIs) domestic institutional investors (DIIs) bought shares worth Rs 7,498.29 crore and Rs 441.05 crore in the Indian equity market on June 2, provisional data available on the NSE showed.

Stock under F&O ban on NSEVodafone Idea is under the F&O ban for June 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!