Sensex and Nifty ended in the green for the second consecutive day on June 8 even as the benchmarks witnessed profit-booking.

Sensex ended the day 83 points higher at 34,370 while Nifty closed with gains of 25 points at 10,167.

"The recent rally, seen globally, is based on expectations of economic recovery, post easing of lockdown measures. In India, the COVID-19 cases continue to rise and the market seems to be ignoring this, for the time being, giving more priority to the news of the economy opening up. There was a lot of stock-specific news which resulted in gains today and this stock-specific action is likely to continue," said Vinod Nair, Head of Research at Geojit Financial Services.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for NiftyAccording to pivot charts, the key support level for Nifty is placed at 10,082.3, followed by 9,997.1. If the index moves up, key resistance levels to watch out for are 10,290.6 and 10,413.7.

Nifty BankThe Nifty Bank closed 0.73 percent higher at 21,187.35. The important pivot level, which will act as crucial support for the index, is placed at 20,796.53, followed by 20,405.77. On the upside, key resistance levels are placed at 21,692.73 and 22,198.17.

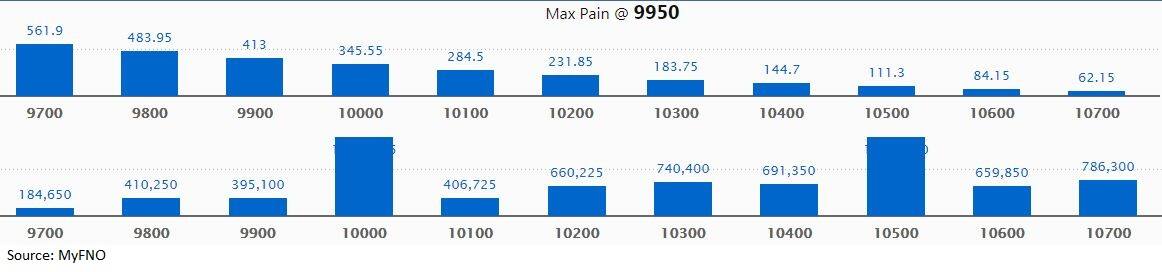

Call option dataMaximum call OI of 16.85 lakh contracts was seen at 10,500 strike, which will act as crucial resistance in the June series.

This is followed by 10,000, which holds 16.74 lakh contracts, and 10,700 strikes, which has accumulated 7.86 lakh contracts.

Significant call writing was seen at the 10,400, which added 1.91 lakh contracts, followed by 10,300 strikes that added 1.54 lakh contracts.

Call unwinding was witnessed at 10,000, which shed 1.06 lakh contracts, followed by 10,100 strike, which shed 51,750 contracts and 9,900 strike, which shed 51,600 contracts.

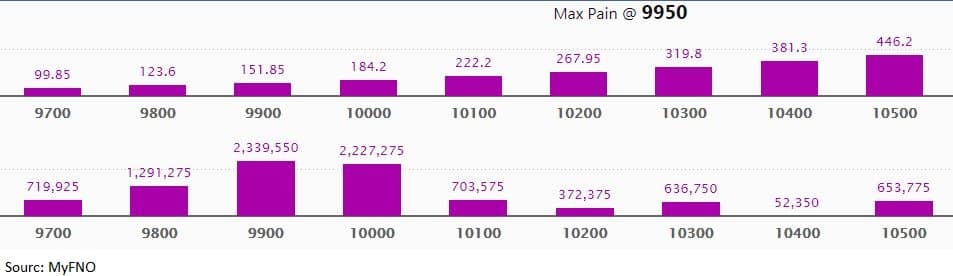

Maximum put OI of 23.4 lakh contracts was seen at 9,900 strike, which will act as crucial support in the June series.

This is followed by 10,000, which holds 22.27 lakh contracts, and 9,800 strikes, which has accumulated 12.91 lakh contracts.

Significant put writing was seen at 10,300, which added 4.71 lakh contracts, followed by 9,800 strikes, which added 1.62 lakh contracts.

Put unwinding was seen at 10,500, which shed 16,950 contracts.

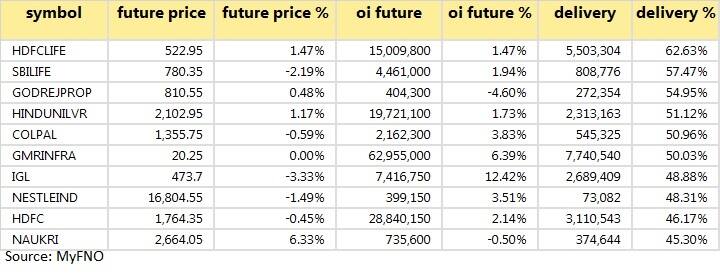

A high delivery percentage suggests that investors are showing interest in these stocks.

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

Hero Motocorp, Bombay Dyeing, Century Enka, eClerx Services, Gujarat Pipavav Port, Graphite India, Kirloskar Ferrous Industries, KRBL, Mangalore Refinery & Petrochemicals, PSP Projects, Tata Steel Long Products, TeamLease Services, Xelpmoc Design.

Stocks in the newsCoffee Day Enterprises: Kotak Mahindra Investments sold 12,84,619 shares at Rs 14.05 per share.

Titan Company Q4:Profit at Rs 346.25 cr versus Rs 353.6 cr, revenue at Rs 4,711.50 cr versus Rs 4,888.77 cr YoY.

Chalet Hotels Q4: Profit at Rs 42.77 cr versus Rs 13.3 cr, revenue at Rs 227.35 cr versus Rs 269.86 cr YoY.

PVR Q4: Loss at Rs 75 crore versus profit at Rs 47 cr, revenue at Rs 662 crore versus Rs 846 cr.

Gayatri Projects: Company received an order of Rs 145.53 crore from State Water and Sanitation Mission in UP.

Inox Leisure Q4: Loss at Rs 82.15 cr versus profit at Rs 48.08 cr, revenue at Rs 371.58 cr versus Rs 478.84 cr YoY.

Fund flow

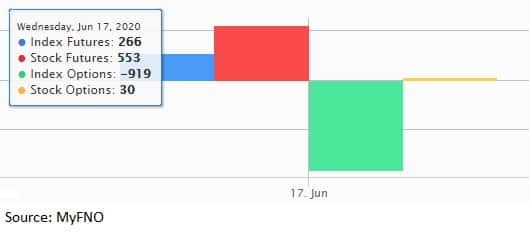

Foreign institutional investors (FIIs) bought shares worth Rs 813.27 crore, while domestic institutional investors (DIIs) sold shares worth Rs 1,238.23 crore in the Indian equity market on June 8, provisional data available on the NSE showed.

Stock under F&O ban on NSEFour stocks - BHEL, Vodafone Idea, Just Dial and NCC - are under the F&O ban for June 9. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!