Indian benchmark indices overcame early weakness and rose steadily before profit booking emerged towards the end of the session. The Nifty has been moving within a range over the past two days, with the VIX falling below 15. Yesterday on June 11, it closed marginally higher by 6 points at 23,265. Despite multiple attempts to break above the 23,380–23,410 range, prices failed and reversed to close at 23,264. Experts suggest that a move below 23,200 might trigger short-term selling pressure unless the index closes above 23,410. 2.

Here are 15 data points to help you spot profitable trades:

Key Levels for the Nifty 50:

Supports based on pivot points: 23,186.93, 23,114.67, and 22,929.92

Resistance based on pivot points: 23,371.68, 23,484.17, and 23,668.92

Special Formation: A small negative candle was formed on the daily chart with upper shadow. After a sharp upmove recently, the market showing such formations in the last two sessions indicates possibility of minor downward correction in the short term.

Key Levels for the Bank Nifty:

Resistance based on pivot points: 50,148.32, 50,515.73, and 51,145.93

Supports based on pivot points: 49,518.12, 49,255.33, and 48,625.13

Special Formation: The Bank Nifty ended the session at 49,705.75, down by 0.15 percent, forming a bearish candle with a small body. The index failed to surpass the 50,000 level but remains above its short-term moving average.

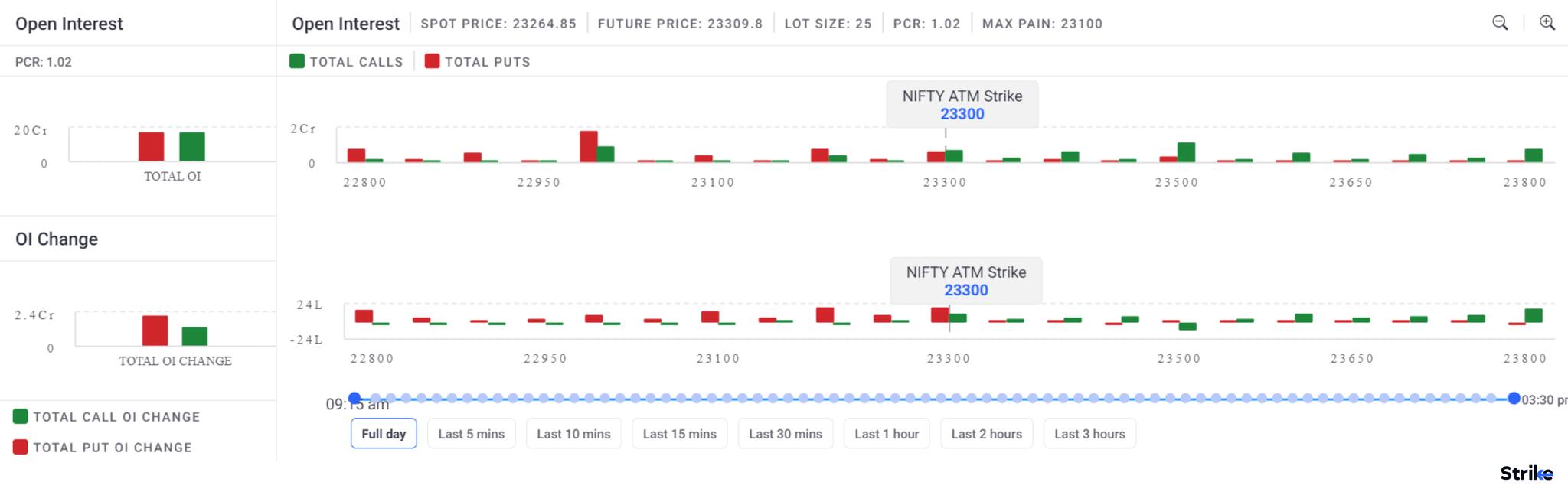

Nifty Call Options Data: Weekly options data show the 23,500 strike (with 94 lakh combined OI) has the maximum Call open interest, acting as a key resistance level for the Nifty in the short term. This is followed by the 23,400 strike (51 lakh combined OI). The 23,000 strike saw call writers exiting (bears exiting) and put writing (bulls entering). The 23,200 and 23,300 strikes saw significant put writing.

Nifty Put Options Data: On the Put side, the maximum open interest was at the 23,000 strike (with 76 lakh combined OI), acting as a key support level for the Nifty. This was followed by the 22,800 strike with 20 lakh combined OI.

FII Funds Flow (Rs crore):

Put-Call Ratio: The Nifty Put-Call Ratio (PCR), indicating market sentiment, improved moderately to 1.02 on June 11 compared to the previous session. A PCR above 0.7 or surpassing 1 generally indicates bullish sentiment, while a ratio below 0.7 or moving towards 0.5 indicates a bearish mood.

Nifty Max Pain Point: The Nifty max pain point has dropped to 23,100 from the 23,150 strike price in the previous session.

India VIX: Volatility continues to decrease as the India VIX, the fear index, closed 9.96 percent lower on an intraday basis, settling at 14.76.

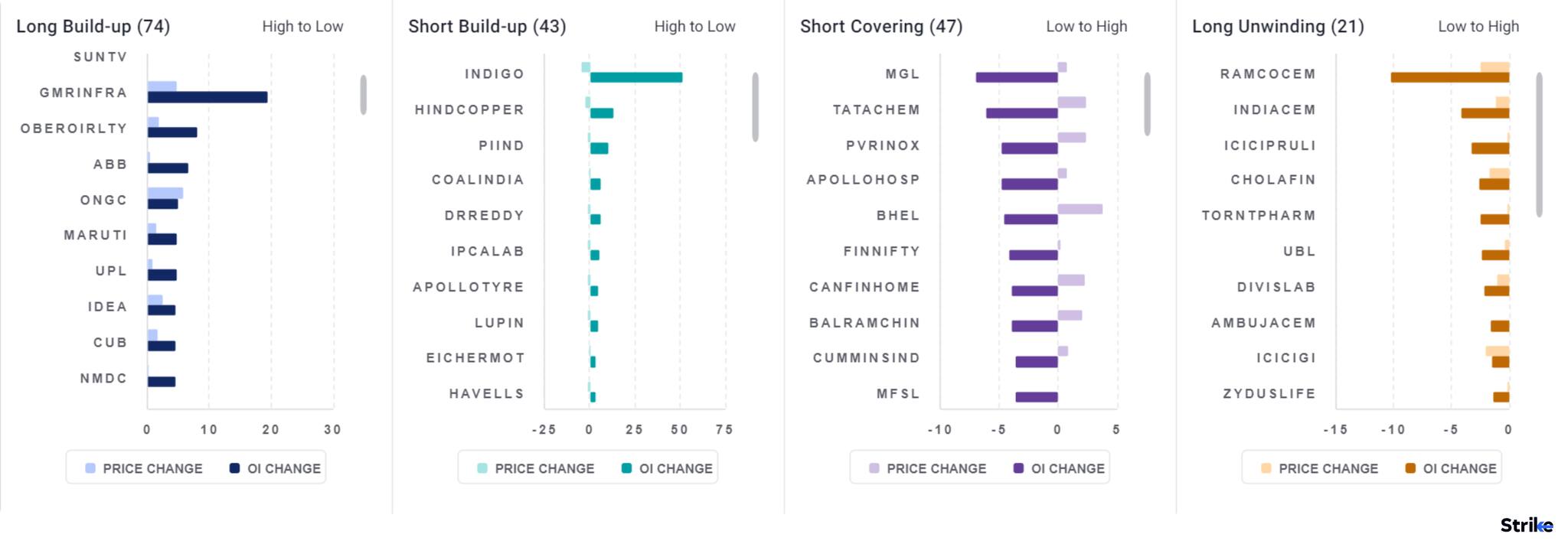

Long Build-up (74 Stocks): A long build-up was observed in 74 stocks, indicated by an increase in open interest (OI) and price.

Long Unwinding (21 Stocks): 21 stocks saw a decline in OI along with a fall in price, indicating long unwinding.

Short Build-up (43 Stocks): 43 stocks saw an increase in OI along with a fall in price, indicating a build-up of short positions.

Short-Covering (47 Stocks): 47 stocks saw short-covering, indicated by a decrease in OI along with a price increase.

Stocks Under F&O Ban: Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Stocks in F&O ban: HindCopper, GMR Airports Infrastructure, India Cement, Balrampur Chini, SAIL, and ZEEL.

Stocks added to F&O ban list: HindCopper and GMR Infra

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before making any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.