The market performed well in the week gone by as the S&P BSE Sensex rallied 2.2 percent while the Nifty50 was up 1.9 percent.

The undertone of the market looks positive but profit-booking cannot be ruled out as the benchmarks are at peak valuation.

"Going ahead, we believe 13,600 would be the key level to watch, as only a decisive close above 13,600 would lead to the extension of the ongoing rally towards the 13,900 mark as it is the 161.8 percent extension of the consolidation range (13,200-12,800), projected from the breakout area of 13,200, placed at 13,847," said Dharmesh Shah, Head – Technical, ICICI direct.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13417.97, followed by 13322.13. If the index moves up, the key resistance levels to watch out for are 13594.47 and 13675.13.

Nifty Bank

The important pivot level, which will act as crucial support for the index, is placed at 30351.53, followed by 30098.27. On the upside, key resistance levels are placed at 30834.93 and 31065.07.

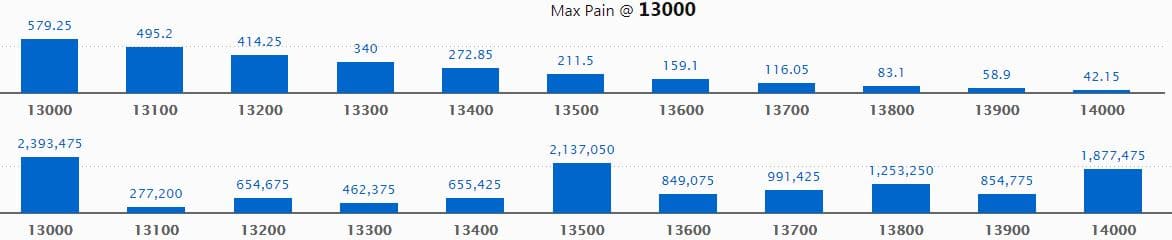

Call option data

Maximum Call open interest of 23.93 lakh contracts was seen at 13,000 strike, which will act as a crucial level in the December series.

This is followed by 13,500 strike, which holds 21.37 lakh contracts, and 14,000 strike, which has accumulated 18.77 lakh contracts.

Call writing was seen at 13,700 strike, which added 2 lakh contracts, followed by 13,800 strike which added 1.93 lakh contracts.

Call unwinding was seen at 13,500 strike, which shed 51,150 contracts, followed by 13,300 strike which shed 23,475 contracts.

Put option data

Maximum Put open interest of 38 lakh contracts was seen at 13,000 strike, which will act as crucial support in the December series.

This is followed by 13,200 strike, which holds 23.95 lakh contracts, and 13,500 strike, which has accumulated 15.06 lakh contracts.

Put writing was seen at 13,200 strike, which added 5.24 lakh contracts, followed by 13,500 strike, which added 3.92 lakh contracts.

A Put unwinding of 1,125 contracts was seen at 13,900 strike on December 11.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

33 stocks saw long build-up

Based on the open interest future percentage, here are the 10 stocks in which a long build-up was seen.

27 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

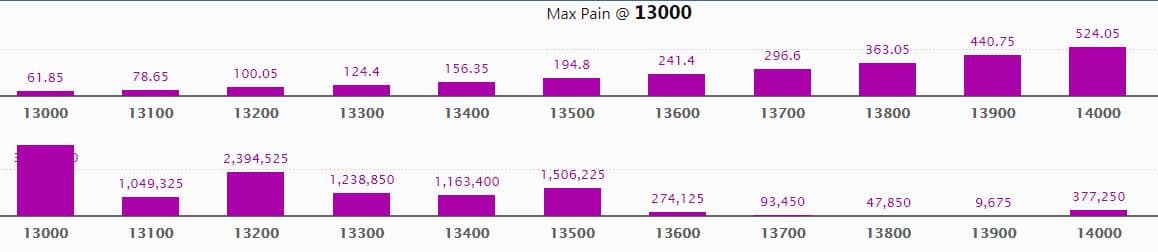

47 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

32 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

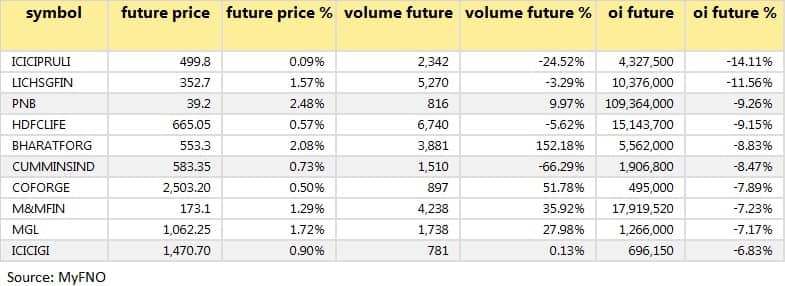

Bulk deals

(For more bulk deals, click here)

Board Meetings

The board of Shiva Cement will meet on December 14 to consider and approve an increase in authorised capital and the preferential issue of shares.

The respective boards of Adroit Infotech, QGO Finance and Abhinav Capital Services will meet on December 14 for general purposes.

The respective boards of Aanchal Ispat, Indian Sucrose and ISMT will meet on December 14 to consider and approve quarterly results.

Stocks in the news

Central Bank of India - Capital Raising Committee approved the proposal for raising capital funds up to Rs 500 crore.

Zuari Global - Company acquires 100 percent shares of Zuari Insurance Brokers from Zuari Finserv.

Union Bank - Bank issuing bonds of maximum Rs 1,500 crore on private placement basis.

Jindal Steel & Power - company reports growth of 15 percent in standalone steel production at 6,14,000 tonnes in Nov 2020 versus 5,33,000 tonnes in a year-ago period.

Cipla - Company settles litigation with Celgene Corporation.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 4,195.43 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,359 crore in the Indian equity market on December 11, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Canara Bank and Punjab National Bank - are under the F&O ban for December 14. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!