The Nifty climbed 9,200 on Friday to hit a record high of 9,218.40 but quickly pared gains as traders preferred to book profits ahead of the weekend. The index finally closed 6 points higher at 9,160.05.

We have collated top ten data points on how to help you in spotting profitable trade:

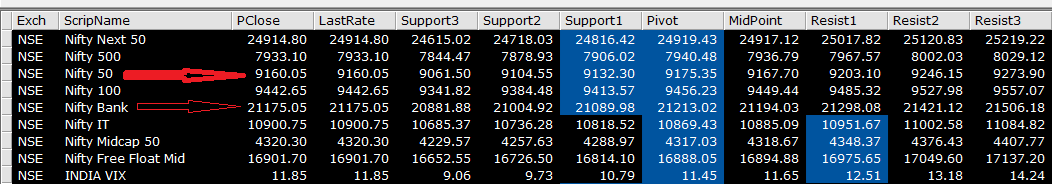

Key Support & Resistance Level:

The Nifty saw a breakout on Friday but profit booking gripped markets which pulled the index towards its crucial support level of 9,160. According to Pivot charts, the key support level for Nifty is placed at 9132, followed by 9104, and 9,061.

If the index starts to move higher then key resistance levels to watch out are 9,203, followed by 9,246 and 9,273.

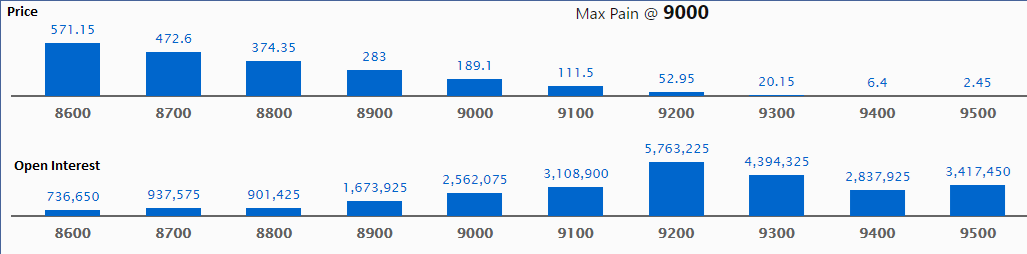

Call Options Data:

On the options front, maximum Call open interest (OI) of 57 lakh contracts stands at strike price 9,200, followed by 9,300 which now holds 43 lakh contracts in open interest and 9,500 which has accumulated 34 lakh contracts in OI.

There was hardly any Call writing but unwinding was seen at strike prices 9,000 (2.7 lakh contracts shed), followed by 9,100 (3.3 lakh contracts shed), and 9,500 (7.9 lakh contracts shed).

This is the fourth day when we saw massive Call unwinding which is a positive sign for the bulls.

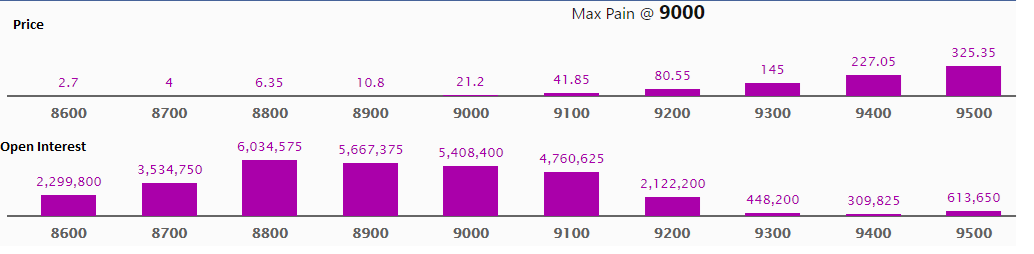

Put Options Data:

Maximum Put OI of 60 lakh contracts was seen at strike price 8,800 which will act as a crucial base for the index, followed by 8,900 which has accumulated 56 lakh contracts, and 9,000 which now holds 54 lakh contracts in OI.

Fresh Put writing at strike prices 8,800 (1.2 lakh contracts were added), followed by 8,900 (5.09 lakh contracts were added), 9,000 (5.8 lakh contracts were added), 9,100 (6.6 lakh contracts were added) and 9,200 (6.3 lakh contracts were added).

Fresh Putt writing and Call unwinding at strike prices such as 9,000, 9,100 as well as 9,500 strengthens the bullish argument for the coming week.

Nifty Bank:

The index rallied nearly 650 points for the week and ended well above the sizeable Call base of 21,000. The key pivot levels for NiftyBank are 21,089, followed by 21,004 and 20,881 which will act as crucial support while key resistance lev1els are 21,298, followed by 21,421, and 21,506.

“The Nifty Bank saw huge additions in open interest on March 14, which was the highest of March series. Nifty Bank was near 21100 during this day,” ICICI Securities said in a report.

“The index rallied on the back of short covering as closure of positions was clearly visible. We feel the ongoing trend is likely to continue and the index is well placed to test the level of 21500, which is also the highest Call base,” it said.

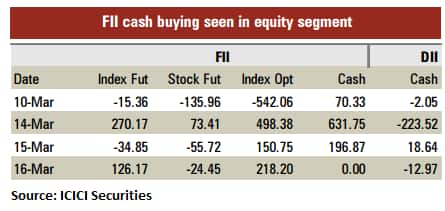

FII & DII Data:

The foreign institutional investors (FIIs) bought shares worth Rs 1,532 crore compared to domestic institutional investors which sold Rs 711 crore in Indian equity market.

India VIX:

The India Volatility Index (VIX) a gauge of the market's short-term expectation of volatility stood slipped by 0.48 per cent to 11.85 compared to the previous close of 11.91.

Volatility Index is a measure of market's expectation of volatility over the near term. Usually, during periods of market volatility, market moves steeply up or down and the volatility index tends to rise.

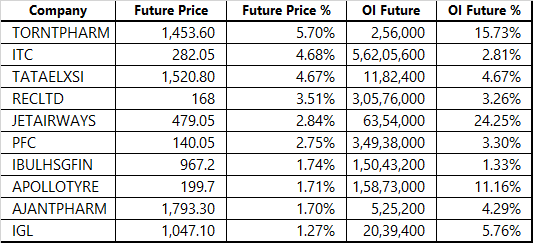

31 stocks saw Long Buildup:

25 stocks saw short covering was seen:

Short covering is seen when price moves higher but OI reduces.

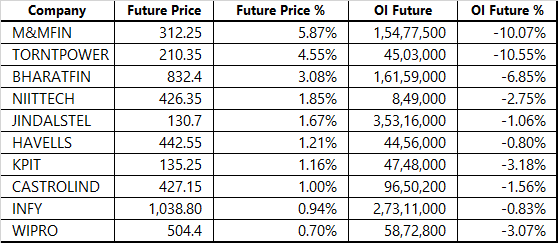

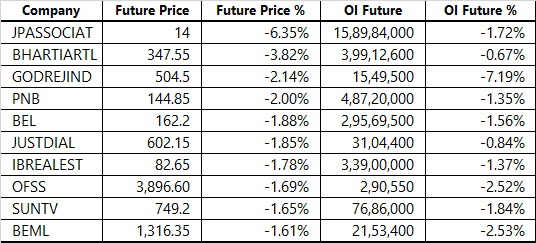

62 stocks saw Long Unwinding:

Long Unwinding happens when there is a decrease in OI as well as in price.

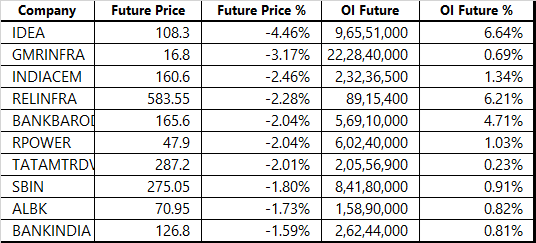

57 stocks saw Short Buildup:

Short Buildup was seen in stocks where there is an increase in open interest along with a decrease in price.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.