Shabbir Kayyumi

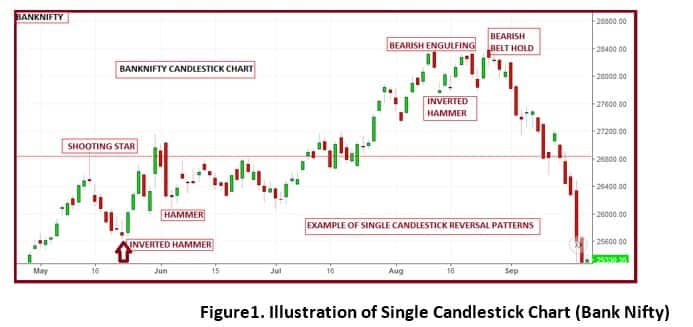

Candlestick charts are a visual aid for decision making in stock, currency and commodity trading. Some investors find them more visually appealing than the standard bar charts and the price actions easier to interpret.

What is ‘Single Candlestick Pattern’?

Candlesticks are so named because the rectangular shape and lines on either end resemble a candle with wicks. Each candlestick usually represents one day’s worth of price data about a stock.

Each candlestick is densely packed with information, candlestick tend to represent price action and trading patterns over the specific time frame.

Formation of Single Candlestick

The trading signal is generated based on 1 day’s trading action. The length signifies the range for the trading day; however trades have to be qualified based on the length of the candle as well.

One should avoid trading based on subdued short candles. An aggressive trader can place the trade on the same day as the pattern forms; however risk adverse traders can place the trade on the next day after ensuring the confirmation candle.

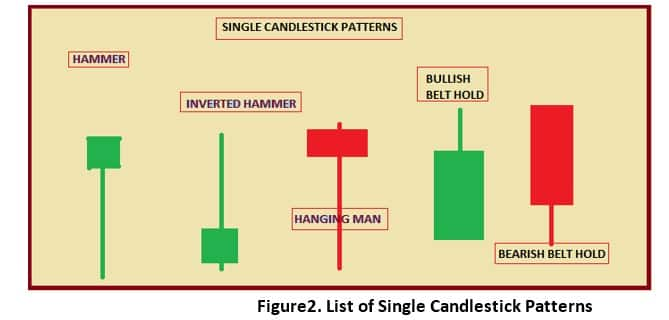

List of Single Candlestick Patterns

Candlestick patterns can be made up of one candle or multiple candlesticks, and can form reversal or continuation patterns. Some of the most useful & popular single candlestick patterns are mentioned below.

1. Hammer

2. Inverted Hammer

3. Hanging Man

4. Shooting Star

5. Bullish Belt Hold

6. Bearish Belt Hold

Single Candlestick patterns are depicted in the section above; there are more complex and difficult patterns of more than two candlesticks which have been identified since the candlestick charting method's inception.

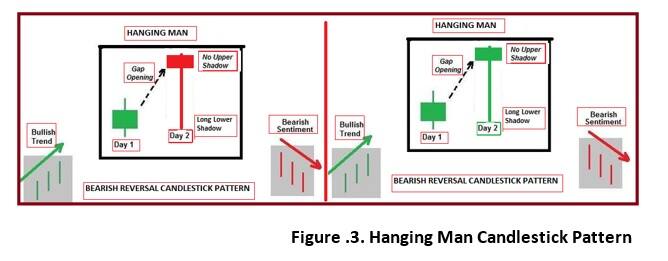

Hanging Man

Definition

This pattern occurs at the top of an uptrend. It is a single candlestick pattern which has a long lower shadow and a small body at top almost near to high. The name Hanging Man comes from the fact that the candlestick looks somewhat like a hanging man.

Identification Criteria

• The market is an existing uptrend.

• A small real body at the upper end of the trading range is observed. The color of the body is not important (green or red as indicated in above figure).

• The length of the lower shadow should be at least twice as long as the solid body.

• There is no upper shadow.

Interpretation

The Hanging Man is a bearish reversal pattern. It signals a top for the market or a resistance level. Since the pattern is observed after an advance, it signals that selling pressure is starting to increase. The long lower shadow indicates that the bear’s pushed prices lower during the trading session.

Although the bulls regained control and drove prices higher towards the close, the appearance of this selling pressure after a rally creates a doubt in bulls & it is hint of a correction. If the body is red, it indicates that the close was not able to get back to the opening price level, which has potentially more bearish implications rather than green body.

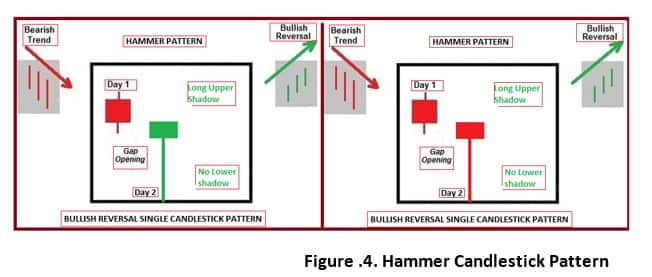

Hammer

Definition

This pattern occurs at the bottom of a trend or during a downtrend. It is a single candlestick pattern that has a long lower shadow and a small solid body at the top near to high.

Identification Criteria

• The market is in an existing downtrend.

• A small body at the upper end of the trading range is observed. The color of the body is not important (either green or red).

• The lower shadow of this candlestick is at least twice or more as long as the body.

• There is (almost) no upper shadow.

Interpretation

Hammer candlesticks form when a security moves significantly lower after the open, but rallies to close well above the intraday low. The resulting candlestick looks like a square lollipop with a long stick. If this candlestick forms during a decline, then it is called a “Hammer”.

After the decline comes to an end, price almost returns to the high of the day. Market fails to continue on the selling side. This price movement reduces the previous bearish sentiment causing short traders to feel increasingly uneasy with their bearish positions. If the body of the Hammer is green, then the situation looks even better for the bulls as compared to red body hammer.

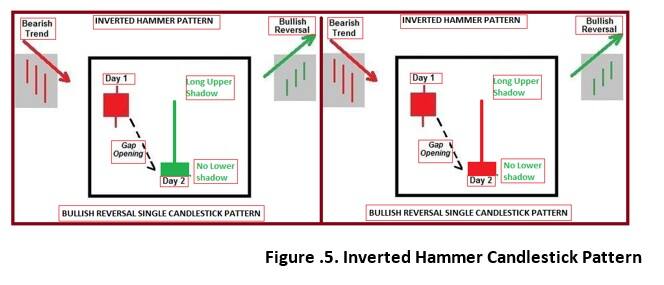

Inverted Hammer

Definition

This pattern occurs at the bottom of a trend or during a downtrend. It is a single candlestick pattern that has a long upper shadow and a small solid body at the bottom near to low.

Identification Criteria

• The market is in an existing downtrend.

• A small body at the lower end of the trading range is observed. The color of the body is not important (either green or red).

• The upper shadow of this candlestick is at least twice or more as long as the body.

• There is (almost) no lower shadow.

Interpretation

Inverted Hammer candlesticks form when a security moves significantly lower after the open, but rallies to close well above the intraday low. The resulting candlestick looks like an inverted hammer. If shooting start with a long upper stick forms in downtrend, then it is called a “Inverted Hammer”. If the body of the Inverted Hammer is green, then the situation looks even better for the bulls as compared to red body Inverted hammer.

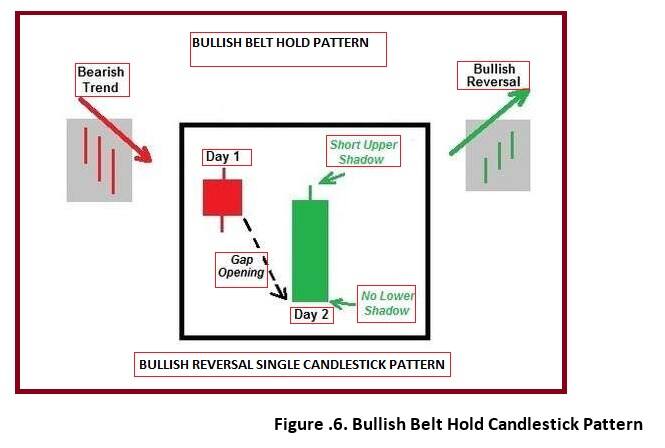

Bullish Belt Hold

Definition

Bullish Belt Hold is a single candlestick pattern, basically, a bullish opening Marubozu (long candlestick with no lower shadow) occurs in a downtrend. It opens at the low of the day, and then rallies against the current down trend in the market to close almost near the high.

Identification Criteria

• The market is in an existing downtrend.

• A long body at the lower end of the trading range is observed. The color of the body should be green and open is almost equal to low.

• There is no lower shadow.

Interpretation

The market opens lower with a significant gap down in the direction of the existing downtrend. After the market opening, sentiment changes rapidly and the market moves in the opposite direction towards upside. This causes fear among traders who have short positions, leading to the covering of short positions faster, which further adds strength in the rally in the market.

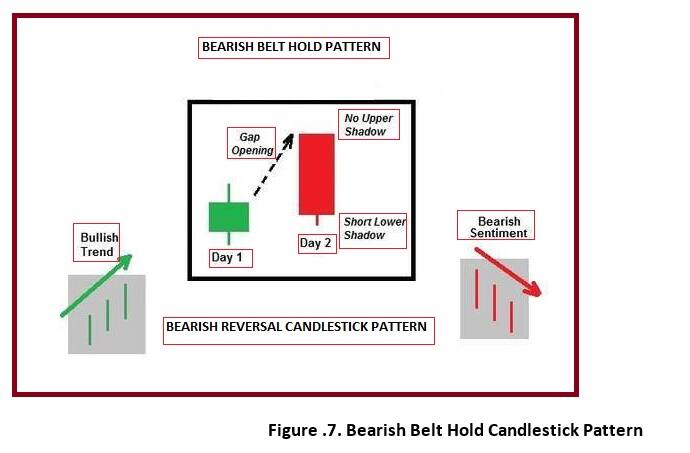

Bearish Belt Hold

Definition

Bearish Belt Hold is a single candlestick pattern, a red Marubozu that occurs in an uptrend. Market opens at the high of the day (gap up), and then prices begin to fall during the day against the overall up trend of the market, eventually closing near the low.

Identification Criteria

Identification Criteria

• The market is in an existing uptrend.

• The market gaps up and opens at its high and closes near to the low of the day.

• A long red body that has no upper shadow.

Interpretation

The market opens higher, with a gap in the direction of the prevailing uptrend. However, after the market opening, it starts moving in the opposite direction. This creates a doubt in bulls and brings a sense of fear among the bulls, leading them to close their long position which tends to accelerate sell off and eventually forming a long body red Marubozu.

The author is head - technical & derivative research, Narnolia Financial Advisors.Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on Moneycontrol are their own, and not that of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.