The results of major IT companies for the quarter ended September 2023 are out, and the report card is not looking good. India’s five largest IT companies — Tata Consultancy Services, Infosys, HCL Technologies, Wipro and LTIMindtree — saw a muted quarter due to demand slowdown, macroeconomic headwinds and weak discretionary spending. Analysts don't see tailwinds for these companies in the near term, either.

While the management talk across companies has stressed how deal wins have been good and that they executed well in a tough environment, brokerages are of the view that most IT majors have not been able to convert deal wins into growth.

All five companies reported better-than-expected margins on account of cost-control measures, rationalising employee pyramid and efficiency improvements. However, this might not be a sign of sharp margin expansion in the near term. Additionally, the weak revenue guidance by Infosys, Wipro, HCL Tech does not inspire much confidence.

Also Read | Cut cut cut: Indian IT firms slash revenue guidance across the board as growth sputters

IT stocks fall after Q2 results disappointFollowing the subdued quarterly earnings, major IT stocks have seen a fall. While TCS share price has tanked over 5 percent since October 11, Infosys shares have declined around 4 percent since its results on October 12. HCL Technologies share price has remained largely unchanged. Wipro shares tumbled more than 4 percent on October 19, a day after the Bengaluru-based company reported its Q2 earnings.

LTIMindtree, however, gained more than 4 percent on October 19 as the company reported a better-than-expected margin. The EBIT margin was a “positive surprise”, according to brokerages. Despite weak discretionary spending, prevailing uncertainty and anticipated higher-than-usual furloughs in Q3, the management is confident of delivering a better performance in the second half of this fiscal.

"IT companies are expected to face ongoing challenges. The future of IT companies will be heavily influenced by the commentary from the Federal Reserve," said Shrikant Chouhan - Head - Equity Research, Kotak Securities. If someone is interested in taking a contrarian position in the IT sector, Infosys appears to be a more favourable option, he added.

Also Read | India’s top 3 IT firms see headcount drop by over 16,000 in Q2

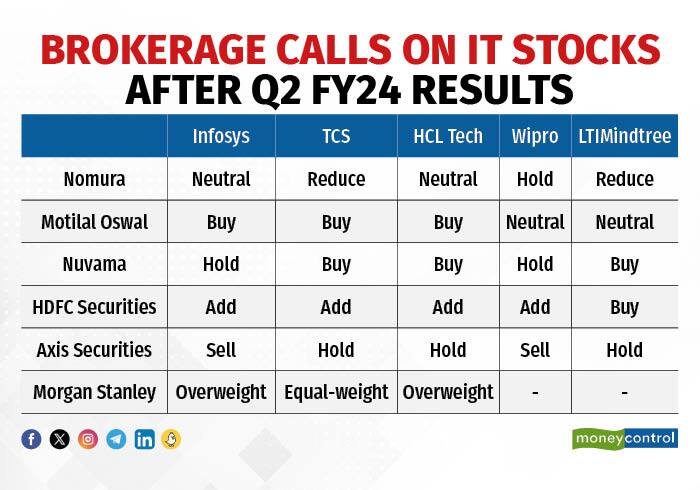

After the release of the September quarter results for IT companies, brokerages' opinions remained varied. Infosys received predominantly positive ratings such as ‘Outperform’, ‘Overweight’, or ‘Buy’. However, target prices were cut due to concerns about margin pressures and a less robust revenue outlook.

In the case of TCS, HCL Technologies, and Wipro, brokerages have largely assigned ratings like ‘Hold’, ‘Reduce’, or ‘Equal Weight’ owing to a somewhat pessimistic outlook. In fact, some analysts even issued ‘Sell’ recommendations for Wipro and TCS. LTIMindtree, on the other hand, primarily received favourable recommendations, with ‘Buy’ or ‘Add’ calls from analysts.

The way aheadThe major theme emerging from the IT majors’ Q2 report card is that the macroeconomic conditions remain shaky. Elevated interest rates along with weak consumer sentiment in Western economies have led to a persistent slowdown in discretionary spends, leading to delays in decision-making as well as deal conversions.

Further, the AI theme that every IT major's management has talked about is unlikely to be a short-term game-changer. The positive effects of these efforts are anticipated to significantly influence outcomes in the medium to long term.

Also Read | Infosys trumps TCS and HCL in order wins but lags in revenue collection

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisionsDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.