Foreign bond investors in India are locking in yields amid signs the central bank is sticking with its high interest rates in the run-up to the securities being included in JPMorgan Chase & Co. indexes.

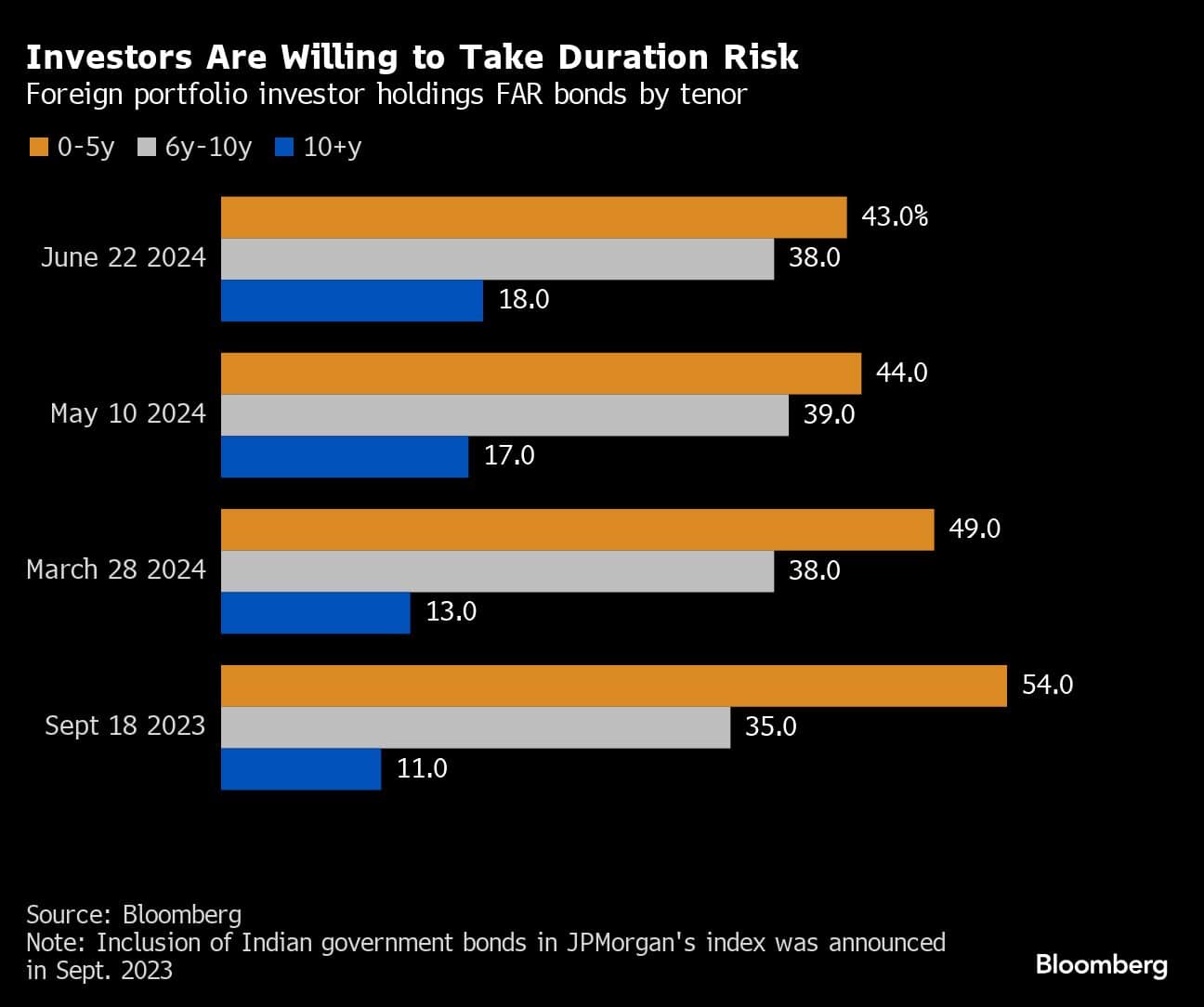

Global funds increased the proportion of notes due in 10 years or more to the highest in nine months, according to calculations by Bloomberg. The share held in short-dated securities has fallen steadily in that time frame.

The South Asian country’s debt has become a hot play among emerging markets, with investors attracted to its solid finances and stable currency. The prospect of the Reserve Bank of India keeping its policy rate at a five-year high to combat sticky inflation is adding to the allure.

Foreigners have already plowed roughly $10 billion into the securities eligible to join JPMorgan’s index on June 28, and Goldman Sachs Group Inc. sees at least $30 billion more of flows in coming months as India’s weighting on the index steadily rises to 10%. That’s likely to keep bond prices buoyant.

“If we were to zoom in on one point of the curve, I would say probably seven to 10 years,” said Prashant Singh, senior portfolio manager at Neuberger Berman Group LLC. “From a liquidity perspective as well as the shape of the curve perspective, that is probably the sweet spot.”

Thanks to fiscal belt-tightening and RBI interventions to keep the currency on an even keel, investors at Goldman, Bank of America Corp. and BlackRock Inc. are bullish on the country’s debt and currency. But that newfangled popularity, as traders seek alternatives to China, risks causing a bubble that may burst.

A big risk stems from politics. Having unexpectedly lost his parliamentary majority in national elections and forged a coalition government this month, Prime Minister Narendra Modi may loosen the purse strings to mollify voters and political partners during his third term in office.

While news of Modi’s poor electoral showing triggered a bond selloff, the market later recovered after cabinet appointments including Finance Minister Nirmala Sitharaman were seen to indicate no change to the government’s pro-business stance.

Bloomberg Economics sees the combination of cautious fiscal policy and lower government borrowing pushing down 10-year yields and lowering the cost of capital for companies. The new government’s first budget may have a deficit target of 5% of gross domestic product, even with higher expenditure, according to Deutsche Bank AG.

“I don’t think it’s over-hyped. I think it’s real,” Wontae Kim, a research analyst at Western Asset Management Co. said of India’s bond market. “From a fundamental perspective what you have is a third term for Modi that’ll probably continue his fiscal consolidation.”

Here are the key Asian economic data this week:

Monday: New Zealand trade balance data, Malaysia foreign reserves, Singapore CPI, Taiwan industrial production data

Tuesday: Westpac consumer confidence data in Australia, Malaysia CPI, Hong Kong exports

Wednesday: Singapore industrial production data

Thursday: Philippines rate decision, ANZ business confidence data in New Zealand, Japan retail sales

Friday: India joins JPMorgan emerging market bond indexes, private sector credit data in Australia, South Korea industrial production data, Thailand current account balance and reserves, India foreign exchange reserves, Japan jobless rate and industrial production data

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.