Swaraj Engines Ltd (SEL) looks like a worthwhile bet as most market participants believe that a firm with high return on equity (ROE) and return on capital employed (ROCE) is available at an attractive valuation. Be that as it may, a section of the market believes SEL could be a tale of caution, not for now but may be going ahead.

SEL was set up in 1985 in Mohali, Punjab. The company is in the business of diesel engines, diesel engine components, and spare parts.

Its principal business is manufacturing diesel engines for the Swaraj tractors manufactured by Mahindra & Mahindra (M&M). This implies that the whole of SEL’s revenue comes from M&M.

Recent acquisitionLast Wednesday, M&M said that it proposes to acquire 17.41 percent stake in SEL from Kirloskar Industries.

Earlier, among the promoters, M&M held 34.72 percent stake while Kirloskar owned 17.41 percent stake. Post the acquisition, M&M's shareholding in SEL will increase to 52.13 percent, and SEL — currently an associate company of M&M — will become a subsidiary.

M&M will also become the largest shareholder and will have the final say in the decision-making process and strategies of SEL.

What does the acquisition mean for SELBecoming an M&M subsidiary post the acquisition is largely positive for SEL, but its margins might take a beating in the years to come.

“There is a possibility of Swaraj Engines slashing product prices for its parent company in the coming years, which might affect profitability, but there should not be any immediate reaction to this,” said Awanish Chandra, head of institutional equities, SMIFS. In the past, Swaraj Engines has had to reduce its margins but it would be difficult for M&M to enforce further cuts.

There are high chances that M&M would shift its business from Kirloskar Industries to Swaraj Engines, which is likely to add to SEL’s topline. Hence, the net effect of topline growth and margin dilution could be largely positive.

Chandra feels there is a high possibility that in the future M&M will consolidate its engine production units.

While there is no announcement or indication to that effect yet, investors have been speculating on these possibilities for quite some time.

Indeed, M&M may look to increase its stake further to implement these strategies. That would further boost SEL’s stock price, added Chandra.

Financial performance

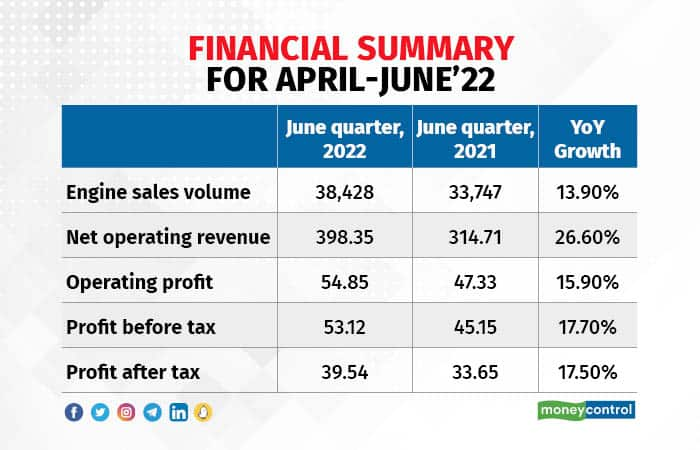

On the back of strong demand for engines, SEL reported its best-ever performance during the June 2022 quarter, in both engine sales volume and profit, the company said in its earnings press release in July.

SEL sold 38,428 units of engines, registering a growth of 13.9 percent over the same period last year (33,747 engines).

“While margins have been impacted due to the rise in commodity prices, that has been mitigated to a large extent with better cost control coupled with economies of scale,” SEL said in its earnings release.

The quarterly profit before tax (PBT) came in at Rs 53.12 crore, the highest ever, clocking 17.7 percent growth over last year's Rs 45.15 crore. Net profit for the quarter stood at Rs 39.54 crore compared to last year’s Rs 33.65 crore.

Over the past five years, SEL has been growing its EBIDTA (earnings before interest, taxes, depreciation, and amortisation) at about 10 percent per annum.

The company has a net cash positive balance sheet, consistent cash flows, and is highly capital-efficient with a history of good returns, and high dividend payouts.

“Despite numerous challenges faced in FY22 and the sharp contraction in the tractor industry in the second half of FY22, SEL recorded its highest-ever annual engines sales of 1,16,811 units, reporting a growth of about 3 percent, which is a green flag for the company,” said Sunil Damania, Chief Investment Officer, MarketsMojo.

Also Read | FIIs sold $1 billion in equities in the last eight sessions. Will FIIs stay invested?

Why has the stock performance been so dull

From around Rs 2,000 in September 2017, the stock has steadily fallen, underperforming the broader Nifty Auto index.

The only reason the stock has shown lacklustre movement is because there is very little liquidity in the stock as the company’s equity base is very small, at about Rs 12 crore, said Avinash Gorakshakar, Head Research, Profitmart Securities.

Meanwhile, Damania said that while the company has been underperforming over the past few years, the returns in the last six months stand at 28 percent, outperforming the broader market. He believes that the stock has started to perform well in recent quarters, and it will continue to reiterate similar performance in the times ahead.

However, M&M’s acquisition of Kirloskar’s shares is for an agreed value of Rs 1,400 per share, a substantial discount to Rs. 1,605.05 today. Damania cautioned that this might put some pressure on the prices in the near term, but the company should perform well in the medium to long term.

The stock as an investmentThe Street is divided on whether to buy the stock post the stake hike by M&M.

ICICI Securities has maintained its ‘hold’ rating, tracking muted growth prospects in the tractor space on the high base of FY21, and awaits structural positives before turning positive on the stock.

In its FY22 annual report, the company said it foresees a good rabi harvest, increase in exports of agri-products, better cash flows in the rural market, availability of adequate financing, a positive monsoon forecast, and continued government thrust on the agri sector, which will bode well for tractor demand in FY23.

SEL is of the opinion that the tractor industry will continue to witness growth in the medium to long term. Against this backdrop, its business is likely to move in tandem with the tractor industry.

“Upgrading our estimates, we now value SEL at Rs 2,075 i.e. 18x P/E on FY24E EPS of around Rs 115/share (earlier target price | 1,680),” the domestic brokerage firm said in its research report.

Damania believes the company is a safe bet and should outperform going forward. He expects the solid performance of M&M to reflect in Swaraj Engines’ numbers in the quarters ahead.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.