Shares of Skipper Ltd zoomed over 15 percent on October 8 after Nuvama Institutional Equities initiated coverage on the stock with a buy call with a target price of Rs 650 per share, implying a 46 percent upside from the last closing price.

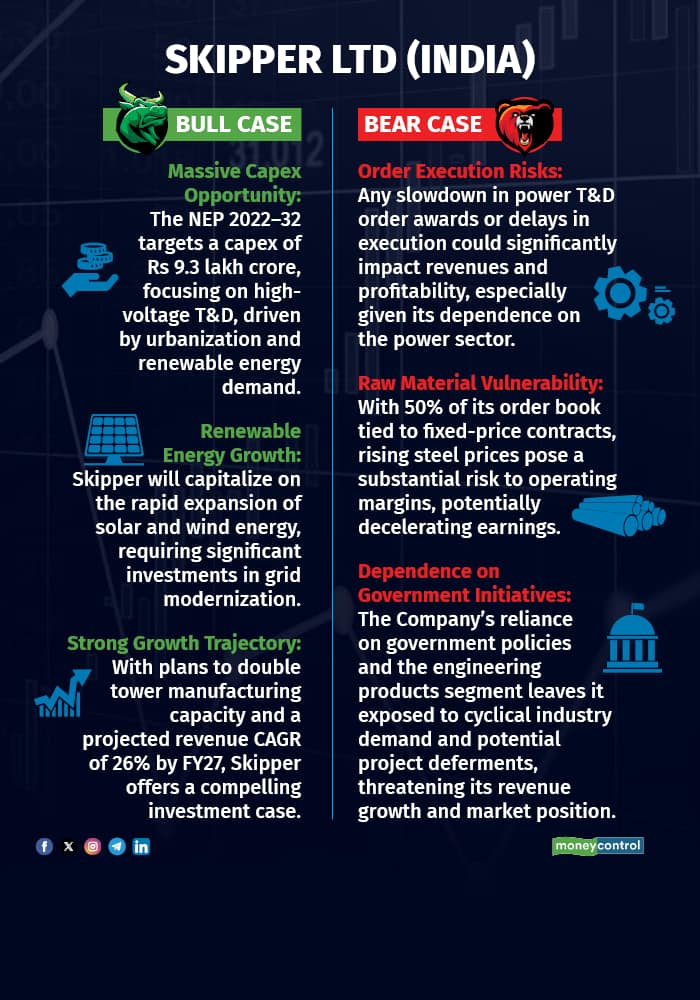

Analysts at Nuvama highlighted that Skipper is well-positioned for strong performance across the transmission and distribution (T&D) ecosystem, driven by the proposed National Electricity Policy (NEP) with an indicative transmission capital expenditure of Rs 9.2 lakh crore from FY22 to FY32.

A global shift toward renewable energy (RE) is fueling capital expenditure in high-voltage T&D which augurs well for Skipper. Consequently, Skipper is poised to reap significant benefits from favorable domestic and export order intake trends, the brokerage said.

Follow our market blog to catch all the live actionAdditionally, Skipper expects its operating profit margin (OPM) to rise from 9.7 percent in FY24 to 10.5 percent by FY27, with guidance indicating a target of 11 percent over the next three years.

At 1:25 pm, Skipper shares were trading 14 percent higher at Rs 505 on the National Stock Exchange (NSE). The stock has risen around 119 percent so far this year, outperforming benchmark Nifty's returns of 15 percent by a huge margin

In the past 12 months, the counter has zoomed over 130 percent, more than doubling investors' capital. In comparison, Nifty's gained around 28 percent during this period.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.