The crisis triggered by Russia’s invasion of Ukraine after weeks of geopolitical tensions is slowly but surely engulfing every corner of the world economy, either directly or indirectly.

The two countries are among the world’s biggest producers of commodities, especially oil, gas, and metals, both base metals and specialty metals. Food commodity prices have also increasing as a result of the conflict, which has dented imports of finished goods from other parts of the world by Russia and Ukraine.

Given that Russia is one of the world’s largest producers and suppliers of oil and gas, the impact of the crisis was immediately visible in the swift rise of crude prices, which are trading beyond $100 per barrel for the first time since the highs of 2014. In 2011-14, oil prices were elevated and averaged $110/bbl.

“Apart from geopolitical tensions, China’s investment cycle remained relatively strong until mid-2014, adding to the demand pressures on industrial commodity prices,” Morgan Stanley wrote in a note. “During this period, Asia’s commodity trade deficits were at their widest, averaging 4.9% of GDP, driven by its energy trade deficit.”

This time around, oil prices have spiked although they remain 27% lower than in 2014 in real terms. As Russia and Ukraine are major producers of agricultural products such as wheat, barley and maize, and Russia is also a key producer of metals, these commodity prices are reacting too.

“So far, commodity prices have already gotten a boost from trailing strong global demand and the effects of the energy transition and slower investment in commodity sectors” the Morgan Stanley report added.

Russia’s share in commodities markets

Russia is a leading player in commodities markets ranging from coal to precious metals. At the global level, 35 percent of palladium and 10 percent of platinum is produced by Russia. Russian aluminium giant Rusal accounts for 6 percent of global aluminium supplies and Norsk Nickel meets over 5 percent of global demand for nickel.

Russia is also one of the largest exporters of coal. It accounted for about 18 percent of global thermal coal exports and over 10 percent of coking coal over the last four years. Its steel exports accounted for 6.5 percent of global sea-borne steel exports.

Impact on metals

“In our view, the sanctions on Russia would likely flare up commodity prices – already facing the heat of supply disruption during Covid-19,” Edelweiss Equity Research wrote in a report.

For instance, global thermal coal export volumes in calendar year 2021 were estimated at 992 MMT (Million Metric Tonnes) which was about 10 percent lower compared to 2018-19. So a disruption in Russian supply can be meaningful for global coal prices.

The ongoing conflict has Russian potential implications for non-ferrous metals and energy prices as supply of steel, copper, aluminium, and precious metals feel the impact; higher energy and carbon costs, particularly in Europe, will push the global cost structure higher.

“Base metals have been on a roll for much of 2021, and 2022 got further impetus from Chinese power-led shutdowns and changing monetary policies globally,” said Navneet Damani, senior vice president of commodity and currency research at Motilal Oswal Financial Services.

Aluminum gained over 40 percent in 2021 and has added ~20 percent in 2022. It currently trades at $3,300 per ton in the international market. Sanctions on Russian aluminium maker Rusal in 2018 drove the metal's price up 35 percent in a matter of days.

Used in stainless steel and batteries for electric vehicles, nickel is up around 20 percent this year, having risen 25 percent in 2021.

“Lower inventories in metals along with strong consistent demand had been already supporting the backdrop, and with the latest trigger, it looks like the metal has got some more feet to rally,” Damani added.

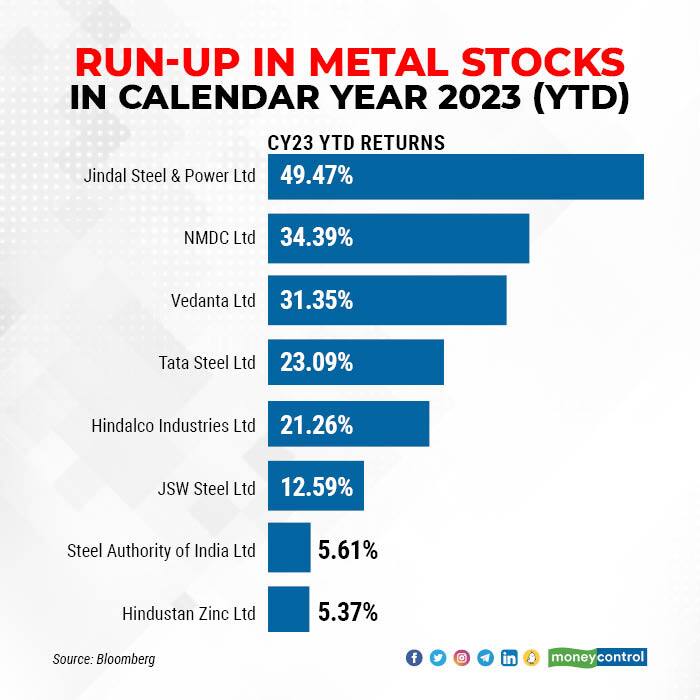

The geo-political crisis has resulted in a flare up in commodity/metal prices and with the supply from two of the world’s largest exporters of metals getting stalled, Indian companies have got the opportunities in the export markets. This has resulted in a run-up in the prices of metal stocks, which have appreciated 10 to 50 percent.

Jindal Steel & Power has generated the highest returns of 49.47 percent so far in this year. Its captive coal has put in a good stead compared to the competition.

NMDC, Vedanta, Tata Steel and Hindalco are other stocks that have appreciated more than 20 percent during this calendar year.

Impact on food commodities

Both Ukraine and Russia contribute significantly to the global supply of food grains, especially wheat and corn.

Data from the US Department of Agriculture (USDA) shows that Russia and Ukraine together supplied around 56 MMT of wheat in 2020-21, which equates to around 27.6 percent of global exports.

The data also suggests that both countries also exported around 27.9 MMT of corn in 2020-21, which accounted for 15.4 percent of global exports.

Any disruption in food grain exports from Russia and Ukraine will increase the prices of essential food commodities like wheat and corn.

Likely beneficiaries

Edelweiss Equity Research is of the view that the ongoing conflict has the potential to aid both prices and volumes as domestic steel players are likely to get an unfettered exports market in Southeast Asia where Russia has emerged as the regional price setter.

Edelweiss added: “If Russian exports are curtailed, coupled with the ongoing maintenance activities at Far East Mills and China focusing on reducing steel exports, we are likely to see benefits for Indian steel mills such as JSW Steel and Tata Steel gaining in the export market. ii) Uptick in LME Aluminium prices will aid Hindalco the most, as its integration would limit the cost increase. iii) Jindal Stainless will likely gain from higher nickel prices.”

That said, an uptick in coking coal price might impact the costs of steelmakers although Tata Steel and JSPL may be at a relative advantage.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!