ITC which got hammered on Tuesday after the government increased the cess on cigarettes but it is unlikely to lose its charm among fund managers, suggest analysts. The smart money is unlikely to move out considerably from ITC or HUL.

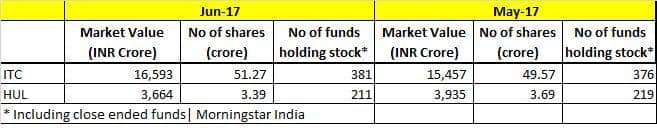

The number of funds holding ITC increased from 376 recorded in the month of May to 381 in the month of June with an aggregate market value of Rs16,593 crore, according to Morningstar India data.

On the other hand, the number of funds holding HUL decreased from 219 funds in the month of May to 211 funds in the month of June with an aggregate value of Rs3664 crore.

The decision of GST Council meeting earlier this week to increase the cess on cigarettes wiped out Rs50,000 crore of investors’ wealth on Tuesday from ITC when the stock crashed nearly 13 percent.

The stock had plunged 15 percent in intra-day trade on Tuesday, the sharpest fall in a decade, to hit a low of Rs 276.4 on the National Stock Exchange (NSE).

The increase in cess, according to Finance Minister Arun Jaitley, was taken to “reduce profiteering by companies and harm to public health,” but that didn’t go well for investors.

After a sharp fall, there were reports that smart money might move into HUL which might become the next favoured choice for investors in the FMCG space.

However, analysts which Moneycontrol spoke to have a mixed view as 2 out of 3 experts feel that ITC will still attract smart money as HUL is trading at slightly stretched valuations.

“We believe ITC will give superior returns after Tuesday’s fall. In past as well, tax rates have been increased on several occasions. This could be a temporary phenomenon and the FMCG major is available at reasonable valuations compared to other FMCG players,” Rahul Shah, VP - Equity advisory, MOSL told Moneycontrol.

“On one hand, HUL trades at a rich valuation. The biggest problem with the sector is volume growth, so after this event, we might see some volume de-growth in ITC. But, lower valuation augurs well for ITC,” he said.

Increased compensation cess on cigarettes leads to 8-9 percent increase in effective tax rate for ITC. If ITC takes a price hike then it might lead to lower sales and single-digit EBIT growth in the cigarette business.

Reacting to the news event, most global brokerage firms have already downgraded the stock and lowered their respective target price.

Credit Suisse downgraded ITC to neutral from outperform and also slashed target price to Rs310 from Rs400 following cut in FY18-20 estimates by 10-12 percent.

Morgan Stanley, too, downgraded the stock to equal-weight from overweight and reduced target price to Rs 285 from Rs 395, saying it is a clear negative with obvious impact on volume growth and valuation multiples.

According to the research house, ITC will need 12-13 percent weighted average cigarette price hike here on with around 20 percent price increase in KSFT segment to offset the tax increase.

Given that ITC has already taken around 4 percent price hike versus an average of FY17, it expects an incremental 8-9 percent pricing action over the next few days, said the report.

Investors should understand that the fall in ITC's share price is a temporary phenomenon seen due to a hike in the effective GST rates on cigarettes.

“If we have a look at the past tax increase on cigarettes in the past budgets the history suggests it is a non-event from a profitability point of view. In fact, falls arising from such an event always was a great opportunity to invest,” Jimeet Modi, CEO, SAMCO Securities told Moneycontrol.

“The 5-year CAGR sales growth of ITC has 6.74 percent while HUL's sales have grown by only 4.2 percent. ITC's profits have increased by 6.25 percent 5-year CAGR while HUL's have increased by only 3.2 percent 5-year CAGR. This shows that even after the tax hikes, ITC performs better than HUL,” he said.

Modi further added that the smart money is more likely to move to ITC because HUL is currently trading at a PE and PB of 66 and 37 times respectively while ITC is trading at PE and PB of 36 and 8.52 respectively.

Commenting on the price action, Modi said that ITC's stock plummets at every tax hike and then start rising again in 20-25 days. This is the right time to buy the stock.

However, some analysts are of the view that HUL will find some flows trickle into the counter post increase in cess on ITC after the FMCG major reported a stellar performance in the June quarter.

HUL delivered a stellar performance in Q4FY2017, beating D-Street expectation with high single digit revenue growth and OPM improving by almost 100bps despite a significant increase in the raw material prices.

“HUL is a better play in the FMCG as it will be one of the key beneficiaries of implementation of GST and recovery in the rural demand,” Kaustubh Pawaskar, analyst, Sharekhan by BNP Paribas told Moneycontrol.

“We expect volume growth to improve in H2FY2018 and would gradually improve in the subsequent years. So, it becomes a better play in the large cap FMCG space. We believe that investors might opt for stocks with better-earning visibility in the term coupled with decent valuations at the current juncture and wait for a better entry point to enter HUL,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.